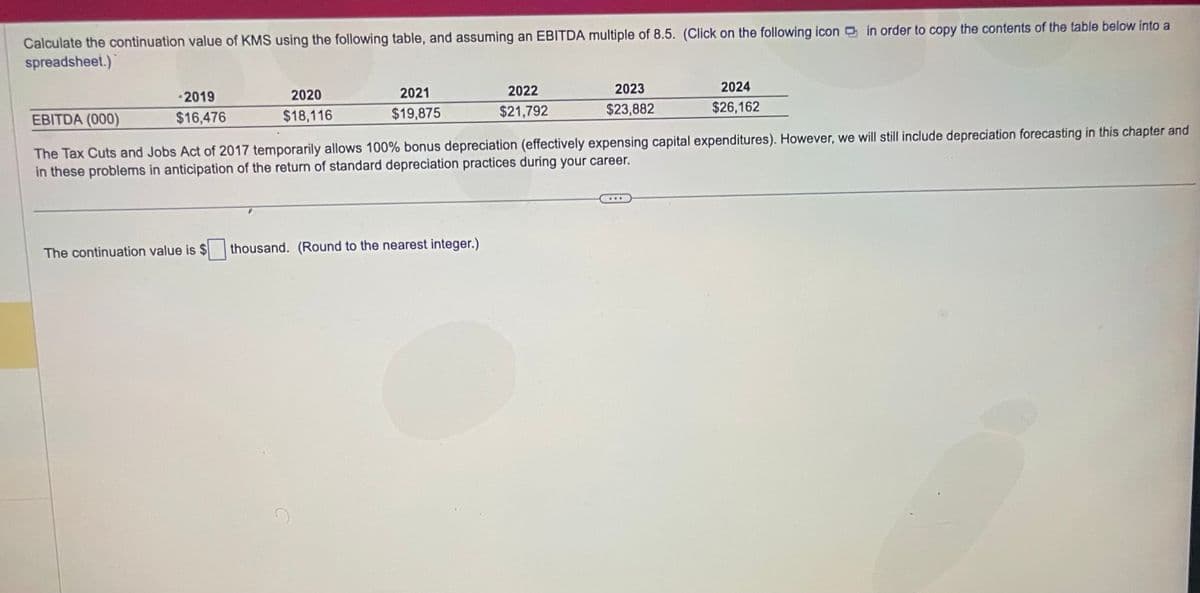

Calculate the continuation value of KMS using the following table, and assuming an EBITDA multiple of 8.5. (Click on the following icon in order to copy the contents of the table below into a spreadsheet.) -2019 $16,476 2020 $18,116 The continuation value is $ 2021 $19,875 2022 $21,792 thousand. (Round to the nearest integer.) 2023 $23,882 EBITDA (000) The Tax Cuts and Jobs Act of 2017 temporarily allows 100% bonus depreciation (effectively expensing capital expenditures). However, we will still include depreciation forecasting in this chapter and in these problems in anticipation of the return of standard depreciation practices during your career. 2024 $26,162

Calculate the continuation value of KMS using the following table, and assuming an EBITDA multiple of 8.5. (Click on the following icon in order to copy the contents of the table below into a spreadsheet.) -2019 $16,476 2020 $18,116 The continuation value is $ 2021 $19,875 2022 $21,792 thousand. (Round to the nearest integer.) 2023 $23,882 EBITDA (000) The Tax Cuts and Jobs Act of 2017 temporarily allows 100% bonus depreciation (effectively expensing capital expenditures). However, we will still include depreciation forecasting in this chapter and in these problems in anticipation of the return of standard depreciation practices during your career. 2024 $26,162

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter8: Current And Contingent Liabilities

Section: Chapter Questions

Problem 2MCQ

Related questions

Question

Transcribed Image Text:Calculate the continuation value of KMS using the following table, and assuming an EBITDA multiple of 8.5. (Click on the following icon in order to copy the contents of the table below into a

spreadsheet.)

-2019

$16,476

2020

$18,116

The continuation value is $

2021

$19,875

2022

$21,792

thousand. (Round to the nearest integer.)

2023

$23,882

EBITDA (000)

The Tax Cuts and Jobs Act of 2017 temporarily allows 100% bonus depreciation (effectively expensing capital expenditures). However, we will still include depreciation forecasting in this chapter and

in these problems in anticipation of the return of standard depreciation practices during your career.

2024

$26,162

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning