Calculate the Social Security Tax and Medicare Tax columns of the payroll register for the below-listed employees of TCLH Industries, a manufacturer of cleaning products. None of the employees files as married filing separately on their year-end tax return. 1. Zachary Fox does not make any voluntary deductions that impact earnings subject to federal income tax withholding. He files as married filing jointly, and his weekly gross pay was $1,162. When completing form W-4, Zachary checked box 2c, entered $2,000 in step 3 of the form, and left step 4 blank. The current pay period is his first with the company. 2. Calvin Bell makes a 401(k) retirement plan contribution of 6% of gross pay. He is single, claims two federal withholding allowances and one state withholding allowance, and his weekly gross pay was $417.93. His current year taxable earnings for FICA taxes, prior to the current pay period, are $20,478.57. 3. David Alexander makes a 401(k) retirement plan contribution of 12% of gross pay. He is single, claims one withholding allowance for both federal and state taxes, and his weekly gross pay was $4,050. His current year taxable earnings for FICA taxes, prior to the current pay period, are $198,450. 4. Michael Sierra contributes $50 to a flexible spending account each period. He is married, claims four federal withholding allowances and three state withholding allowances, and his weekly gross pay was $2,450. His current year taxable earnings for FICA taxes, prior to the current pay period, are $117,600. 1: Zachary Fox Social Security Tax = $ Medicare Tax = $ 2: Calvin Bell Social Security Tax = $ Medicare Tax = $ 3: David Alexander Social Security Tax = $ Medicare Tax = $ 4: Michael Sierra Social Security Tax = $ Medicare Tax = $

Calculate the Social Security Tax and Medicare Tax columns of the payroll register for the below-listed employees of TCLH Industries, a manufacturer of cleaning products. None of the employees files as married filing separately on their year-end tax return. 1. Zachary Fox does not make any voluntary deductions that impact earnings subject to federal income tax withholding. He files as married filing jointly, and his weekly gross pay was $1,162. When completing form W-4, Zachary checked box 2c, entered $2,000 in step 3 of the form, and left step 4 blank. The current pay period is his first with the company. 2. Calvin Bell makes a 401(k) retirement plan contribution of 6% of gross pay. He is single, claims two federal withholding allowances and one state withholding allowance, and his weekly gross pay was $417.93. His current year taxable earnings for FICA taxes, prior to the current pay period, are $20,478.57. 3. David Alexander makes a 401(k) retirement plan contribution of 12% of gross pay. He is single, claims one withholding allowance for both federal and state taxes, and his weekly gross pay was $4,050. His current year taxable earnings for FICA taxes, prior to the current pay period, are $198,450. 4. Michael Sierra contributes $50 to a flexible spending account each period. He is married, claims four federal withholding allowances and three state withholding allowances, and his weekly gross pay was $2,450. His current year taxable earnings for FICA taxes, prior to the current pay period, are $117,600. 1: Zachary Fox Social Security Tax = $ Medicare Tax = $ 2: Calvin Bell Social Security Tax = $ Medicare Tax = $ 3: David Alexander Social Security Tax = $ Medicare Tax = $ 4: Michael Sierra Social Security Tax = $ Medicare Tax = $

Chapter12: Tax Credits And Payments

Section: Chapter Questions

Problem 4BCRQ

Related questions

Question

Can you answer each question.

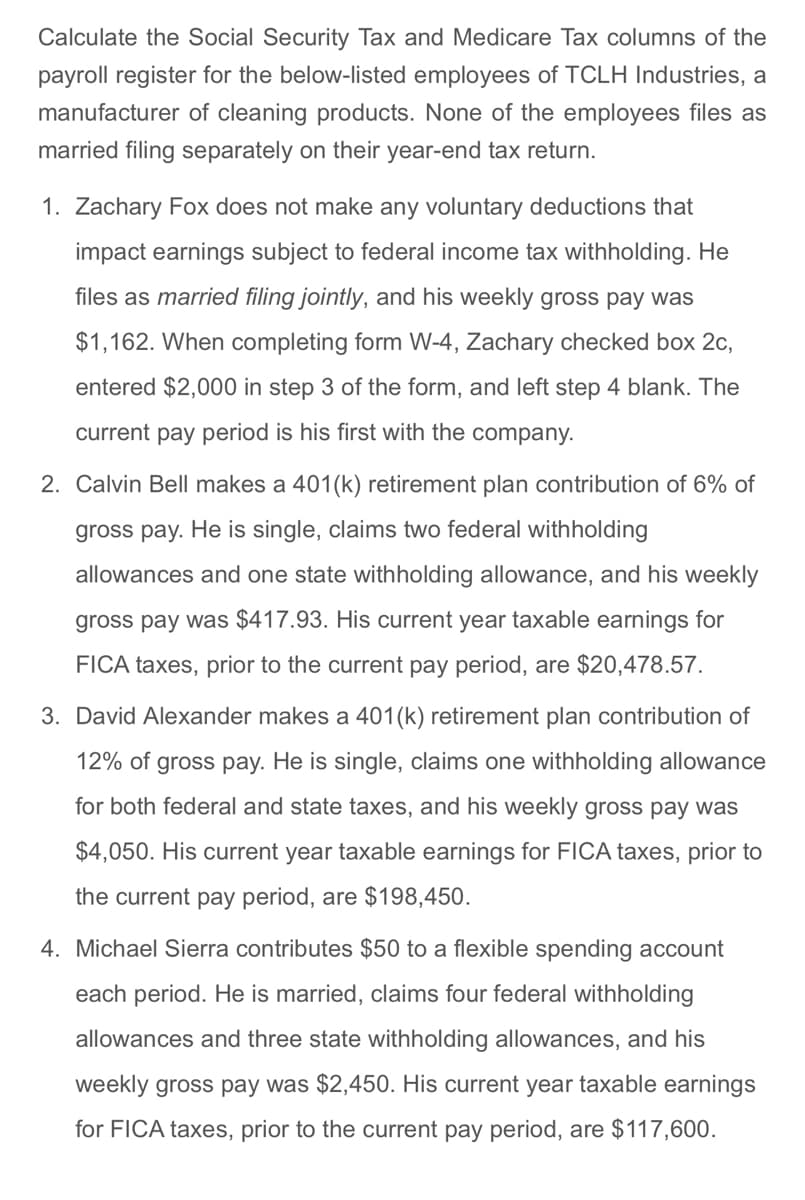

Transcribed Image Text:Calculate the Social Security Tax and Medicare Tax columns of the

payroll register for the below-listed employees of TCLH Industries, a

manufacturer of cleaning products. None of the employees files as

married filing separately on their year-end tax return.

1. Zachary Fox does not make any voluntary deductions that

impact earnings subject to federal income tax withholding. He

files as married filing jointly, and his weekly gross pay was

$1,162. When completing form W-4, Zachary checked box 2c,

entered $2,000 in step 3 of the form, and left step 4 blank. The

current pay period is his first with the company.

2. Calvin Bell makes a 401(k) retirement plan contribution of 6% of

gross pay. He is single, claims two federal withholding

allowances and one state withholding allowance, and his weekly

gross pay was $417.93. His current year taxable earnings for

FICA taxes, prior to the current pay period, are $20,478.57.

3. David Alexander makes a 401(k) retirement plan contribution of

12% of gross pay. He is single, claims one withholding allowance

for both federal and state taxes, and his weekly gross pay was

$4,050. His current year taxable earnings for FICA taxes, prior to

the current pay period, are $198,450.

4. Michael Sierra contributes $50 to a flexible spending account

each period. He is married, claims four federal withholding

allowances and three state withholding allowances, and his

weekly gross pay was $2,450. His current year taxable earnings

for FICA taxes, prior to the current pay period, are $117,600.

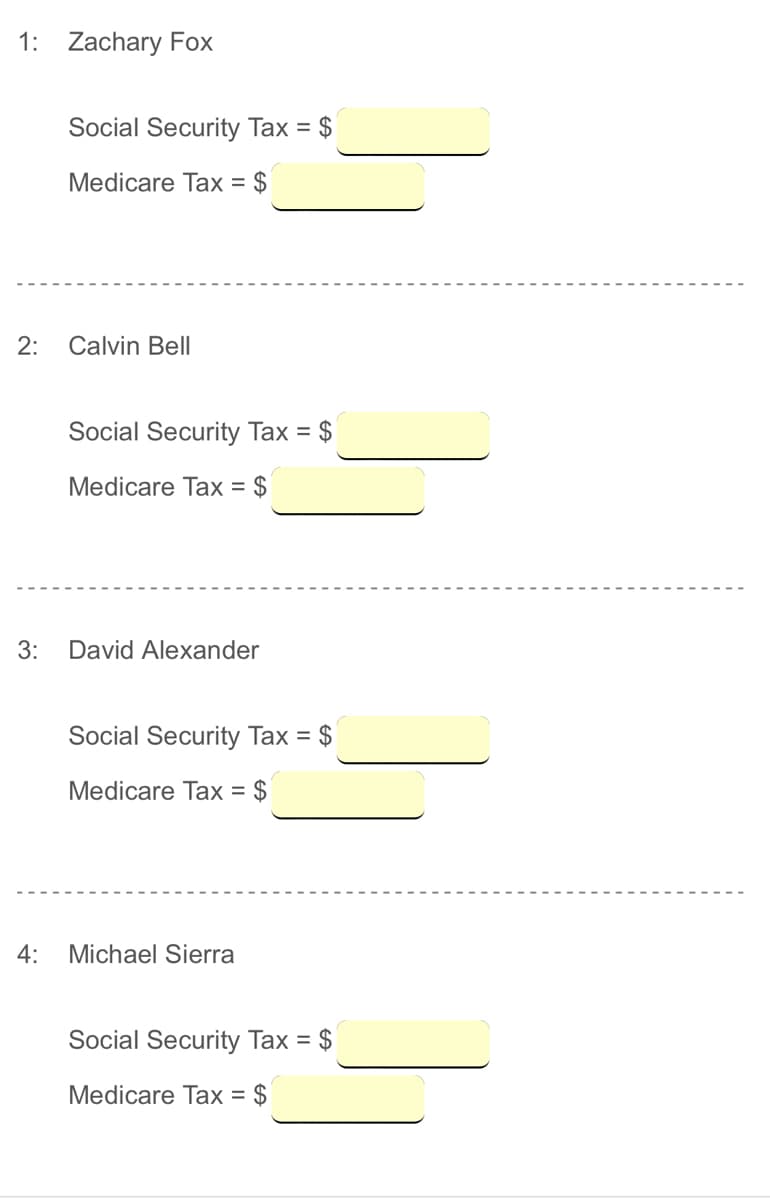

Transcribed Image Text:1: Zachary Fox

Social Security Tax = $

Medicare Tax = $

2: Calvin Bell

Social Security Tax = $

Medicare Tax = $

3: David Alexander

Social Security Tax = $

Medicare Tax = $

4:

Michael Sierra

Social Security Tax = $

Medicare Tax = $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 1 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT