Calculate Social Security taxes, Medicare taxes, and FIT for Jordon Barrett. He earns a monthly salary of $11,300. He is single and claims 1 deduction. Before this payroll, Barrett's cumulative earnings were $128,070. (Social Security maximum is 6.2% on $128,400 and Medicare is 1.45%.) Calculate FIT by the percentage method. (Use Table 91 and Table 9.2) (Round your answers to 2 decimal places.)

Calculate Social Security taxes, Medicare taxes, and FIT for Jordon Barrett. He earns a monthly salary of $11,300. He is single and claims 1 deduction. Before this payroll, Barrett's cumulative earnings were $128,070. (Social Security maximum is 6.2% on $128,400 and Medicare is 1.45%.) Calculate FIT by the percentage method. (Use Table 91 and Table 9.2) (Round your answers to 2 decimal places.)

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter7: Employee Earnings And Deductions

Section: Chapter Questions

Problem 7E

Related questions

Question

Need help with this question .

Transcribed Image Text:Calculate Social Security taxes, Medicare taxes, and FIT for Jordon

Barrett. He earns a monthly salary of $11,300. He is single and

claims 1 deduction. Before this payroll, Barrett's cumulative

earnings were $128,070. (Social Security maximum is 6.2% on

$128,400 and Medicare is 1.45%.) Calculate FIT by the percentage

method. (Use Table 91 and Table 9.2) (Round your answers to 2

decimal places.)

FIT

Social Security taxes

Medicare taxes

Transcribed Image Text:222

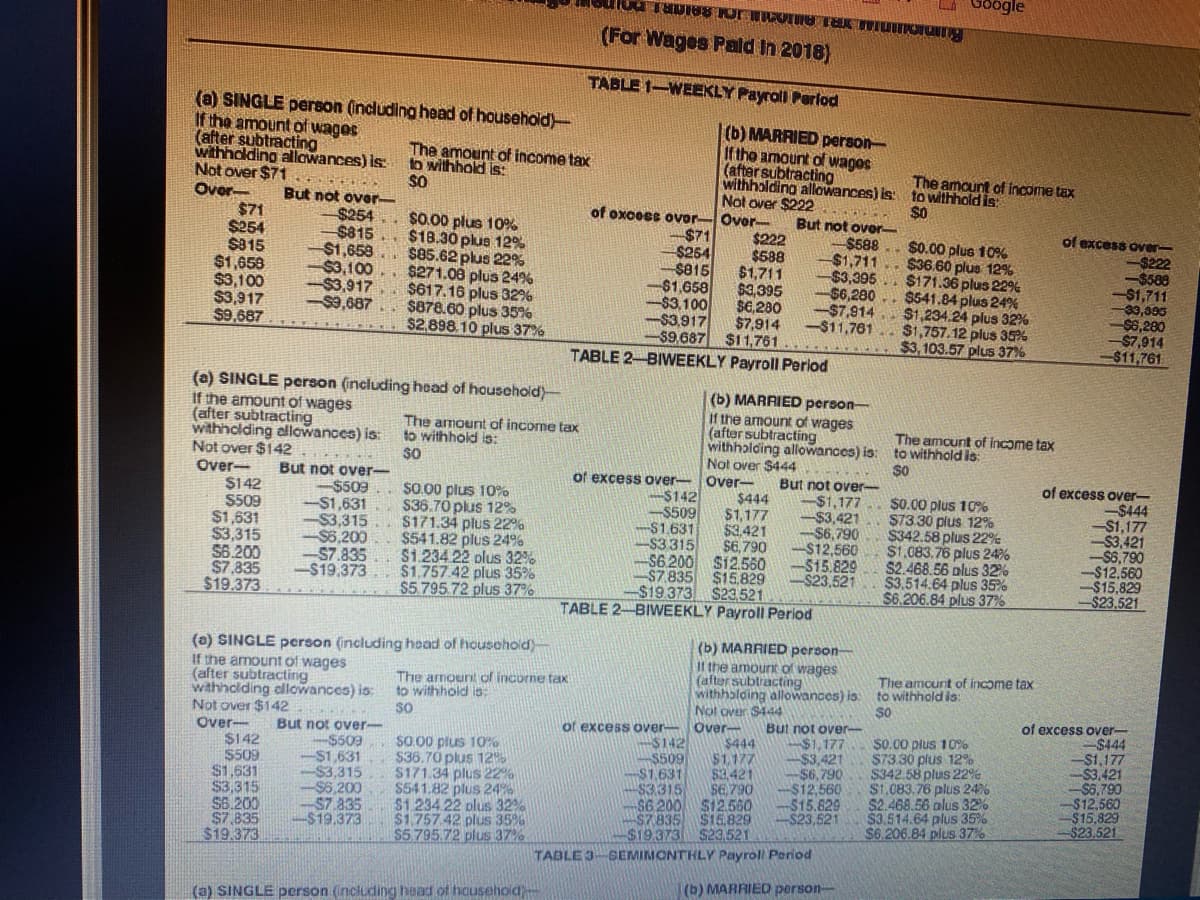

(For Wages Pald In 2018)

TABLE 1-WEEKLY Payrall Perlod

(a) SINGLE person (including head of household)-

If the amount of wages

(after subtracting

withholding allawances) is

Not over $71..

Ovor-

$71

$254

$815

$1,658

$3,100

$3,917

$9,687

(b) MARRIED person-

If the amount of wagos

The amount of income tax

to withhold is:

SO

(aftersubtracting

The amount of income tax

withholding allowances) is to withhold is:

Not over $222

But not over-

so

of oxoess ovor Over

$254,. $0.00 plus 10%

$815.. $18.30 plus 12%

$85.62 plus 22%

$271.08 plus 24%

$617.16 plus 32%

$878.60 plus 35%

$2,898. 10 plus 37%

But not

over

$588

$1,711

$3,395

-$6,280 .. $541.84 plus 24%

-$7,914. $1,234.24 plus 32%

$11,761.. $1,757.12 plus 3%

of excess over-

$71

$254

$815

-$1,658

-$3,100

S3,917

-$9,687

$222

$588

$1,711

$3,395

$6,280

$7,914

$11,761

$0.00 plus 10%

$1,658

$3,100

$3,917

$9,687

.. $36.60 plus 12%

$588

-$1,711

-33,395

$6,280

-$7,914

-$11,761

$171.36 plus 22%

$3, 103.57 plus 37%

TABLE 2-BIWEEKLY Payroll Period

(a) SINGLE person (including head of houschoid)-

If the amount of wages

(after subtracting

withholding allowances) is:

Not over $142 . . .

Over-

$142

S509

$1,631

$3,315

S6.200

$7.835

$19.373

(b) MARRIED person

If the amount of wages

(after subtracting

The amount of income tax

to withhold is:

SO

The amount of income tax

withholding allowances) is: to withhold is

Not over $444

But not

$1,177

SO

But not over-

$509

S1,631

$3,315

$6,200

-S7.835

-$19,373

of excess over- over-

S142

$509

-S1.631

S3315

tover-

S0.00 plus 10%

S36.70 plus 12%

S171.34 plus 22%

$541.82 plus 24%

S1.234.22 olus 32%

$1,757.42 plus 35%

$5 795 72 plus 37%

of excess over-

-$444

-$1,177

-$3,421

-$6,790

-$12.560

-$15,829

-$23.521

$444

$1,177

$0.00 plus 10%

$3.421 $73.30 plus 12%

$6,790 $342.58 plus 22%

-S12,560 $1.083.76 plus 24%

-S15.829 S2.468.56 olus 32%

$3.514.64 plus 35%

$6.206.84 plus 37%

$3.421

$6,790

S6.200 S12.550

S7.835 $15.829

$19 373 $23,521

-$23,521

TABLE 2-BIWEEKLY Payroll Period

(b) MARRIED person

If the amount of wages

(a) SINGLE pcrson (including hoad of household)

If the amount of wages

(after subtracting

withholding allowances) is:

Not over $142

Over-

$142

S509

$1,531

$3,315

S6.200

$7.835

$19.373

The amcunt of income tax

to withhold is:

SO

(after subtracting

The armount of incorne tax

to withhold is:

SO

withhalding allowances) is:

Not over $444

But not over-

$1,177

$3,421

$6,790

$12,560

$15.829

S23,521

of excess over-

-$444

$1,177

$3.421

-$6,790

$12.560

$15,829

$23.521

of excess over Over-

$142

But not over-

5509

-$1,631

-$3,315

$6,200

S7.835

$19.373

$0.00 plus 10%

S73.30 plus 12%

$342.58 plus 22%

$1,083.76 plus 24%

$2.468.56 olus 32%

$3.514.64 plus 35%

$6.206.84 plus 37%

$444

So.00 plus 10%

$36.70 plus 12%

$171.34 plus 22%

$541.82 plus 24%

$1.234 22 plus 32%

$1.757.42 plus 35%

$5.795 72 plus 37%

$509

$1.177

$3.421

S1.631

$3315

S6 790

-S6.200 S12.560

S7835 $15,829

$19.373 $23,521

TABLE 3-SEMIMONTHLY Payroll Period

(b) MARRIED person-

(a) SINGLE person (including head of household

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning