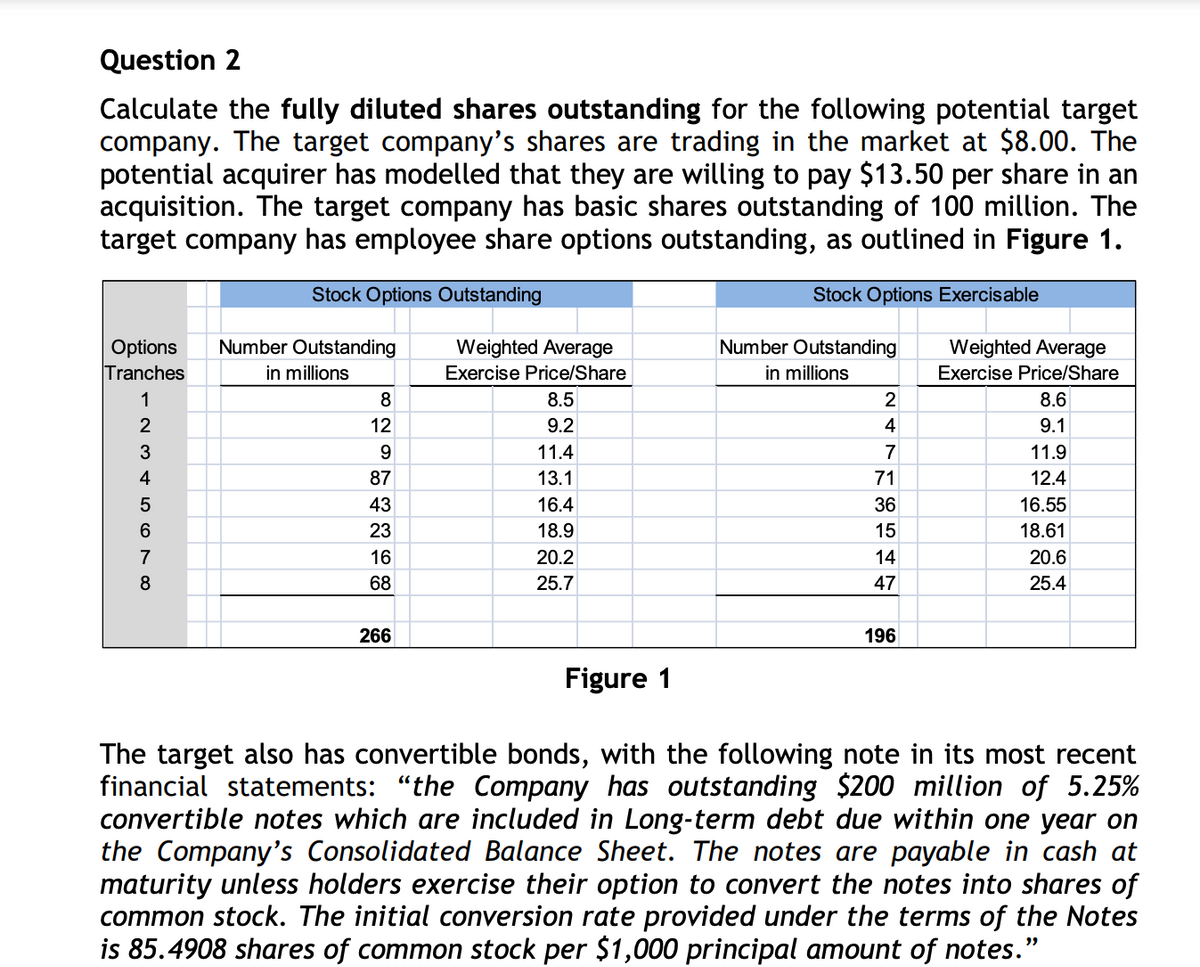

Calculate the fully diluted shares outstanding for the following potential target company. The target company's shares are trading in the market at $8.00. The potential acquirer has modelled that they are willing to pay $13.50 per share in an acquisition. The target company has basic shares outstanding of 100 million. The target company has employee share options outstanding, as outlined in Figure 1. Stock Options Outstanding Stock Options Exercisable Options Number Outstanding Tranches in millions 5678 A W N 3 4 8 12 9 87 43 23 16 68 266 Weighted Average Exercise Price/Share 8.5 9.2 11.4 13.1 16.4 18.9 20.2 25.7 Number Outstanding in millions 2 4 7 71 36 15 14 47 196 Weighted Average Exercise Price/Share 8.6 9.1 11.9 12.4 16.55 18.61 20.6 25.4 Figure 1 The target also has convertible bonds, with the following note in its most recent financial statements: "the Company has outstanding $200 million of 5.25% convertible notes which are included in Long-term debt due within one year on the Company's Consolidated Balance Sheet. The notes are payable in cash at maturity unless holders exercise their option to convert the notes into shares of common stock. The initial conversion rate provided under the terms of the Notes is 85.4908 shares of common stock per $1.000 principal amount of notes."

Calculate the fully diluted shares outstanding for the following potential target company. The target company's shares are trading in the market at $8.00. The potential acquirer has modelled that they are willing to pay $13.50 per share in an acquisition. The target company has basic shares outstanding of 100 million. The target company has employee share options outstanding, as outlined in Figure 1. Stock Options Outstanding Stock Options Exercisable Options Number Outstanding Tranches in millions 5678 A W N 3 4 8 12 9 87 43 23 16 68 266 Weighted Average Exercise Price/Share 8.5 9.2 11.4 13.1 16.4 18.9 20.2 25.7 Number Outstanding in millions 2 4 7 71 36 15 14 47 196 Weighted Average Exercise Price/Share 8.6 9.1 11.9 12.4 16.55 18.61 20.6 25.4 Figure 1 The target also has convertible bonds, with the following note in its most recent financial statements: "the Company has outstanding $200 million of 5.25% convertible notes which are included in Long-term debt due within one year on the Company's Consolidated Balance Sheet. The notes are payable in cash at maturity unless holders exercise their option to convert the notes into shares of common stock. The initial conversion rate provided under the terms of the Notes is 85.4908 shares of common stock per $1.000 principal amount of notes."

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter11: Stockholders' Equity

Section: Chapter Questions

Problem 11.4DC

Related questions

Question

Transcribed Image Text:Question 2

Calculate the fully diluted shares outstanding for the following potential target

company. The target company's shares are trading in the market at $8.00. The

potential acquirer has modelled that they are willing to pay $13.50 per share in an

acquisition. The target company has basic shares outstanding of 100 million. The

target company has employee share options outstanding, as outlined in Figure 1.

Stock Options Outstanding

Stock Options Exercisable

Options

Tranches

1

2

8656 AWN

3

4

7

Number Outstanding

in millions

8

12

9

87

43

23

16

68

266

Weighted Average

Exercise Price/Share

8.5

9.2

11.4

13.1

16.4

18.9

20.2

25.7

Number Outstanding

in millions

2

4

7

71

36

15

14

47

196

Weighted Average

Exercise Price/Share

8.6

9.1

11.9

12.4

16.55

18.61

20.6

25.4

Figure 1

The target also has convertible bonds, with the following note in its most recent

financial statements: "the Company has outstanding $200 million of 5.25%

convertible notes which are included in Long-term debt due within one year on

the Company's Consolidated Balance Sheet. The notes are payable in cash at

maturity unless holders exercise their option to convert the notes into shares of

common stock. The initial conversion rate provided under the terms of the Notes

is 85.4908 shares of common stock per $1,000 principal amount of notes."

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning