Chapter12: Corporate Valuation And Financial Planning

Section: Chapter Questions

Problem 12SP

Related questions

Question

100%

Transcribed Image Text:13

pints

Skipped

eBook

Print

References

Mc

Graw

Hill

20621_131512.jpg

F1

!

1

Q

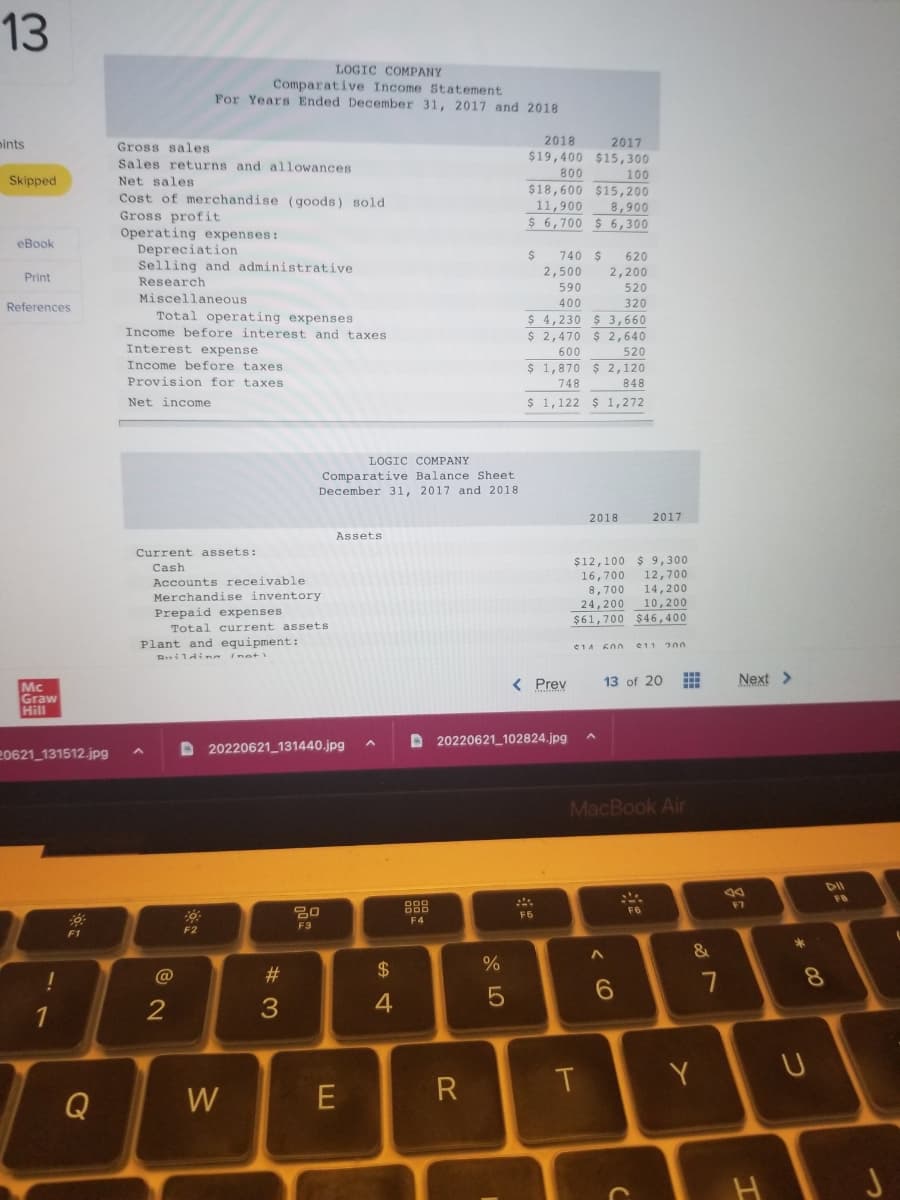

LOGIC COMPANY

Comparative Income Statement

For Years Ended December 31, 2017 and 2018

Gross sales

Sales returns and allowances.

Net sales

Cost of merchandise (goods) sold

Gross profit

Operating expenses:

Depreciation

Selling and administrative

Research

Miscellaneous

Total operating expenses

Income before interest and taxes

Interest expense

Income before taxes

Provision for taxes

Net income

Current assets:

Cash

2

Accounts receivable

Merchandise inventory

Prepaid expenses

Total current assets

Plant and equipment:

Building (net1

A

D20220621_131440.jpg

20

F2

F3

W

LOGIC COMPANY

Comparative Balance Sheet

December 31, 2017 and 2018.

Assets

#3

E

A

$

4

< Prev

D20220621_102824.jpg

F4

R

%

2017

2018

$19,400 $15,300

800

100

$18,600 $15,200

11,900

8,900

$ 6,700 $ 6,300

$

740

740 $ 620

2,500

2,200

590

520

400

320

$ 4,230

$3,660

$ 2,470 $ 2,640

600

520

$ 1,870 $ 2,120

748

848

$ 1,122 $ 1,272

2018

2017

$12,100 $9,300

16,700

12,700

8,700

14,200

24,200 10,200

$61,700 $46,400

14 600

11 200

www

13 of 20 www

www

5

F5

MacBook Air

F6

T

A

6

C

&

Y

7

Next >

80

F7

H

* 00

8

U

DII

FB

J

Transcribed Image Text:13

oints

Skipped

eBook

C

Print

References

Mc

Graw

Hill

!

1

F1

Q

A

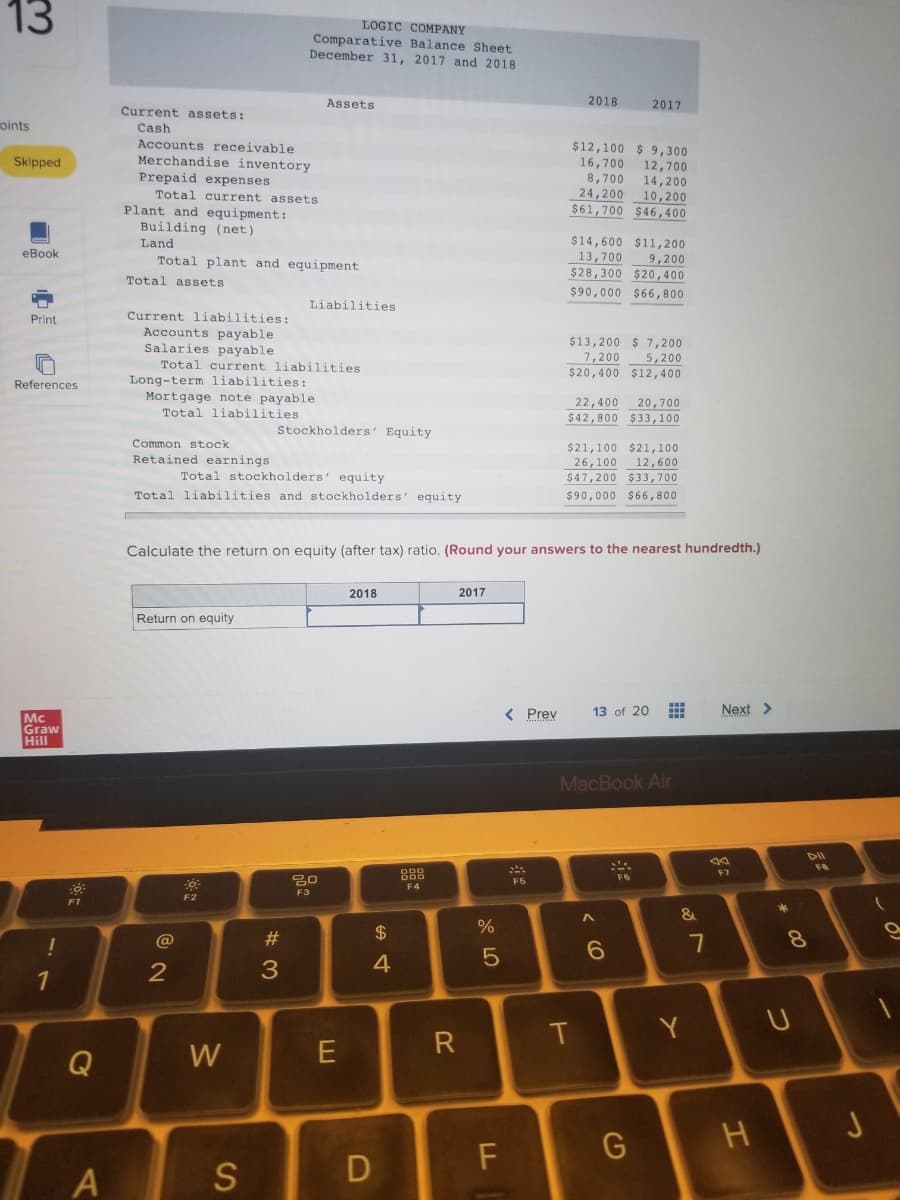

2018

2017

$12,100 $ 9,300

Accounts receivable

Merchandise inventory

Prepaid expenses

16,700 12,700

8,700 14,200

24,200 10,200

$61,700 $46,400

Total current assets

Plant and equipment:

Building (net)

Land

$14,600 $11,200

13,700

9,200

Total plant and equipment

$28,300 $20,400

Total assets

$90,000 $66,800

Current liabilities:

Accounts payable

Salaries payable

$13,200 $ 7,200

7,200

5,200

Total current liabilities

$20,400 $12,400

Long-term liabilities:

Mortgage note payable

22,400 20,700

Total liabilities.

$42,800 $33,100

Stockholders' Equity

Common stock

$21,100 $21,100

26,100 12,600

Retained earnings

Total stockholders' equity

$47,200 $33,700

$90,000 $66,800

Total liabilities and stockholders' equity

Calculate the return on equity (after tax) ratio. (Round your answers to the nearest hundredth.)

2018

2017

Return on equity

13 of 20

< Prev

Next >

MacBook Air

FB

F2

Current assets:

Cash

@

2

W

S

LOGIC COMPANY

Comparative Balance Sheet

December 31, 2017 and 2018

Assets

#3

Liabilities

20

F3

E

$

4

D

F4

R

%

5

F

F5

T

A

6

G

‒‒‒

&

on

Y

7

F7

H

*

8

U

FB

J

6)

9

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,