Calculate the profitability index for project X. B. Calculate the profitability for project Y C. Using the NPV method combined with the PI aporoach, which project would you select? Use a discount rate of 13 perce

Calculate the profitability index for project X. B. Calculate the profitability for project Y C. Using the NPV method combined with the PI aporoach, which project would you select? Use a discount rate of 13 perce

Chapter9: Capital Budgeting Techniques

Section: Chapter Questions

Problem 12PROB

Related questions

Question

A. Calculate the profitability index for project X.

B. Calculate the profitability for project Y

C. Using the NPV method combined with the PI aporoach, which project would you select? Use a discount rate of 13 percent

Transcribed Image Text:mework (part 1)

Saved

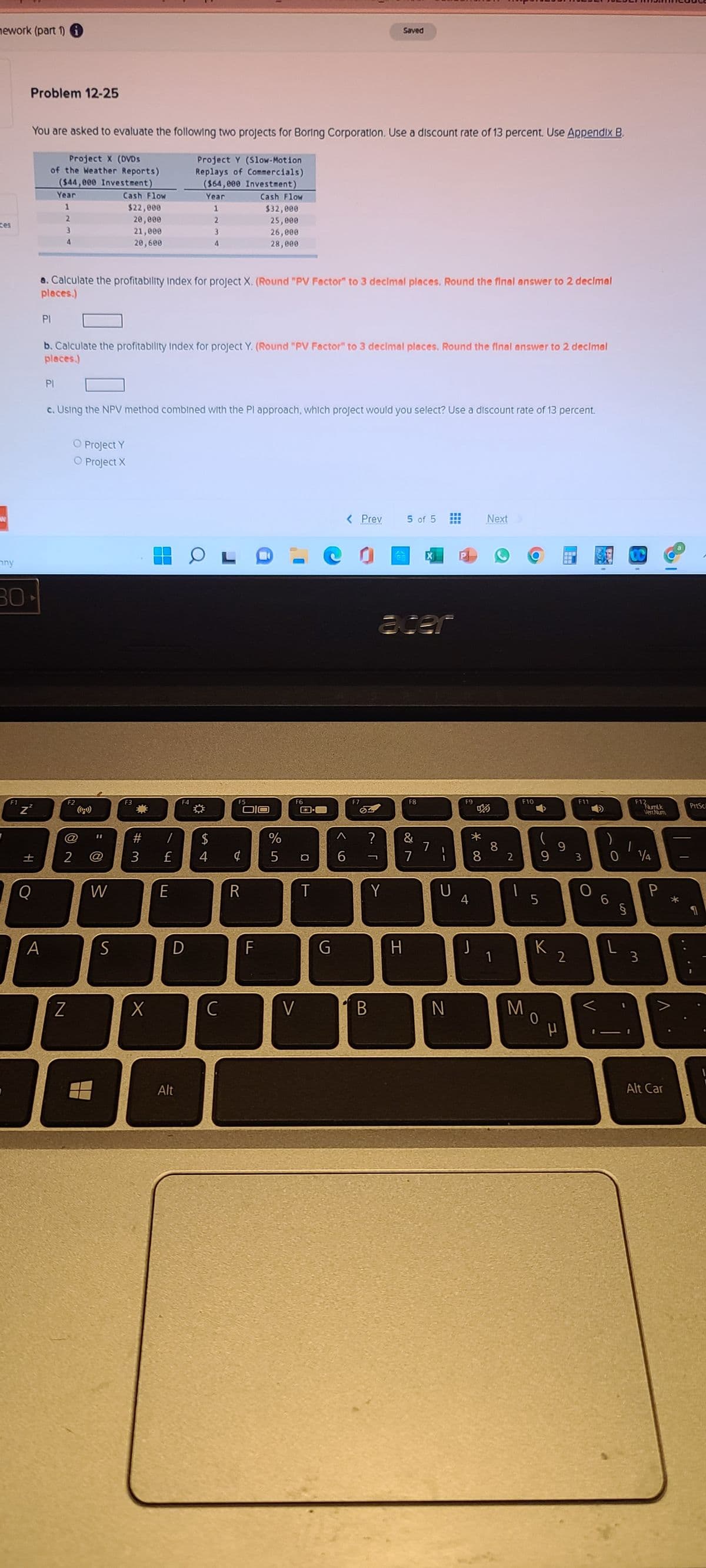

Problem 12-25

You are asked to evaluate the following two projects for Boring Corporation. Use a discount rate of 13 percent. Use Appendix B.

Project X (DVDs

Project Y (Slow-Motion

Replays of Commercials)

of the Weather Reports)

($44,000 Investment)

($64,000 Investment)

Year

Year

Cash Flow

Cash Flow

$22,000

1

1

$32,000

2

20,000

2

25,000

ces

3

21,000

3

26,000

4

20,600

4

28,000

a. Calculate the profitability Index for project X. (Round "PV Factor" to 3 decimal places. Round the final answer to 2 decimal

places.)

PI

b. Calculate the profitability Index for project Y. (Round "PV Factor" to 3 decimal places. Round the final answer to 2 decimal

places.)

PI

c. Using the NPV method combined with the Pl approach, which project would you select? Use a discount rate of 13 percent.

O Project Y

O Project X

www

< Prev

5 of 5

***

Next

cer

F8

&

7

mny

30

F1

F2

@

± 2

Z²

+1

Q

A

11

W

S

F3

E

#3

Z

X

T

F4

F5

/ $

£ 4 ¢

E

R

D

Alt

S4

C

F

%

5

F6

V

E3-

¤ 6

T

G

<

F7

83

?

Y

B

H

7

U

N

F9

4

J

*00

8

8 2

1

F11

9

93 0 1/4

5

§

F10

A

K

0

Mo

2

P

V

6

L

F12

3

NumLk

VertNum

V

Alt Car

PrtSc

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you