Calculate RETURNED ON INVESTED CAPITAL by referring the pictures of Financial Position and Statement of Profit or Loss given with this question.

Calculate RETURNED ON INVESTED CAPITAL by referring the pictures of Financial Position and Statement of Profit or Loss given with this question.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

ChapterA2: Investments

Section: Chapter Questions

Problem 23E

Related questions

Question

100%

Calculate RETURNED ON INVESTED CAPITAL by referring the pictures of Financial Position and Statement of Profit or Loss given with this question.

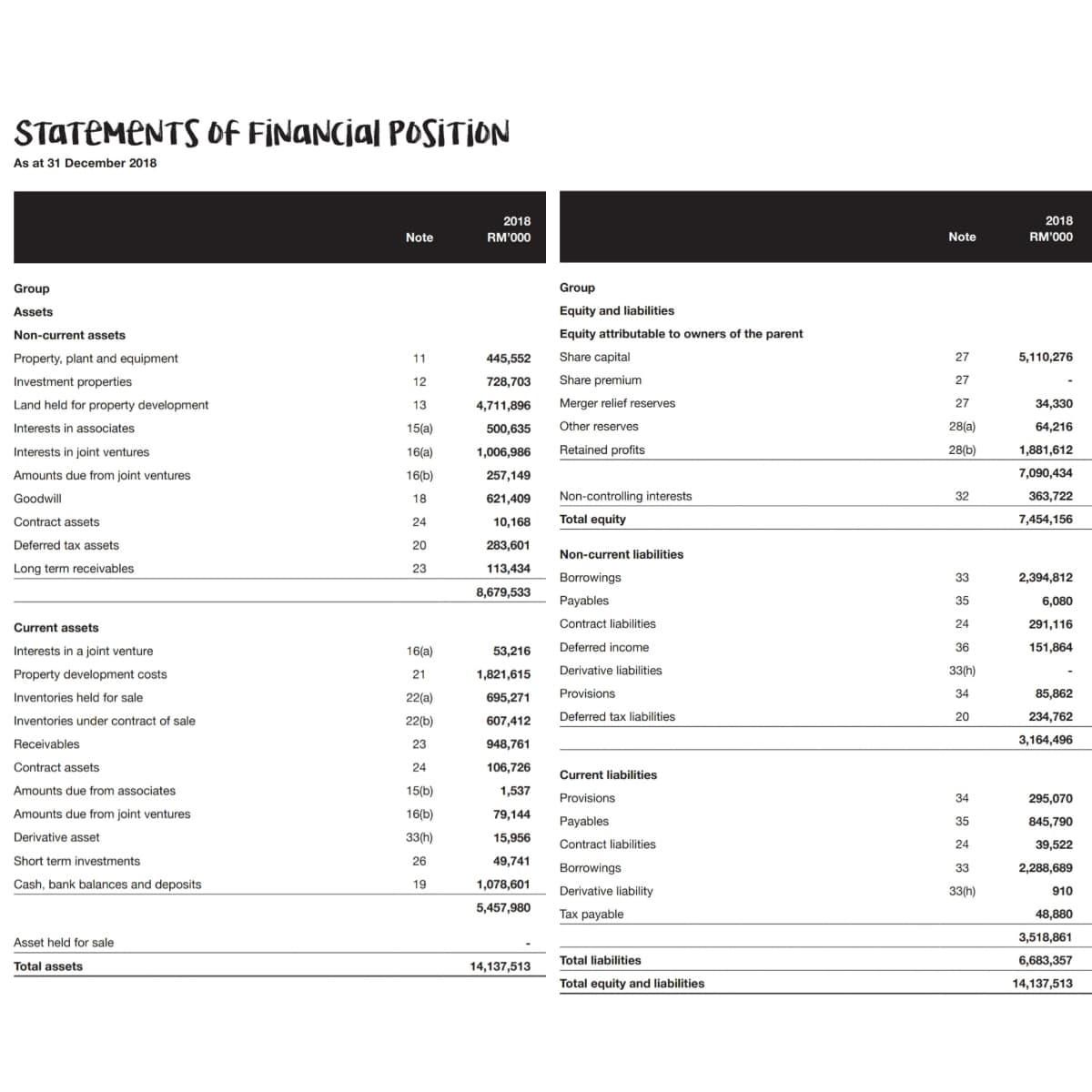

Transcribed Image Text:STATEMENTS Of FİNANCjal POSITION

As at 31 December 2018

2018

2018

Note

RM'000

Note

RM'000

Group

Group

Assets

Equity and liabilities

Non-current assets

Equity attributable to owners of the parent

Property, plant and equipment

11

445,552

Share capital

27

5,110,276

Investment properties

12

728,703

Share premium

27

Land held for property development

13

4,711,896

Merger relief reserves

27

34,330

Interests in associates

15(a)

500,635

Other reserves

28(a)

64,216

Interests in joint ventures

16(a)

1,006,986

Retained profits

28(b)

1,881,612

Amounts due from joint ventures

16(b)

257,149

7,090,434

Goodwill

18

621,409

Non-controlling interests

32

363,722

Contract assets

10,168

Total equity

7,454,156

24

Deferred tax assets

20

283,601

Non-current liabilities

Long term receivables

23

113,434

Borrowings

33

2,394,812

8,679,533

Payables

35

6,080

Current assets

Contract liabilities

24

291,116

Interests in a joint venture

16(a)

53,216

Deferred income

36

151,864

Property development costs

21

1,821,615

Derivative liabilities

33(h)

Inventories held for sale

22(a)

695,271

Provisions

34

85,862

Deferred tax liabilities

20

234,762

Inventories under contract of sale

22(b)

607,412

Receivables

23

948,761

3,164,496

Contract assets

24

106,726

Current liabilities

Amounts due from associates

15(b)

1,537

Provisions

34

295,070

Amounts due from joint ventures

16(b)

79,144

Payables

35

845,790

Derivative asset

33(h)

15,956

Contract liabilities

24

39,522

Short term investments

26

49,741

Borrowings

33

2,288,689

Cash, bank balances and deposits

19

1,078,601

Derivative liability

33(h)

910

5,457,980

Tax payable

48,880

Asset held for sale

3,518,861

Total assets

14,137,513

Total liabilities

6,683,357

Total equity and liabilities

14,137,513

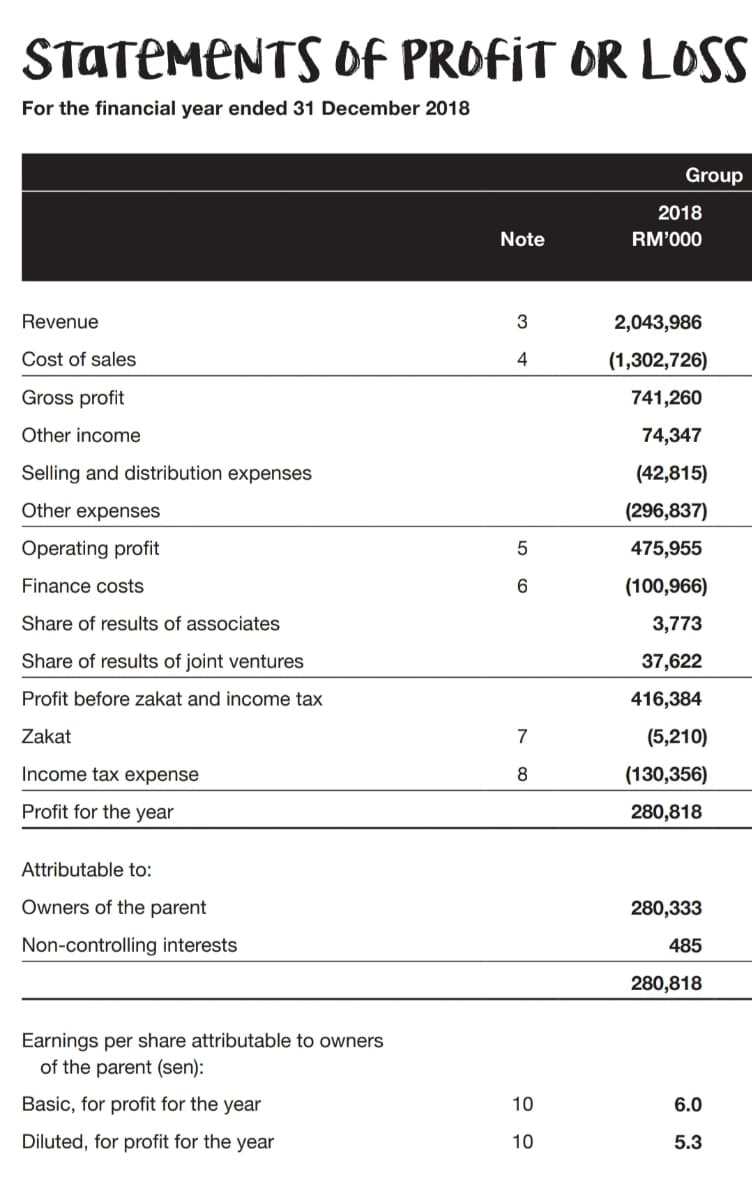

Transcribed Image Text:STATEMENTS Of PROFİT OR LOSS

For the financial year ended 31 December 2018

Group

2018

Note

RM'000

Revenue

3

2,043,986

Cost of sales

4

(1,302,726)

Gross profit

741,260

Other income

74,347

Selling and distribution expenses

(42,815)

Other expenses

(296,837)

Operating profit

475,955

Finance costs

6.

(100,966)

Share of results of associates

3,773

Share of results of joint ventures

37,622

Profit before zakat and income tax

416,384

Zakat

7

(5,210)

Income tax expense

8

(130,356)

Profit for the year

280,818

Attributable to:

Owners of the parent

280,333

Non-controlling interests

485

280,818

Earnings per share attributable to owners

of the parent (sen):

Basic, for profit for the year

10

6.0

Diluted, for profit for the year

10

5.3

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning