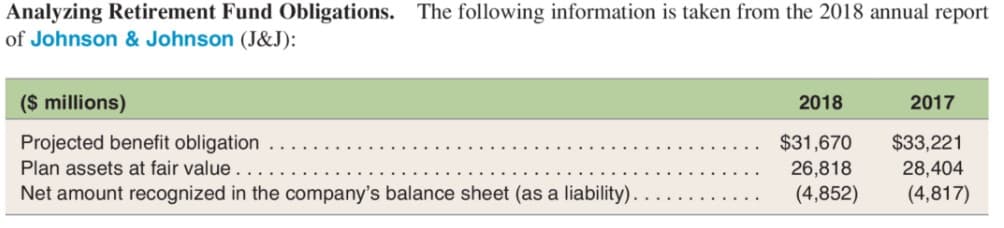

Calculate the amount that J&J’s retirement fund obligations are underfunded as of each year-end. How much of the underfunding is reported on the company’s balance sheet?

Q: firm’s retained earnings represent: That portion of earnings put aside for reinvestment.…

A: Retained earnings is that portion of profit which is not distributed to shareholders and retained in…

Q: A statement of comprehensive income for a company with a defined benefit pension plan does not…

A: The expected return on plan assets is the estimated investment revenue on plan assets invested. This…

Q: tark Inc. follows IFRS for financial reporting and has established a defined benefit pension plan…

A: Step 1 A pension benefit obligation is the present value of retirement benefits earned by employees…

Q: Client transacted on May 9, 2012, Wednesday, to participate in the Peso Fixed Income Fund after…

A: Client transaction = May 9, 2012 May 9, 2012 NAV = 215.391634 May 10, 2012 NAV = 215.337169

Q: Under the defined-benefit pension plan for a company, the expected return on plan assets is $124,000…

A: Ans. Where any differences occurs between the actual return on plan assets and expected returns on…

Q: Calculate the amount that J&J's retirement fund obligations are und as of each year-end. How much of…

A: 1) The amount that J&J's retirement fund obligations are underfunded as of each year-end is :…

Q: Pension data for David Emerson Enterprises include the following: ($ in millions) Discount…

A: Pension plan: The pension plan is an agreement between the employer and the employee. After the…

Q: If an employee’s income is reported based on the total amount received in a year, what basis is the…

A: Taxation - Employees get taxed on the income they earned after deducting exemptions and deductions.

Q: Describe how pension expense is a composite of periodic changes that occur in both the pension…

A: Pension plan: It is the plan devised by corporations to pay the employees an income after their…

Q: In pension accounting, the employer's net pension liability:

A: Govermetal accounting standard Board 68 defined the Net pension liabilities. The net pension…

Q: Sunshine company has a defined benefit pension plan. Using the data available related to pension,…

A: Defined Benefit Plan is a form of retirement benefits for the employees of a corporation in which…

Q: At the start of the year,Boy had the following balances in its pension benefit memo records: Fair…

A: Interest costs = Accrued benefit obligations x Discount rate = 3,200,000 x 9% = 288,000

Q: In determining the present value of the prospective benefits (often referred to as the defined…

A: In determining the present value of the prospective benefits (often referred to as the defined…

Q: Question The following are the balances extracted from the public Accounts on the consolidated fund…

A: Receipt & payment account: It is the statement which shows the actual cash receipt and payment…

Q: The following information is related to the defined benefit pension plan of Melissa Larson Company…

A: Pension expense = Service cost + Interest cost + Expected return on plan assets

Q: The following date relate to the defined benefit plan of Bronson Company for the year ended December…

A: As per relevant IAS, Employee benefit if there is any loss or gain in defined benefit obligation…

Q: Which of the following is Considered Cash? Pension Fund Sinking Fund "Bond Attached is 2 year…

A: Solution: Petty cash fund is cash for small day to day routine expenses.

Q: Describe what factors contribute to the pension benefit obligation. Discuss the effect of the…

A: A projected benefit obligation (PBO) is an actuarial calculation of how much money a firm will…

Q: Explain the following terms. Include the definition, how they are calculated, treated in the…

A: Since you have posted a question with multiple sub-parts, we will solve the first three subparts for…

Q: Discuss the relative objectivity of the measurement process of accrual versus cash (pay-as-you-go)…

A: Pension is the regular payment allowed for an employee after their active working life. It is a…

Q: etermine Douglas-Roberts's pension expense for 2021. 2. Prepare the appropriate journal entries to…

A: Plan assets are those assets which are held for the sole purpose of providing benefits to the…

Q: The return on plan assets is the increase in plan assets (at fair value), adjusted for contributions…

A: Return on plan assets is calculated as Plan assets * Expected Return

Q: Does a credit balance in the fund balance account(s) at the end of the year necessarily mean the…

A: In case if in the fund balance accounts, there is a credit balance then it doesn't mean that the…

Q: The following data relate to Voltaire Company's defined benefit pension plan: ($ in millions) Plan…

A: Particulars Amount Plan assets at the beginning of the year $600 million Add: Actual…

Q: Presented below is information related to Sandhill Inc. pension plan for 2021. Service cost $…

A: Pension Expense = (Service cost+Interest on projected benefit obligation+Amortization of prior…

Q: The accumulated benefit obligation measures __the shortest possible period for funding to maximize…

A: A pension plan refers to the plan that an individual or the company made for the future of their…

Q: Riko Company had the following data related to its defined benefit pension plan: 1/1 Plan Assets…

A: In this question, we have been asked to calculate the ending balance of the pension fund. For which…

Q: Pension plan assets were $80 million at the beginning of the year and $83 million at the end of the…

A: Plan assets at the end of year = Plan assets at the beginning + Return on plan + Cash contribution -…

Q: The Pension Expense in a pension plan for the year were recorded at $856,800. In addition, an amount…

A: Under ASPE, The amount of pension expense that company will record is the pension expense which…

Q: In a defined contribution plan, a formula is used that: O Requires an employer to contribute a…

A: Defined contribution plans are funded by the employees and the amount if collected for their…

Q: While examining the books and records in the general and administrative expense account of X Ltd.,…

A: A pension plan is any plan,fund or scheme which provides retirement income

Q: Which of the following is true about plan assets? Any excess return on plan assets are earned to…

A: Plan assets refer to the form of assets that are held onto by the owner for long-term employee…

Q: Pension data for Millington Enterprises include the following: (S in millions) Discount rate, 10%…

A: Interest cost = Projected benefit obligation at the beginning of the year x Discount rate = $360…

Q: Refer to the situation described below Assume Electronic Distribution prepares its financial…

A: Pension.is a type of income for government employees which they receive on monthly basis post or…

Q: Pension plan assets were $120 million at the beginning of the year and $130 million at the end of…

A:

Q: 1. How much is the annual deposit to the fund? 2. How much is the fund balance as of December 31,…

A: Balance at the end which is required at the end of the specified period, the investor or company…

Q: Indicate by letter whether each of the events listed below increases (I), decreases (D), or has no…

A: Answer: Events 1. N 2. N 3. D 4. I 5. I 6. D 7. I 8. I 9. N 10. I 11. D…

Q: Pension data for Coda Corporation included the following for the current calendar year: Service cost…

A: Interest cost = PBO x discount rate = 720,000 x 10% = $72000

Q: The accounting staff of Wildhorse Inc. has prepared the following pension worksheet. Unfortunately,…

A: A journal entry is a form of accounting entry that is used to report a business transaction in a…

Q: Warrick Boards calculated pension expense for its underfunded pension plan as follows: ($ in…

A: Solution:- Calculation of the elements of Warrick’s balance sheet are affected by the components of…

Q: What amount should Webb Company contribute in order to report an accrued liability for retirement…

A: In the given question we are provided with the data of Webb Company. With the given data we are…

Q: Which of the following statements is false? Unmatured principal installments and accrued…

A: Liabilities should be reported when the transaction resulted in the amount that needs to be paid in…

Q: Generous Inc. determined the following amounts related to its pensions: $ 335,438 Benefits paid to…

A: Pension is an amount which is a big expenditure for any company. Pension expense depends on plan we…

Calculate the amount that J&J’s retirement fund obligations are underfunded as of each year-end. How much of the underfunding is reported on the company’s

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- The actuary for the pension plan of Buffalo Inc. calculated the following net gains and losses. Incurred during the Year (Gain) or Loss 2020 $302,700 2021 476,700 2022 (209,000) 2023 (288,200) Other information about the company’s pension obligation and plan assets is as follows. As of January 1, Projected BenefitObligation Plan Assets(market-related asset value) 2020 $3,993,500 $2,394,800 2021 4,542,200 2,203,200 2022 4,952,900 2,575,400 2023 4,228,400 3,066,100 Buffalo Inc. has a stable labor force of 400 employees who are expected to receive benefits under the plan. The total service-years for all participating employees is 4,400. The beginning balance of accumulated OCI (G/L) is zero on January 1, 2020. The market-related value and the fair value of plan assets are the same for the 4-year period. Use the average remaining service life per employee as the basis for amortization.Compute the…The Pension Expense in a pension plan for the year were recorded at $856,800. In addition, an amount of $161,400 had been debited to the Other Comprehensive Income account to record all actuarial losses for the year. In addition, the company had contributed a cash amount of $350,000 to the Plan Assets. What would have been the amount recorded as Pension expenses for 2019 if the company were reporting under ASPE? Select one: a. $856,800. b. $757,200. c. $161,400. d. $350,000. e. None of the above.Pension data for Sterling Properties include the following: ($ in thousands) Service cost, 2024 $ 116 Projected benefit obligation, January 1, 2024 550 Plan assets (fair value), January 1, 2024 600 Prior service cost—AOCI (2024 amortization, $7) 86 Net loss—AOCI (2024 amortization, $2) 107 Interest rate, 6% Expected return on plan assets, 10% Actual return on plan assets, 11% Required: Assume Sterling Properties prepares its financial statements according to International Financial Reporting Standards (IFRS). The interest rate on high-grade corporate bonds is 6%. Determine the net pension cost. Note: Enter your answer in thousands (i.e., 10,000 should be entered as 10).

- The following information relates to the defined retirement benefit plan of Integrity Company as of December 31, 2021: Net actuarial gain due to remeasurement of benefit obligation and plan assets taken to OCI - P123,000 Prior service cost due to amendment of plan included in retirement benefit expense - P443,000 Fair value of plan assets - P2,557,000 Accrued benefit obligation - P2,800,000 What amount should be shown in the statement of financial position at December 31, 2021 as Prepaid or Accrued Retirement Benefit Cost? a. P243,000 accrued b. P563,000 accrued c. P323,000 prepaid d. P77,000 prepaidThe following information was obtained from the financial statements of X Inc. Defined Benefit Plan Obligations Pension Benefits 2020……………………..2019 Defined Benefit Obligation(DBO): Balance, beginning of year…………………………………………$40,032…………………..42,370 Current Service Cost…………………………………………………… 864…………………. 1,126 Interest Cost…………………………………………………………… 2,344…………………... 2,255 Benefits Paid……………………………………………………………(3,198)………………….. (2,881) Actuarial Gains………………………………………………………... (3,339)………………….. (2,838) Balance, end of year………………………………………………….$36,703……………….….$40,032 Defined Benefit Plan Assets Pension Benefits 2020…………..…………2019 Balance, beginning of year…………………………………………$75,891………………….$90,828 Expected return on Plan Assets……………………………………. 5,599………………….. 6,723 Employee contributions……………………………………………….…The following information was obtained from the financial statements of X Inc. Defined Benefit Plan Obligations Pension Benefits 2020……………………..2019 Defined Benefit Obligation(DBO): Balance, beginning of year…………………………………………$40,032…………………..42,370 Current Service Cost…………………………………………………… 864…………………. 1,126 Interest Cost…………………………………………………………… 2,344…………………... 2,255 Benefits Paid……………………………………………………………(3,198)………………….. (2,881) Actuarial Gains………………………………………………………... (3,339)………………….. (2,838) Balance, end of year………………………………………………….$36,703……………….….$40,032 Defined Benefit Plan Assets Pension Benefits 2020…………..…………2019 Balance, beginning of year…………………………………………$75,891………………….$90,828 Expected return on Plan Assets……………………………………. 5,599………………….. 6,723 Employee contributions……………………………………………….…

- The following information was obtained from the financial statements of X Inc. Defined Benefit Plan Obligations Pension Benefits 2020……………………..2019 Defined Benefit Obligation(DBO): Balance, beginning of year…………………………………………$40,032…………………..42,370 Current Service Cost…………………………………………………… 864…………………. 1,126 Interest Cost…………………………………………………………… 2,344…………………... 2,255 Benefits Paid……………………………………………………………(3,198)………………….. (2,881) Actuarial Gains………………………………………………………... (3,339)………………….. (2,838) Balance, end of year………………………………………………….$36,703……………….….$40,032 Defined Benefit Plan Assets Pension Benefits 2020…………..…………2019 Balance, beginning of year…………………………………………$75,891………………….$90,828 Expected return on Plan Assets……………………………………. 5,599………………….. 6,723 Employee contributions……………………………………………….…The following information is available for Oriole Corporation’s pension plan for the year 2020: Plan assets, January 1, 2020 $410,000 Actual return on plan assets 17,000 Benefits paid to retirees 40,300 Contributions (funding) 94,100 Discount rate 11% Defined benefit obligation, January 1, 2020, accounting basis valuation 506,000 Service cost 66,300 Calculate pension expense for the year 2020, assuming that Oriole follows ASPE, and its accounting policy is to use an accounting basis valuation for its defined benefit obligation. Pension expense $ Provide the entries to recognize the pension expense and funding for the year. (Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit December 31, 2020 (To record pension expense.)…Sandhill Co. had the following selected balances at December 31, 2021: Projected benefit obligation $4,640,000 Accumulated benefit obligation 4,540,000 Fair value of plan assets 4,285,000 Accumulated OCI (PSC) 165,000 Calculate the pension asset/liability to be recorded at December 31, 2021. Pension $

- The following relates to the define benefit obligation plan for Tokwa’t Baboy Inc. in 2016:Accrued benefit obligation, January 1 4,600,000Accrued benefit obligation, December 31 4,929,000FV of plan assets, January 1 5,035,000FV of plan assets, December 31 5,565,000Actuarial gain due to remeasurement of benefit obligation 32,500Employer contributions 425,000Benefits paid to retirees 390,000Discount rate 10% The service cost for current year would beA. P219,500 B. P226,500 C. P262,500 D. P291,500 . The actual return on plan assets for the year isA. P105,000 B. P495,000 C. P503,500 D. P512,000 What is the retirement benefit expense reported in profit or loss for the year 2016?A. P224,000 B. P242,000 C. P248,000 D. P284,000Rockwell Corporation received the following information from its actuary concerning theoperation of the corporation’s defined benefit pension plan. January 1, 2019 December 31, 2019 $000 $000 Vested benefit obligation 1500 1900Accumulated benefit obligation 1900 2730Defined benefit obligation 3600 4700Plan assets (fair value) 2320 3500Discount (Interest) rate 10%Pension asset/liability 1280 ?Service cost for the year 2019 590Contributions (funding in 2019)…The actuary for the pension plan of Gustafson Inc. calculated the following net gains and losses. IncurredDuring the Year (Gain) or Loss 2020 $300,000 2021 480,000 2022 (210,000) 2023 (290,000) Other information about the company's pension obligation and plan assets is as follows. As of January 1, Projected BenefitObligation Plan Assets(market-related asset value) 2020 $4,000,000 $2,400,000 2021 4,520,000 2,200,000 2022 5,000,000 2,600,000 2023 4,240,000 3,040,000 Gustafson Inc. has a stable labor force of 400 employees who are expected to receive benefits under the plan. The total service-years for all participating employees is 5,600. The beginning balance of accumulated OCI (G/L) is zero on January 1, 2020. The market-related value and the fair value of plan assets are the same for the 4-year period. Use the average remaining service life per employee as the basis for amortization. Instructions (Round to the nearest dollar.) Prepare a…