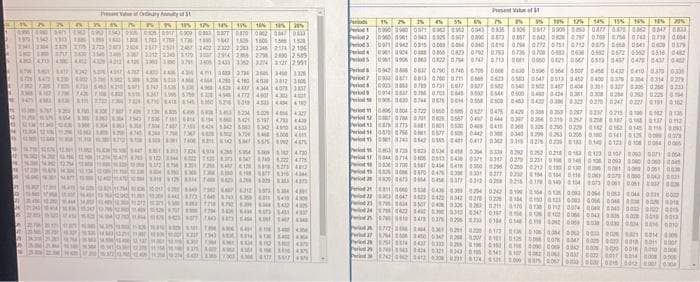

Calculate the present value of the following future cash flows, rounding all calculations to the nearest dollar (Click the icon to view Present Value of $1 table) (Click the icon to view Present Value of Ordinary Annuity of $1 table) $12,000 received in five years with interest of 7% $12,000 received in each of the following five years with interest of 7% Payments of $7,000, $8,000, and $5,500 received in years 3, 4 and 5, respectively, with interest of 9% 11. 12. 13. 11. Calculate the present value of $12,000 received in five years with interest of 7% (Enter any factor amounts to three decimal places, X.XXX.) Present value X X Year 3 Year 4 Year 5 Total 12. Calculate the present value of $12,000 received in each of the following five years with interest of 7% (Enter any factor amounts to three decimal places, X.XXX.) Present value of an annuity X 13. Calculate the present value for payments of $7,000, $8,000, and $5,500 received in years 3, 4 and 5, respectively, with interest of 9% (Enter any factor amounts to three decimal places, XXXX) 7500 Present value X COB = x =

Calculate the present value of the following future cash flows, rounding all calculations to the nearest dollar (Click the icon to view Present Value of $1 table) (Click the icon to view Present Value of Ordinary Annuity of $1 table) $12,000 received in five years with interest of 7% $12,000 received in each of the following five years with interest of 7% Payments of $7,000, $8,000, and $5,500 received in years 3, 4 and 5, respectively, with interest of 9% 11. 12. 13. 11. Calculate the present value of $12,000 received in five years with interest of 7% (Enter any factor amounts to three decimal places, X.XXX.) Present value X X Year 3 Year 4 Year 5 Total 12. Calculate the present value of $12,000 received in each of the following five years with interest of 7% (Enter any factor amounts to three decimal places, X.XXX.) Present value of an annuity X 13. Calculate the present value for payments of $7,000, $8,000, and $5,500 received in years 3, 4 and 5, respectively, with interest of 9% (Enter any factor amounts to three decimal places, XXXX) 7500 Present value X COB = x =

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

ChapterA3: Time Value Of Money

Section: Chapter Questions

Problem 12E

Related questions

Question

K Calculate the present value of the following future cash flows, rounding all calculations to the nearest dollar (Click the icon to view Present Value of $1 table) (Click the icon to view Present Value of Ordinary Annuity of $1 table) $12,000 received in five years with interest of 7% $12,000 received in each of the following five years with interest of 7% Payments of $7,000, $8,000, and $5,500 received in years 3, 4 and 5, respectively, with interest of 9% 11. 12. 13. 11. Calculate the present value of $12,000 received in five years with interest of 7% (Enter any factor amounts to three decimal places, X.XXX.) Present value X X Year 3 Year 4 Year 5 Total 12. Calculate the present value of $12,000 received in each of the following five years with interest of 7% (Enter any factor amounts to three decimal places, X.XXX.) Present value of an annuity X 13. Calculate the present value for payments of $7,000, $8,000, and $5,500 received in years 3, 4 and 5, respectively, with interest of 9% (Enter any factor amounts to three decimal places, XXXX) 7500 Present value X COB = x =

Transcribed Image Text:Primary My St

n

PS IPS 175 MS

1990 400 2975 AM 690 850 909090303 0877

180 150 130 188 189 180 1780 17 57 148 152

SNG 377 3400 3545 346 3367 3312 220 1370 303 294 285 276 28002589

ANDATO A424064212 413 3380 100 37 2408 140 1382 324 3127 2991

4725 6479 420 400257 552 53 5.28 $30 44464420 4160 4330 3812 1000

4.750 5483 620 Y EN S 4 453 43444078 3337

1995 57503004540 4772

42307046704400526 130

153200430 20 74 78 63054581453 123

7536381 64 658055 519

4507 4300 400

435 440 412

1.009

750 44 132 550 130 450 4530

371347 448 4.000 5724 640 6.000 41

47400 52 610 54 555 000 475

UT 494 428 554 400 40

122 8644 622 1125 833 647 49 5222 4775

228.43072 SA CON 5 ST 480

104 5877 436 4344

V

V

M

HAP

BIG NYE MEL DE M

NE

3012 ECE RCE COVE cz stst EST EE WEINE

PHONE

E

M

WEEPEE HET HY METYYDY SHES M

19% 14% 14% Ens

870 02 047 080

1525 1.000 1500 150

DE

404437

(

YOU HE

n

HEY HESS OF

AFX 45 8743 63000 so

444 142

170408 603 141

$ 780 7 645

450 44 6

K 750 4 SSO SA

AME 43410 SE

335 ANU AM M

7001 4M 4177 54

ON N

IN

125

15 125 125 14% 15% 10%

1900 091 MM 0943 0305 306 097 0900 800 0477 07 0062 047 0833

1901 0943 0325 0907 0300 0873 08570842 026 077 0709 0756 0743 0739 0004

1942 0915 000 0004 0000 0794 0772 6751 0712 0675 066 064 0000 0379

004088 0850 0823 072 0763 07356 0708 0082 0636 0582 572 0562 816 042

0961 0906 083 0822 0754 0.747 0713 001 0050 0821 056 0519 0457 0475 0437

0943 88 5637 090 6.746 0700 0006 06300506 6564 650 0456 043 0410 0370 033

0000 081 081 070 arm

0.003 0.003 079 0731 0677 0427 05820540 502 3487 0404 9301 0337 036 0206 0233

0014 083 766 8.703 0645 857 6544 0500 0.460 0424 03810308 0254 0263 0225 814

0005 0.620 8744 B6 014 0558 05000483 0422 03 0322 020 0247 0227 0191 0162

080608648722 050 055 05270475 0429 03080360 0247 0237 6215 01142 0135

078701 862 0587 04670444 0347 0366 0310 0257 0280187 058 013 012

8775 80601 0530 04080415 02006225 426 02290120168 0145 116 S

8758 6877 0505 0442 03 0340 8.200 0.253 02060160 0541 250 00

Period 1501 3743 042 055 4 0417 0362 33 0276 0230 0183 0140 0123 6100 004 000

M

IN

S

LEJOHETA, JURNAE

E

ce ico

SOC

87288285340458 034 833

0714 06 0513 5436 0371 6317 0279 0231 010 0100100000000000041

9700 1587 0.454 041 6300 6296 0290 0212 0183 0130 00 00 00 00 003

048470 047 0331 6377 0232154 0164 0118 00 00 00 00 01

8475 404 0377 0342 025 8215 6178 03492104 8073000100104

0600 1538 43 8399 024 0242 81 164 135 003 004 005 004 003 00

064020422 0542 028 0226

14343507 04 03080200211

612 004 0049 6040 001 002 0015

0000043 3010013

4616 478 6275 0296 8230 14 04

ECO IS YOE WEE

COND

AZZO FICO VOCO SITO O ISO 959

90 100000 2000 20

SIE WOOD WOD 10000001

A172 3660400 0000 002 0144000

437 1764 3600 1400 634 260 01 813560 Gas 0047 002 003 0010011 000

MEN 9333 0206 8050 4000 00 00 00 00 00 00 00

DOWE 00 200 0

OG FOOD 0 2100 20000 20151152 CONTEND

OD 1000000 2000 SIDD00000 ROCE 20IN

Transcribed Image Text:K

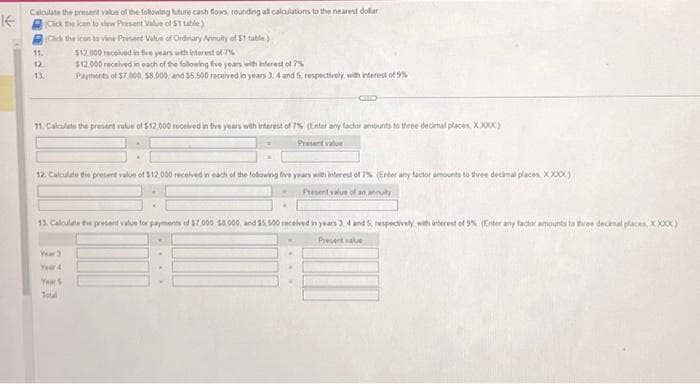

Calculate the present value of the following future cash flows, rounding all calculations to the nearest dollar

Click the ican to view Present Value of $1 table)

(Click the icon to vine Present Value of Ordinary Annuity of $1 table)

11.

12.

13.

$12.000 received in five years with interest of 7%

$12.000 received in each of the following five years with interest of 7%

Payments of $7,000, $8,000, and $5,500 received in years 3, 4 and 5, respectively, with interest of 9%

11. Calculate the present value of $12.000 received in five years with interest of 7%. (Enter any factor amounts to three decimal places, XXXXXX)

Present value

CHIED

12. Calculate the present value of $12,000 received in each of the following five years with interest of 7%. (Enter any factor amounts to three decimal places, XXXX)

Present value of an anty

Year 3

Year A

Your S

Total

13. Calculate the present value for payments of $7,000 $3.000, and $5.500 received in years 3: 4 and 5, respectively, with interest of 9% (Enter any factor amounts to three decimal places, XXXX)

Present value

P

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College