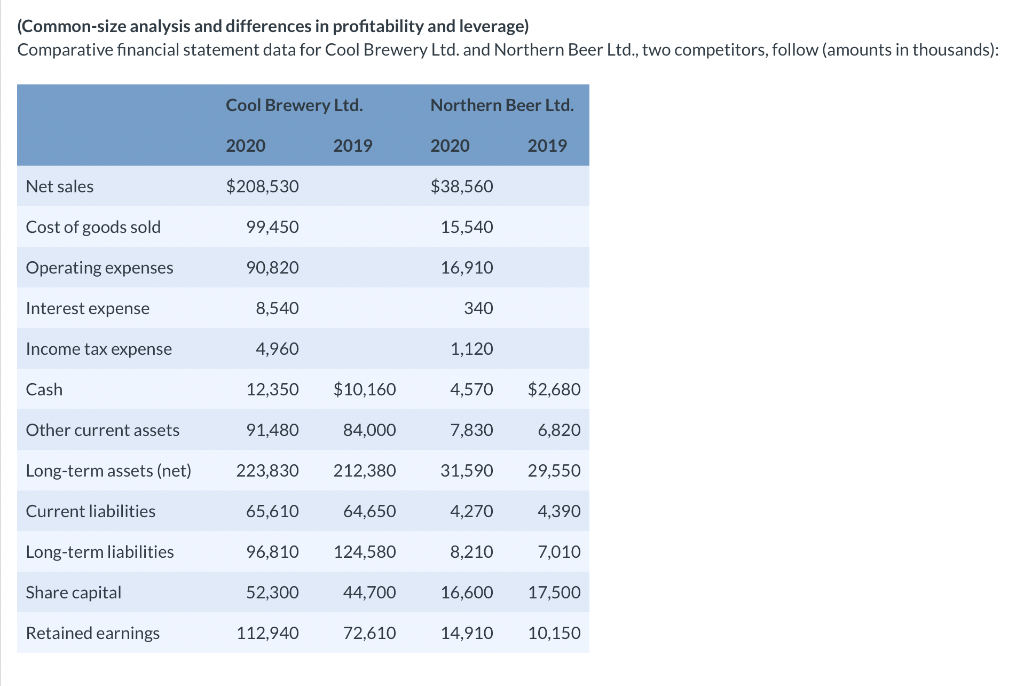

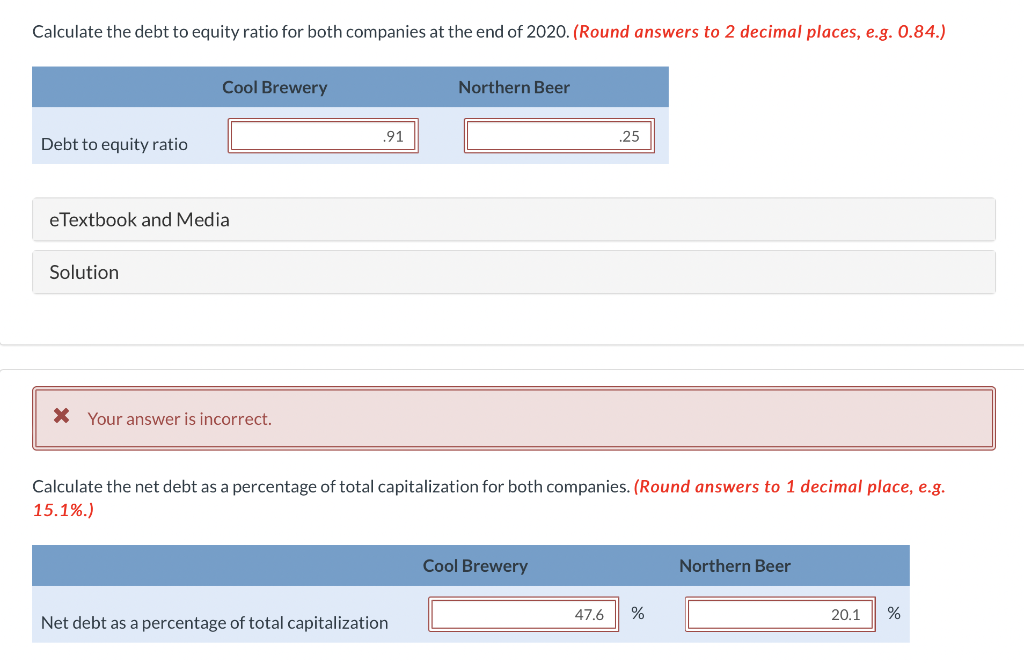

Calculate the debt to equity ratio for both companies at the end of 2020. (Round answers to 2 decimal places, e.g. 0.84.) Debt to equity ratio Cool Brewery eTextbook and Media Solution * Your answer is incorrect. .91 Northern Beer Net debt as a percentage of total capitalization Calculate the net debt as a percentage of total capitalization for both companies. (Round answers to 1 decimal place, e.g. 15.1%.) .25 Cool Brewery 47.6 % Northern Beer 20.1 %

Q: on 1 enny's direct material cost is $5 per unit. The direct labor rate is $19 per hour and each…

A: The cost of goods sold is, essentially, the cost that is incurred to produce the goods sold. These…

Q: Mr Jose Peralta, a Filipino merchant residing in Greenhils, made the following gifts in 2021 and…

A: Mr Jose Peralta, a Filipino merchant residing in Greenhils has given a few gifts during the year…

Q: On September 1, 2019 Philips corporation sold merchandise to a foreign customer for 300,000…

A: Date Account Titles Debit ($) Credit ($) 01-Sep-19 Account Receivable (K) (300,000 x 0.46) 138,000…

Q: What are the tax implications of the different methods through which property is disposed? USA

A: Taxation - Taxation is the imposition of a tax on individuals and various types of organizations,…

Q: In 20x1, Devin Co. enters into a contract to construct a building for a customer. Devin Co.…

A: Comment; We’ll answer the first question since the exact one wasn’t specified. Please submit a new…

Q: please help with this genernal and admin expense budget

A: Introduction: A budget is an estimation of items of income and cost for the coming periods. Budget…

Q: n 1 July 2021 Michael Ltd. issues $1 million in five – year debentures that pay interest each six…

A: Lets understand the basics. When debenture is issued at less than the face value of bond then bond…

Q: Prepare journal entries to record the following merchandising transactions of Zhang's, which uses…

A: The process of recording business transactions in the books of accounts for the first time is…

Q: Lohan company uses plant wise predetermined overhead rate of $23.40 per direct labour hour. This…

A: Manufacturing overheads means the overheads incurred on the manufacture or production of the goods.…

Q: b) Using the information provided, prepare an income statement for 2001 similar to Exhibit 16.2…

A: Income Statements have various formats depending on the type of business a company is reporting. It…

Q: QS 8-15 (Algo) Intangible assets and amortization LO P4 On January 1 of this year, Diaz Boutique…

A: Introduction: The act of logging any transaction, whether or not it is an economic one, is known as…

Q: At the beginning of the period, the Cutting Department budgeted direct labor of $125,000, direct…

A: A budget is a forecast of revenue and expenses for a certain future period of time that is generally…

Q: [The following information applies to the questions displayed below.] Ramirez Company installs a…

A: Business organizations are required to charge the depreciation expense so that the assets are shown…

Q: ABC (S) Pte Ltd, incorporated in 2010, is in the business of manufacturing tyres. For the year ended…

A: Taxable income: It implies to the income that is earned by a business or any individual and subject…

Q: Required information Problem 8-4A Preparing a bank reconciliation and recording adjustments LO P3…

A: The business transaction is firstly recorded in the accounting records by making journal entries.…

Q: What is the amount deductible under Section 14Q in Year of Assessment 2020? Group of answer choices…

A: Deduction under section 14Q :— in this section we get the deduction of refurbishment and renovation…

Q: On January 1, 2021, Tonge Industries had outstanding 460,000 common shares ($1 par) that originally…

A: Numerator / Denominator = Earning per share Basic $ 550,000 / 463,000 =…

Q: Dimsdale Sports, a merchandising company, reports the following balance sheet at December 31.…

A: Every business organization's are required t maintain the capital expenditure budget so as to run…

Q: As of December 31, 2020, Dayton Industries had $2,000 of raw materials Inventory. At the beginning…

A: Inventory is the value of goods manufactured, bought, kept or sold by a business entity. It includes…

Q: Use the following information for the Exercise below. (Algo) Skip to question [The…

A: Variable Costing - Variable costing formula = Sales - Variable Costs - Fixed Cost = Operating Income…

Q: You are auditing general cash for the Tampa Supply Company for the fiscal year ended March 31, 2019.…

A: Bank reconciliation statement It summarises the banking and business activity, by reconciling the…

Q: Job A3B was ordered by a customer on September 25. During the month of September, Jaycee Corporation…

A: Total cost of the job included the raw material and conversion cost incurred for the job. Total cost…

Q: On January 1, 2012, Horizon Group sold property carried in inventory at a cost of P1,470,000 for…

A: installment method is method of revenue recognition in which gross profit is deffered until the…

Q: Miller and Sons' static budget for 10,500 units of production includes $44,700 for direct materials,…

A:

Q: Describe how total fixed costs and unit fixed costs behave as the level of activity increases?

A: Fixed cost: It is a cost that does not change with an increase or decrease in output i.e it remains…

Q: Blossom Inc. issues $210,000, 10-year, 8% bonds at 96. Prepare the journal entry to record the sale…

A: The process of recording business transactions in the books of accounts for the first time is…

Q: On December 1, 2022, Splish Brothers Inc. had the following account balances. Cash Accounts…

A: The income statement is the financial statement of the business. It tells about the profit or losses…

Q: Sharp Company manufactures a product for which the following standards have been set: Standard…

A: Variance refers to the difference between the actual and the standard performance of the company.…

Q: Diaz Company owns a machine that cost $126,900 and has accumulated depreciation of $92,800. Prepare…

A: Journal entries forms the basis for accounting. Usually, organization follow dual accounting…

Q: + Laurel Ltd. has just started a business with capital of £9,000. The following budgeted information…

A: Cash budget is one of the budget being prepared for tracking of cash receipts and cash payments from…

Q: ased on a sales forecast of 80,000 T-shirts: Sales Cost of Goods Sold Gross Profit Operating…

A: Answer : In a flexible budget for sales of 60,000 T shirts, how much would Baskin budget for…

Q: The Harris Company is the lessee on a four-year lease with the following payments at the end of each…

A: Leasing is an agreement which is usually written between the lessor and the lessee which allows for…

Q: Troy Engines, Limited, manufactures a variety of engines for use in heavy equipment. The company has…

A: Making the decision to manufacture a product internally versus buying it from a third party provider…

Q: In July what are the total estimated cash disbursements for raw materials purchases? Assume the cost…

A: Cash Disbursement of Raw materials purchase :— It is the cash payment for the purchase of raw…

Q: Determine the second-year depreciation using the straight-line method.

A: Depreciation is a periodical expenses charged to the profit and loss account over the asset life.…

Q: A corporation declared a 40% share capital dividend on its 60,000 shares of P20 par ordinary shares…

A: Introduction: Current profits less any dividends or even other distributions to shareholders are a…

Q: The actual margin per unit and margin per unit estimated in the plan are $6 and $8, respectively.…

A: The margin variance is computed by deducting the actual margin from the budgeted margin. The formula…

Q: Morganton Company makes one product and it provided the following information to help prepare the…

A: A master budget is a financial plan that outlines an organization's projected income and expenses…

Q: The fixed budget for 20,000 units of production shows sales of $400,000; variable costs of $80,000;…

A: Working:

Q: Use the following information for Brief Exercises 15-24 and 15-25: Jasmine Company provided the…

A: 15-24/15.1 Particulars Year 1 Year 2 Year 2 Year 3 Year 3 Dollars ($) Dollars ($) % Dollars…

Q: October 1, 2022, the Integrity Main Office established a sales agency in Ortigas. · The main…

A: Net profit is calculated by deducting all related expenses from gross profit. Expenses including…

Q: he Pacific Division of Cullumber Industries reported the following data for the current year. Sales…

A: Return on investment is one of the profitability ratio which is being used in business. This shows…

Q: Food Harvesting Corporation is considering purchasing a machine for $1,718,750. The machine is…

A: Introduction: The payback period is the number of years needed to repay the initial financial…

Q: fore reconciling its bank statement, Rollin Corporation's general ledger had a month-end balance in…

A: Bank Reconciliation The purpose of preparing the bank Reconciliation statement is to rectify the…

Q: Ramirez Company installs a computerized manufacturing machine in its factory at the beginning of the…

A: Under the units-of-production method or activity method the yearly depreciation is calculated based…

Q: QUESTION 5 Big Three Company produces televisions. Budgeted sales for February are 1070 units.…

A: As per the given information; Budgeted sales for February - 1070 units Finished goods inventory on…

Q: Ayala Corporation accumulates the following data relative to jobs started and finished during the…

A:

Q: $800,000. If he received $200,000 in cash and 100 shares of stock, the resulting bases are: O Elon's…

A: Whenever a Business Entity sold goods or provide services, it receive something in consideration.…

Q: On July 1, 2018, Tremen Corporation acquired 40% of the shares of Delany Company. Tremen paid…

A: Investment is the amount which is put into some assets or securities to gain some returns in future.…

Q: 5. What is the maximum price that Silven should be willing to pay the outside supplier for a box of…

A: Lets understand the basics. When there is option to either make or buy product then management try…

please help me to solve this problem

Step by step

Solved in 2 steps with 1 images

- Prepare the common-size financial statement for the entities below and provide a reasoned explanation of the benefits relative to ratios when used to compare performance and establish trends. Income statements for year ending 31 December 2020 Energy Plus Co. ltd V8 Splash Ltd. $’000 $’000 Net revenue 35,119 30,990 Cost of goods sold 12,693 11,088 Gross profit 22,426 19,902 Selling & administrative expenses 13,158 11,358 Other operating expenses 819…Presented below is the 2018 income statement and comparative balance sheet information for Tiger Enterprises.TIGER ENTERPRISESIncome StatementFor the Year Ended December 31, 2018($ in thousands)Sales revenue $7,000Operating expenses:Cost of goods sold $3,360Depreciation 240Insurance 100Administrative and other 1,800Total operating expenses 5,500Income before income taxes 1,500Income tax expense 600Net income $ 900Balance Sheet Information ($ in thousands) Dec. 31, 2018 Dec. 31, 2017Assets:Cash $ 300 $ 200Accounts receivable 750 830Inventory 640 600Prepaid insurance 50 20Plant and equipment 2,100 1,800Less: Accumulated depreciation (840) (600)Total assets $3,000 $2,850Liabilities and Shareholders’ Equity:Accounts payable $ 300 $360Payables for administrative and other expenses 300 400Income taxes payable 200 150Note payable (due 12/31/2019) 800 600Common stock 900 800Retained earnings 500 540Total liabilities and shareholders’ equity $3,000 $2,850Required:Prepare Tiger’s statement of…Here are comparative financial statement data for Sandhill Company and Wildhorse Company, two competitors. All data are as of December 31, 2022, and December 31, 2021. Sandhill Company Wildhorse Company 2022 2021 2022 2021 Net sales $1,872,000 $559,000 Cost of goods sold 1,100,736 297,388 Operating expenses 263,952 79,378 Interest expense 9,360 4,472 Income tax expense 54,288 6,149 Current assets 326,000 $314,500 83,500 $78,600 Plant assets (net) 519,600 497,900 141,000 125,100 Current liabilities 66,000 75,800 36,600 29,800 Long-term liabilities 107,800 91,600 30,400 25,600 Common stock, $10 par 498,000 498,000 122,500 122,500 Retained earnings 173,800 147,000 35,000 25,800 (a) Prepare a vertical analysis of the 2022 income statement data for Sandhill Company and Wildhorse Company. (Round percentages…

- The most recent financial statements for Assouad, Incorporated, are shown here: Income Statement Balance Sheet Sales $ 8,700 Current assets $ 4,200 Current liabilities $ 1,900 Costs 5,600 Fixed assets 10,400 Long-term debt 3,800 Taxable income $ 3,100 Equity 8,900 Taxes (25%) 775 Total $ 14,600 Total $ 14,600 Net income $ 2,325 Assets, costs, and current liabilities are proportional to sales. Long-term debt and equity are not. The company maintains a constant 40 percent dividend payout ratio. As with every other firm in its industry, next year’s sales are projected to increase by exactly 15 percent. What is the external financinHere are comparative financial statement data for Bramble Company and Maria Company, two competitors. All data are as of December 31, 2022, and December 31, 2021. Bramble Company Maria Company 2022 2021 2022 2021 Net sales $1,824,000 $559,000 Cost of goods sold 1,050,624 296,829 Operating expenses 269,952 79,937 Interest expense 7,296 4,472 Income tax expense 54,720 6,708 Current assets 329,000 $312,100 82,300 $78,900 Plant assets (net) 520,800 499,700 140,700 125,100 Current liabilities 65,000 74,200 34,400 29,000 Long-term liabilities 108,400 92,000 30,800 25,200 Common stock, $10 par 495,500 495,500 122,500 122,500 Retained earnings 180,900 150,100 35,300 27,300Here are comparative financial statement data for Bonita Company and Linda Company, two competitors. All data are as of December 31, 2022, and December 31, 2021. Bonita Company Linda Company 2022 2021 2022 2021 Net sales $1,836,000 $561,000 Cost of goods sold 1,029,996 297,330 Operating expenses 269,892 79,662 Interest expense 9,180 4,488 Income tax expense 53,244 6,171 Current assets 326,500 $310,300 83,200 $78,000 Plant assets (net) 519,000 499,100 139,200 125,700 Current liabilities 65,000 75,600 36,200 29,600 Long-term liabilities 107,600 89,800 28,800 24,400 Common stock, $10 par 505,000 505,000 116,000 116,000 Retained earnings 167,900 139,000 41,400 33,700 Compute the 2022 return on assets and the return on common stockholders’ equity ratios for both companies. (Round…

- Below are the Income Statement and Balance Sheet for Longborg Corporation for the years ended 2020 and 2021. Calculate the profitability ratios in the table to the right for the year ended 2021. Longborg Corporation Comparative Income Statement For the Years Ended December 31, 2021 and 2020 2021 2020 Amount Amount Sales $60,200,300 $52,410,500 Cost of goods sold 44,850,700 39,050,800 Gross profit 15,349,600 13,359,700 Selling expenses 2,725,500 2,860,600 Administrative expenses 2,850,300 2,575,400 Total operating expenses 5,575,800 5,436,000 Income from operations 9,773,800 7,923,700 Interest Expense 385,200 425,600 Other income 125,000 105,000 Income before income tax 9,513,600 7,603,100 Income tax expense 3,329,800…Here are the comparative income statements of Cullumber Corporation. CULLUMBER CORPORATIONComparative Income StatementFor the Years Ended December 31 2022 2021 Net sales $639,400 $578,200 Cost of goods sold 464,800 433,400 Gross Profit 174,600 144,800 Operating expenses 70,500 43,000 Net income $ 104,100 $ 101,800 (a)Prepare a horizontal analysis of the income statement data for Cullumber Corporation, using 2021 as a base. (If amount and percentage are a decrease show the numbers as negative, e.g. -55,000, -20% or (55,000), (20%). Round percentages to 1 decimal place, e.g. 12.1%.) CULLUMBER CORPORATIONComparative Income Statementchoose the accounting period For the Years Ended December 31For the Month Ended December 31December 31 Increase or (Decrease) During 2022 2022 2021 Amount Percentage Net…Below are the Income Statement and Balance Sheet for Longborg Corporation for the years ended 2020 and 2021. Calculate the leverage ratios in the table to the right for the year ended 2021. Longborg Corporation Comparative Income Statement For the Years Ended December 31, 2021 and 2020 2021 2020 Amount Amount Sales $60,200,300 $52,410,500 Cost of goods sold 44,850,700 39,050,800 Gross profit 15,349,600 13,359,700 Selling expenses 2,725,500 2,860,600 Administrative expenses 2,850,300 2,575,400 Total operating expenses 5,575,800 5,436,000 Income from operations 9,773,800 7,923,700 Interest Expense 385,200 425,600 Other income 125,000 105,000 Income before income tax 9,513,600 7,603,100 Income tax expense 3,329,800 2,661,000 Net income $6,183,800 $4,942,100…

- Below are the Income Statement and Balance Sheet for Longborg Corporation for the years ended 2020 and 2021. Calculate the leverage ratios in the table to the right for the year ended 2021. Longborg Corporation Comparative Income Statement For the Years Ended December 31, 2021 and 2020 2021 2020 Amount Amount Sales $60,200,300 $52,410,500 Cost of goods sold 44,850,700 39,050,800 Gross profit 15,349,600 13,359,700 Selling expenses 2,725,500 2,860,600 Administrative expenses 2,850,300 2,575,400 Total operating expenses 5,575,800 5,436,000 Income from operations 9,773,800 7,923,700 Interest Expense 385,200 425,600 Other income 125,000 105,000 Income before income tax 9,513,600 7,603,100 Income tax expense 3,329,800 2,661,000 Net income $6,183,800 $4,942,100…Here are comparative financial statement data for Bramble Company and Debra Company, two competitors. All data are as of December 31, 2022, and December 31, 2021. Bramble Company Debra company 2022 2021 2022 2021 Net sales $1,896,000 $561,000 Cost of goods sold 1,020,048 297,330 Operating expenses 257,856 79,662 Interest expense 7,584 3,927 Income tax expense 54,984 6,171 Current assets 322,500 $310,000 83,500 $78,000 Plant assets (net) 520,800 500,300 139,800 123,000 Current liabilities 64,200 75,600 34,400 29,600 Long-term liabilities 108,400 90,400 28,400 26,000 Common stock, $10 par 498,000 498,000 122,500 122,500 Retained earnings 172,700 146,300 38,000 22,900 (a) Prepare a vertical analysis of the 2022 income statement data for Bramble Company and Debra Company. (Round…Here are comparative financial statement data for Bramble Company and Debra Company, two competitors. All data are as of December 31, 2022, and December 31, 2021. Bramble Company Debra Company 2022 2021 2022 2021 Net sales $1,896,000 $561,000 Cost of goods sold 1,020,048 297,330 Operating expenses 257,856 79,662 Interest expense 7,584 3,927 Income tax expense 54,984 6,171 Current assets 322,500 $310,000 83,500 $78,000 Plant assets (net) 520,800 500,300 139,800 123,000 Current liabilities 64,200 75,600 34,400 29,600 Long-term liabilities 108,400 90,400 28,400 26,000 Common stock, $10 par 498,000 498,000 122,500 122,500 Retained earnings 172,700 146,300 38,000 22,900 Compute the 2022 return on assets and the return on common stockholders’ equity ratios for both companies. (Round answers to 1 decimal…