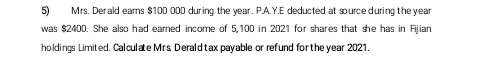

Calculate Mrs Derald tax payable or refund for the year 2021.

Q: Fickel Company has two manufacturing departments—Assembly and Testing & Packaging. The predetermined…

A: The manufacturing costs include the costs that are incurred to get the product finished during the…

Q: What is the present value of a security that will pay $22,000 in 20 years if securities of equal…

A: Future value is total of initial investment plus compound interest on that. Compound interest could…

Q: Tax Drill - Revenue Procedure 2004-34 Bigham Corporation, an accrual basis calendar year taxpayer,…

A: The accrual concept states that the revenues are recognized when earned and the expense is…

Q: You negotiate a sale with a mill in which you sell them wheat at a basis of -10 MAR for Jan/Feb…

A: Profit or loss are those which are determined through taking the aggregate revenue of company as…

Q: (a) The following information has been provided by knitwear ltd a company that manufactures jeans.…

A: A cost sheet is a declaration that lists the many costs that make up a product's overall cost and…

Q: a. calculate the purchase consideration b. calculate the goodwill or bargain purchase for this…

A: When one company takes over another and establishes itself as the new owner, the purchase is called…

Q: Mc Graw Hill Total machine-hours Total fixed manufacturing overhead cost Variable manufacturing…

A: Job order costing is one of the costing method, which accumulates and assigns costs on the basis of…

Q: Dana Point Company Income Statement % Change Yr 2 Income Statement Common Size Yr 2 Yr 1 Income…

A: Horizontal analysis is the way to calculate the variance from the different year by year to show an…

Q: Complete the table to calculate the cost of goods sold for both Garcon Company and Pepper Company…

A: Cost Of Goods Sold :— Cost Of Goods Sold is the Cost of Goods which is incurred on the Goods…

Q: EXERCISE Gabriel Auto produces and sells an auto part for P30.00 per unit. In 2021, 100,000 parts…

A: Inventoriable Cost :— It is the total product manufacturing cost which direct cost and manufacturing…

Q: If equity is $300,000 and liabilities are $192,000, then assets equal

A: Balance of both side of balance sheet should be equal. It means Total of equity and liabilities is…

Q: Zion Company has assets of $600,000, liabilities of $250,000, and equity of $350,000. It buys office…

A: An accounting equation refers to a mathematical representation of the transaction. It indicates that…

Q: Southern Cross Ltd issued a prospectus for the issue of 150,000, $6 shares on 1 January 2022. The…

A: Journal Entry :— It is an act of recording transaction in book of account when it is occured for…

Q: Exercise 2-11 (Algo) Understanding financial statement relationships LO 2-2, 2-3 The information…

A: Accounting Equation :— It is the relationship between assets, liabilities and owner's equity.…

Q: ABC Company was incorporated on January 1,2021. The following are the ordinary share transactions…

A: Outstanding Share :— Outstanding Share means the no. Of Share at the Closing date date after all…

Q: 1. The imputed interest rules apply to which of the following type of loan? a.Coercion-related…

A: Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: Creg works as an agent for a number of smaller contractors, earning commission of 10%. Creg’s…

A: Lets understand the basics. Journal entry is required to make to record transaction or event that…

Q: The balance in the equipment account is $3,240,000, and the balance in the accumulated…

A: Book value of assets :— It is the difference of original cost of equipment and accumulated…

Q: What amount of gift tax applicable credit remains available to Norma in 2021?

A: the tax rate that will be applicable in this scenario is 40 percent tax

Q: A businessman loaned P500,000 from a local bank that charges an interest rate of 12% compounded…

A: Time value of money :— According to this concept, value of present money is greater than value of…

Q: Delima Bhd is considering replacing old machine with a new one to meet the increasing demand for its…

A: INTRODUCTION Cash Flow: The net amount of cash flows flowing into and moving out of a business is…

Q: Complete this question by entering your answers in the tabs below. Required A Required B Required C…

A: As per honor code of Bartleby we are bound to give the answer of first question only, please post…

Q: Custom Cabinetry has one job in process (Job 120) as of June 30; at that time, its job cost sheet…

A: Cost of Goods Sold :— Cost of goods sold is the total cost which is paid as a cost directly related…

Q: 3) FRCS? How much PAYE will a person earning chargeable income of $46,128 per annum pay to

A: Amount to be paid to FRCS can be calculated using the following table, For Resident Individuals

Q: What are the major steps in the audit team's assessment of control risk in an IT environment?

A: Introduction: Control risk is the possibility that financial statements would be significantly…

Q: Capital and Revenue Expenditures Kimbrell Freight Lines Co.…

A: Revenue expenditure is regular expenses which is low amount in nature. This is operating expenses…

Q: Constructing and Assessing Income Statements Using Cost-to-Cost Method On March 15, 2012, Frankel…

A: Contract costing is one of the costing method being used by the company for recording and accounting…

Q: Mat Ltd borrows $360 000 from Place Ltd on 1 July 2022 with an interest rate of 6% p.a. The loan is…

A: 1. Gon Ltd records a loan of $360000 from Place Ltd on 1 July 2022. The loan has an interest rate of…

Q: 1. What is the correct net sales for the year? 2. What is the correct cost of sales for the year? 3.…

A: You have asked four sub-parts of the question but as our protocol is to solve first three sub-parts…

Q: On January 1, Vermont Corporation had 43,000 shares of $9 par value common stock issued and…

A: The journal entries are prepared to keep the record of day to day transactions of the business on…

Q: Q12

A: The venture capital funding process is completed in six stages of financing corresponding to the…

Q: Question Content Area Given the following data: Dec. 31, Year 2 Dec. 31, Year 1 Total…

A: Ratio analysis is one of the technique used in management accounting. These ratios are used for…

Q: Compute the 2019 standard deduction for the following taxpayers. a. Ellie is 15 and claimed as a…

A: Since you have posted a question with multiple sub-parts, we will solve the first three sub-parts…

Q: You are assessing the performance of a retail company, Alpha. The income statement and balance sheet…

A: Answer:- DuPont Analysis meaning:- The DuPont Corporation first popularized the DuPont analysis…

Q: statement of Cash Flows-Indirect Method Operating activities: Net income Adjustments to convert net…

A: Cash Flow Statement :— It is one of the financial statement that shows change in cash and cash…

Q: How would I calculate total dividend value?

A: Here stock dividend paid not cash dividend. Stock dividend is in form of share not in cash. This…

Q: TB MC Qu. 8-83 (Algo) Inventory records for Herb's... Inventory records for Herb's Chemicals…

A: Inventory valuation under LIFO Method using perpetual inventory system considers that all items of…

Q: Below are the Income Statement and Balance Sheet for Palmer Corporation for the years…

A: The ratio analysis helps to analyze the financial statements of the business on the basis of various…

Q: During the month of October 20--, The Pink Petal flower shop engaged in the following transactions:…

A: Journal Entries - Journal Entries are the four column format for recording debit and credit of the…

Q: Retail Corporation reported the following Income Statement for the past two years: Retail…

A: The net income from a company's main, core business operations is known as operating profit. Since…

Q: Prepare a retained earnings statement for the month of June. (List items that increase retained…

A: Retained Earning :— Retained Earning are the Amount of Profit of the Company has Left over after…

Q: On December 1, 20x1, AVS Company issued 10% bonds with a face amount of $20 million. The bonds…

A: Here asked for Multi sub part question we will solve for first three sub part of Multi question as…

Q: II. On December 1, 20x1, AVS Company issued 10% bonds with a face amount of $20 million. The bonds…

A: Note: Hi! Thank you for the question, As per the honor code, we are allowed to answer three…

Q: he owner of Yummy Seafood, a seafood supermarket. The business accounts for GST on an accrual basis.…

A: Explanation of Concept:- Booking of expenses as provisioning for doubtful debt : In the case where…

Q: BC Company borrowed $10,000. The entry into a T-account would include: Group of answer choices…

A: In this question, we need to identify the effect of the following transaction in T-account from the…

Q: Tepaid Insurance The balance in the prepaid insurance account, before adjustment at the end of the…

A: The journal entries are prepared to keep the record of day to day transactions of the business on…

Q: Mention the key features of the Income and Expenditure Account.

A: Introduction: Non-trading entities keep an income and expenditure account to determine the surplus…

Q: d. What is the percentage cost of trade credit to customers who do not take the discount and pay in…

A: Accounts receivables are the current assets which allows the customers of an entity to take some…

Q: Complete this question by entering your answers in the tabs below. Payback Period Break even time…

A: Payback Period :— The term payback period refers to the amount of time it takes to recover the cost…

Q: Smith Corporation had Sales of $2,350,000 in 2021 and $2,125,000 in 2020. Cost of Good Sold were…

A: In order to find the changes in the sales are the cost of good sold ,the period of two are…

Step by step

Solved in 2 steps with 2 images

- B Corporation, a calendar year-end, accrual basis taxpayer, is owned 75 percent by Bonnie, a cash basis taxpayer. On December 31,2019, the corporation accrues interest of $4,000 on a loan from Bonnie and also accrues a $15,000 bonus to Bonnie. The bonus is paid to Bonnie on February 1,2020; the interest is not paid until 2021 . How much can B Corporation deduct on its 2019 tax return for these two expenses? $0 $4,000 $15,000 $19,000 $12,000Lisa records nonrefundable Federal income tax credits of 65,000 for the year. Her regular income tax liability before credits is 190,000, and her TMT is 150,000. a. What is Lisas AMT? b. What is Lisas regular income tax liability after credits?Marlene, a cash basis taxpayer, invests in Series EE U.S. government savings bonds and bank certificates of deposit (CDs). Determine the tax consequences of the following on her 2019 gross income: a. On September 30, 2019, she cashed in Series EE bonds for 10,000. She purchased the bonds in 2009 for 7,090. The yield to maturity on the bonds was 3.5%. b. On July 1, 2018, she purchased a CD for 10,000. The CD matures on June 30, 2020, and will pay 10,816, thus yielding a 4% annual return. c. On July 1, 2019, she purchased a CD for 10,000. The maturity date on the CD was June 30, 2020, when Marlene would receive 10,300.

- Melodie's taxable income is $39,000 and she pays income tax of $4,489. If Melodie's taxable income increases to $41,000, she would pay income taxes of $4,884. What is Melodie's marginal tax rate? 19.75 22.00 18.50 12.00 Some other amountBrad and Angie are married and file a joint return. For year 14, they had income from wages in the amount of 100,000 and had the following capital transactions to report on their income tax return: What is the amount of capital loss carryover to year 15? a. (155,000) b. (152,000) c. (132,000) d. (125,000)Determine the taxpayers gross income for tax purposes in each of the following situations: a. Deb, a cash basis taxpayer, traded a corporate bond with accrued interest of 300 for corporate stock with a fair market value of 12,000 at the time of the exchange. Debs cost of the bond was 10,000. The value of the stock had decreased to 11,000 by the end of the year. b. Deb needed 10,000 to make a down payment on her house. She instructed her broker to sell some stock to raise the 10,000. Debs cost of the stock was 3,000. Based on her brokers advice, instead of selling the stock, she borrowed the 10,000 using the stock as collateral for the debt. c. Debs boss gave her two tickets to the Rabid Rabbits rock concert because she met her sales quota. At the time she received the tickets, each ticket had a face price of 200 and was selling on eBay for 300. On the date of the concert, the tickets were selling for 250 each. Deb and her son attended the concert.