Calculate the monthly payment by table lookup and formula. (Answers will not be exact due to rounding of percents in table lookup.) (Use 15.5% for table lookup.) (Use the loan amortization table.) (Round your answers to the nearest cent.) Purchase price of a used car Down payment Number of monthly payments Amount financed Total of monthly payments Total finance charge APR $4,195 $95 60 $ 4,100 $5,944.00 $1,844.00 15.5% Calculate the monthly payment by table lookup and formula. (Answers will not be exact due to rounding of percents in table lookup.) (Use 15.5% for table lookup.) (Use the loan amortization table.) (Round your answers to the nearest cent.) ****TABLE ATTACHED***** Monthly Payment By table: By formula:

Calculate the monthly payment by table lookup and formula. (Answers will not be exact due to rounding of percents in table lookup.) (Use 15.5% for table lookup.) (Use the loan amortization table.) (Round your answers to the nearest cent.) Purchase price of a used car Down payment Number of monthly payments Amount financed Total of monthly payments Total finance charge APR $4,195 $95 60 $ 4,100 $5,944.00 $1,844.00 15.5% Calculate the monthly payment by table lookup and formula. (Answers will not be exact due to rounding of percents in table lookup.) (Use 15.5% for table lookup.) (Use the loan amortization table.) (Round your answers to the nearest cent.) ****TABLE ATTACHED***** Monthly Payment By table: By formula:

Chapter12: Current Liabilities

Section: Chapter Questions

Problem 15MC: Marathon Peanuts converts a $130,000 account payable into a short-term note payable, with an annual...

Related questions

Question

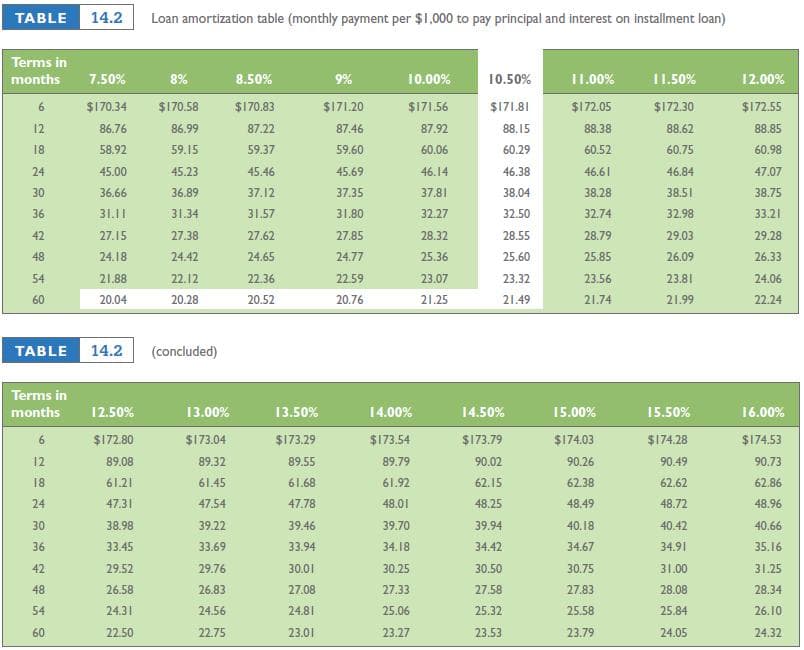

Calculate the monthly payment by table lookup and formula. (Answers will not be exact due to rounding of percents in table lookup.) (Use 15.5% for table lookup.) (Use the loan amortization table.) (Round your answers to the nearest cent.)

| Purchase price of a used car |

Down payment |

Number of monthly payments |

Amount financed |

Total of monthly payments |

Total finance charge |

APR |

| $4,195 | $95 | 60 | $ 4,100 | $5,944.00 | $1,844.00 | 15.5% |

Calculate the monthly payment by table lookup and formula. (Answers will not be exact due to rounding of percents in table lookup.) (Use 15.5% for table lookup.) (Use the loan amortization table.) (Round your answers to the nearest cent.)

****TABLE ATTACHED*****

Monthly Payment

By table:

By formula:

Transcribed Image Text:TABLE

14.2

Loan amortization table (monthly payment per $1,000 to pay principal and interest on installment loan)

Terms in

months

7.50%

8%

8.50%

9%

10.00%

10.50%

11.00%

11.50%

12.00%

$170.34

$170.58

$170.83

$171.20

$171.56

$171.81

$172.05

$172.30

$172.55

12

86.76

86.99

87.22

87.46

87.92

88.15

88.38

88.62

88.85

18

58.92

59.15

59.37

59.60

60.06

60.29

60.52

60.75

60.98

24

45.00

45.23

45.46

45.69

46.14

46.38

46.61

46.84

47.07

30

36.66

36.89

37,12

37.35

37.81

38.04

38.28

38.51

38.75

36

31.11

31.34

31.57

31.80

32.27

32.50

32.74

32.98

33.21

42

27.15

27.38

27.62

27.85

28.32

28.55

28.79

29.03

29.28

48

24.18

24.42

24.65

24.77

25.36

25.60

25.85

26.09

26.33

54

21.88

22.12

22.36

22.59

23.07

23.32

23.56

23.81

24.06

60

20.04

20.28

20.52

20.76

21.25

21.49

21.74

21.99

22.24

TABLE 14.2

(concluded)

Terms in

months

12.50%

13.00%

13.50%

14.00%

14.50%

15.00%

15.50%

16.00%

6.

$172.80

$173.04

$173.29

$173.54

$173.79

$174.03

$174.28

$174.53

12

89.08

89.32

89.55

89.79

90.02

90.26

90.49

90.73

18

61.21

61.45

61.68

61.92

62.15

62.38

62.62

62.86

24

47.31

47.54

47.78

48.01

48.25

48.49

48.72

48.96

30

38.98

39.22

39.46

39.70

39.94

40.18

40.42

40.66

36

33.45

33.69

33.94

34.18

34.42

34.67

34.91

35.16

42

29.52

29.76

30.01

30.25

30.50

30.75

31.00

31.25

48

26.58

26.83

27.08

27.33

27.58

27.83

28.08

28.34

54

24.31

24.56

24.81

25.06

25.32

25.58

25.84

26.10

60

22.50

22.75

23.01

23.27

23.53

23.79

24.05

24.32

6.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning