Q: IRR: Mutually exclusive projects Nile Inc. wants to choose the better of two mutually exclusive…

A: Given, Two projects. Project X and project Y. Initial investment of project X is $500,000 Initial…

Q: e) NPV calculations take into account the time value of money. Di with brief examples: (i) The time…

A: Given, The discount rate is 10%

Q: A technology company deposited $93,900 into an account for quarterly scholarships to be awarded to…

A: The present value method is used to measure the profitability of a project by adding up discounted…

Q: A company is analyzing two mutually exclusive projects, S and L, with the following cash flows: 0…

A: Here we will use the concept of capital budgeting. In capital budgeting the project with the higher…

Q: Project L requires an initial outlay at t = 0 of $67,000, its expected cash inflows are $11,000 per…

A: Formula Payback period = Initial investment/Annual cash inflow Where Initial investment = $67,000…

Q: A construction company is considering procuring one of two types of heavy construction equipment (A…

A: Here in this question, Payback period, benefit cost ratio , Project to be selected and the…

Q: Rene's Fuel and Oil company is planning to expand in 9 year time. To prepare for this expansion,…

A: Future Value of Ordinary Annuity refers to the concept which determines the sum total of all the…

Q: Joan Raft had taken out an $80,000 fire insurance policy for her new shop at a rate of $0.81 per…

A: Given, The fire insurance guidelines says that the person is only eligible for the refund only…

Q: On April 1, 1998, John opened a savings account with a nominal interest rate of 3.4% payable monthly…

A: Quaterly deposit in investment fund is $400 Interest rate of quaterly fund is 4.6% payable quaterly…

Q: You invest $100 in a risky asset with an expected return of 12% and a standard deviation of 15%, and…

A: The percentage of money invested in T bills can be computed with the concept of portfolio expected…

Q: The housing market is crazy right now! Sierra bought her condo for S250,000, 5 years ago. She paid a…

A: The annual rate of return is the method of calculating the payback that has been received by an…

Q: On 20 February 2016, Encik Basri took a personal loan of RM 6,000 from a bank that charged a simple…

A: The Banker’s Rule in case of simple interest is based on 360 days in a year. This is similar to…

Q: A man borrowed from a bank with a promissory note that he signed in the amount of P25000 for a…

A: Given, Amount is P25000 Amount received is P21915 Inspection fees P85.00

Q: A stock has an expected return of 12.5 percent and a beta of 1.16, and the expected return on the…

A: Expected return of stock (Er) = 0.125 (12.5%) Beta (b) = 1.16 Expected return on the market (Rm) =…

Q: You expect to receive the following: $4,448 $22,900 $3,813 $843 $10,528 at the end of each year for…

A: Given: Year Particulars Amount 12 Annuity $4,448 0 Current value $22,900 6 Future value…

Q: What is the unpaid balance after 4 years?

A: The unpaid balance is the remaining principal amount after 4 years. It is the amount remaining to be…

Q: An summary of how you would allocate people and money to the WBS's operations should be provided.

A: Work breakdown structure is referred as the description of the work, which used done regarding the…

Q: Assume that l2t = 0.30% and that it = 0. If the one-year interest rate is 5% and the two-year…

A: The one-year forward rate: The interest rate earned on a one year deposit is known as the one-year…

Q: Bachelor’s Bus Co. uses the residual dividend model to determine its common dividend payout. This…

A: In the residual dividend model we find the retained earnings needed for the capital budget. Any…

Q: For the credit card account, assume one month between billing dates and interest of 1.6% per month…

A: Here, Interest Rate is 1.6% per month on average daily balance

Q: Wants to loan from a certain bank. He asks you for a piece of advice for him to save from the loan.…

A: To analyse the given options, we shall compare the effective interest rate which can be calculated…

Q: Project L requires an initial outlay at t = 0 of $55,000, its expected cash inflows are $13,000 per…

A: Formula MIRR = [Future value of cash inflows/Present value of cash outflows]1/Period-1 Where Future…

Q: Which of the following are economic functions of futures markets? Flexibility in pricing products…

A: "Hi, Thanks for the question. Since you asked multiple question, we will answer first question for…

Q: e discount interest if F = PHP 58,000, discount interest rate 4.5% an

A: Discount is amount of money below the face value of note or any bond or any financial instrument on…

Q: When choosing a mutual fund, one of the most important things to consider is your investment…

A: Note As per Bartleby guidelines,If a question with multiple sub-parts are posted, first 3…

Q: A company has generated over the last year, with the sales of all its product lines, an operating…

A: ROA It is the return on assets to measure the firm's ability to generate net earnings with its…

Q: Series discounts are a form of trade discount. (T or F)

A: Since you have posted multiple questions, we shall be solving the first one for you. In case you…

Q: Eugene began to save for his retirement at age 27, and for 14 years he put $ 275 per month into an…

A: Time value of money (TVM) refers to the method used to measure the amount of money at different…

Q: Billingham Packaging is considering expanding its production capacity by purchasing a new machine,…

A: The difference between the present value of cash inflows and outflows over time is known as net…

Q: Project S requires an initial outlay at t = 0 of $19,000, and its expected cash flows would be…

A: First we need to calculate NPV of the project. NPV is the difference between present value of cash…

Q: What is the value of the levered firm?

A: Value of Levered Firm: A levered firm is a firm that has debt in its capital structure. The value…

Q: All techniques: Decision among mutually exclusive investments Pound Industries is attempting to…

A: To Find:- Payback period IRR Which project to select

Q: Three alternatives have the following cost data associated with them: Data Alt. 1 Alt. 2 Alt. 3 Alt.…

A: EUAW is one of the capital budgeting technique. It is used to compare the projects with unequal…

Q: sale corporation financial statement analysis (case A-181A) - Which information is available at the…

A: Common size statement is very common statement for comparing the performance of company with others…

Q: eeds to raise money to build a bridge. Designing the bridge and constructing it will require a…

A: Long period of finance is that is required for more than 10 years are required and these must be…

Q: The cost of having financial statements audited by an independent accounting firm.

A: Cost refers to the monetary value which includes the expenditure for supplies, services,…

Q: What is the amount of each payment?

A: Time value of money (TVM) refers to the method used to measure the amount of money at different…

Q: Martha purchases a $1,100 bond on November 19, 2024 when the yield-to- maturity is 5.65% compounded…

A: Here,

Q: The weighted average cost of capital is used to determine whether or not a project should be done.…

A: Solution:- Weighted Average Cost of Capital means the minimum return which a firm should earn in…

Q: The answer is somewhat close. The correct answer is 6.8810.

A: Given: Value of call = $1.44 Strike price = $25.60 Value of shares = $20 Interest rate = 2.5%…

Q: In analysis of projects, Elucidate on the six major objectives of financial analysis

A: Given, Meaning of Financial analysis:- For the determination of the suitability and the performance…

Q: You can see from the table that the market value of the fund’s assets is ____ ? If the fund has…

A: Net asset value refers to the market value of the shares of the company based on the net worth. Net…

Q: Why are big oil’s big dividends are under threat

A: Big oil dividends refer to dividends paid by big oil companies. Historically big oil companies have…

Q: Today in the United States, the interest rate on 10-year government bonds was 1.65%, and the…

A: Inflation expectations among the general populace. These expectations determine how much of an…

Q: What is the share price of the company's stock? (Do not round intermediate calculations and round…

A: Share Price: It represents the current value to the sellers and buyers which is dictated by demand…

Q: Question Content Area Falkland, Inc., is considering the purchase of a patent that has a cost of…

A: Solution:- Net Present Value (NPV) means the net value in present terms of a project. NPV = Present…

Q: cts) eBook A firm with a WACC of 10% is considering the following mutually…

A: NPV= Present value of cashinflows - Present value of cashoutflows.

Q: H.W 1- Find the internal rate using the method of Internal Rate of Return (IRR) if i = 15%, for the…

A: Solved using Excel

Q: facts, if the grocer, knowing A, allows him to pay on a later date, granting then only credit on the…

A: Business gives the credit on goods to increase the business but some time that turns into bad debt…

Q: A borrower has taken out a 30-year mortgage for $00,000 at an annual rate of 6% a. Use the table to…

A: i) Monthly Payment Solved using Financial Calculator PV = -99,000 N = 30 years * 12 months = 360…

Step by step

Solved in 6 steps with 2 images

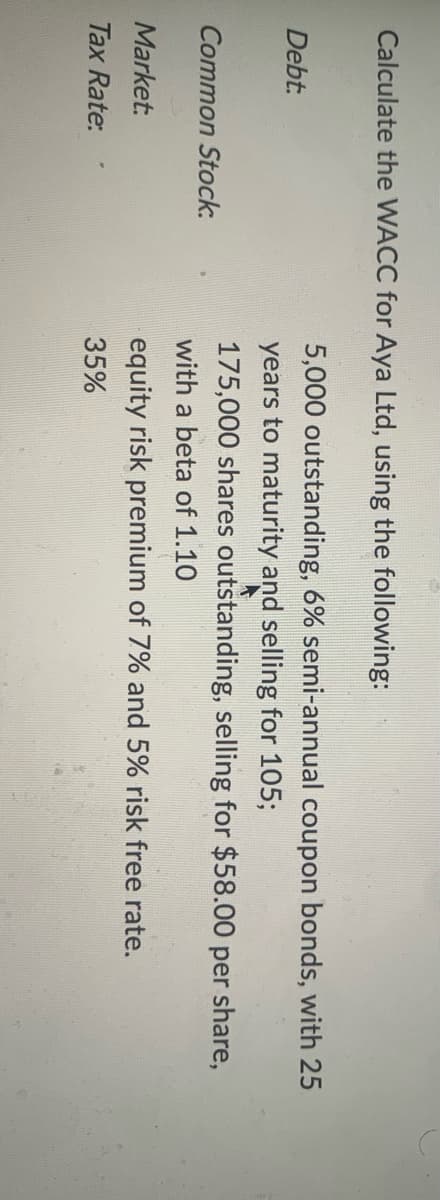

- Waylan Sisters Inc. issued 3-year bonds with a par value of $100,000 and a 6% annual coupon when the market rate of interest was 5%. If the bonds sold at 102.438, how much cash did Williams Sisters Inc. receive from issuing the bonds?Given the following information for Flintstone power Co, find the WACC. Assume the company's tax rate is 35% Debt:6,000 6% coupon bonds outstanding, $1000 par value, 25 years to maturity, selling for 105 percent of par; the bonds make semi-annual payments Common stock:185,000 shares outstanding, selling for $68 per share. the company's beta is 1.20, the risk-free rate is 5% and the market risk premium is 7% (Ans = 10.15%)Consider Higgins Production which has the following information about its capital structures:Debt - 1,500, 5 percent coupon bonds outstanding, $1,000 par value, 7 years to maturity, selling for80 percent of par, the bonds make semi-annual payments Common Stock - 100,000 shares outstanding, selling for $45 per share; the beta is 0.80 Preferred Stock - 25,000 shares of 6 percent preferred stock outstanding, currently sellingfor $150 per share Market Information - 6 percent market risk premium and 4 percent risk-free rate.Required: Calculate the following if the company has a tax rate of 36 percent.Cost of Equity Weighted Average Cost of Capital

- Consider Higgins Production which has the following information about its capital structures:Debt - 1,500, 5 percent coupon bonds outstanding, $1,000 par value, 7 years to maturity, selling for80 percent of par, the bonds make semi-annual payments Common Stock - 100,000 shares outstanding, selling for $45 per share; the beta is 0.80 Preferred Stock - 25,000 shares of 6 percent preferred stock outstanding, currently sellingfor $150 per share Market Information - 6 percent market risk premium and 4 percent risk-free rate.Required: Calculate the following if the company has a tax rate of 36 percent. Total Market Value for the Firm After-tax cost of Debt Cost of Equity Cost of Preferred Stock Weighted Average Cost of CapitalConsider Higgins Production which has the following information about its capital structures:Debt - 1,500, 5 percent coupon bonds outstanding, $1,000 par value, 7 years to maturity, selling for80 percent of par, the bonds make semi-annual payments Common Stock - 100,000 shares outstanding, selling for $45 per share; the beta is 0.80 Preferred Stock - 25,000 shares of 6 percent preferred stock outstanding, currently sellingfor $150 per share Market Information - 6 percent market risk premium and 4 percent risk-free rate. i. Cost of Preferred Stockii. Weighted Average Cost of CapitalConsider Higgins Production which has the following information about its capital structures:Debt - 1,500, 5 percent coupon bonds outstanding, $1,000 par value, 7 years to maturity, selling for 80 percent of par, the bonds make semi-annual payments Common Stock - 100,000 shares outstanding, selling for $45 per share; the beta is 0.80 Preferred Stock - 25,000 shares of 6 percent preferred stock outstanding, currently selling for $150 per share Market Information - 6 percent market risk premium and 4 percent risk-free rate. Required: Calculate the following if the company has a tax rate of 36 percent. Show all working.i. Total Market Value for the Firmii. After-tax cost of Debtiii. Cost of Equityiv. Cost of Preferred Stockv. Weighted Average Cost of Capital

- Consider Higgins Production which has the following information about its capital structures: Debt - 1,500, 5 percent coupon bonds outstanding, $1,000 par value, 7 years to maturity, selling for 80 percent of par, the bonds make semi-annual payments Common Stock - 100,000 shares outstanding, selling for $45 per share; the beta is 0.80 Preferred Stock - 25,000 shares of 6 percent preferred stock outstanding, currently selling for $150 per share Market Information - 6 percent market risk premium and 4 percent risk-free rate. Required: Calculate the following if the company has a tax rate of 36 percent. i. Total Market Value for the Firm ii. After-tax cost of Debt iii. Cost of Equity iv. Cost of Preferred Stock v. Weighted Average Cost of CapitalConsider Higgins Production which has the following information about its capital structures: Debt - 1,500, 5 percent coupon bonds outstanding, $1,000 par value, 7 years to maturity, selling for 80 percent of par, the bonds make semi-annual payments Common Stock - 100,000 shares outstanding, selling for $45 per share; the beta is 0.80 Preferred Stock - 25,000 shares of 6 percent preferred stock outstanding, currently selling for $150 per share Market Information - 6 percent market risk premium and 4 percent risk-free rate. Required: Calculate the following if the company has a tax rate of 36 percent. iv. Cost of Preferred Stock v. Weighted Average Cost of CapitalConsider Higgins Production which has the following information about its capital structures: Debt - 1,500, 5 percent coupon bonds outstanding, $1,000 par value, 7 years to maturity, selling for 80 percent of par, the bonds make semi-annual payments Common Stock - 100,000 shares outstanding, selling for $45 per share; the beta is 0.80 Preferred Stock - 25,000 shares of 6 percent preferred stock outstanding, currently selling for $150 per share Market Information - 6 percent market risk premium and 4 percent risk-free rate. Required: Calculate the following if the company has a tax rate of 36 percent. Total Market Value for the Firm ii. After-tax cost of Debt iii. Cost of Equity iv. Cost of Preferred Stock…

- consider huggins product has the following information about its capital structures: Debt - 1,500, 5 percent coupon bonds outstanding, $1,000 par value, 7 years to maturity, selling for 80 percent of par, the bonds make semi-annual payments Common Stock - 100,000 shares outstanding, selling for $45 per share; the beta is 0.80 Preferred Stock - 25,000 shares of 6 percent preferred stock outstanding, currently selling for $150 per share Market Information - 6 percent market risk premium and 4 percent risk-free rate. Calculate the following if the company has a tax rate of 36 percent: Total Market Value for the Firm , After-tax cost of Debt, Cost of Equity , Cost of Preferred Stock, Weighted Average Cost of Capital. showing both percentages and dollar value for After-tax cost of Debt, Cost of Equity and Cost of Preferred Stock should all be calculated in dollar value and NOT percentages.Consider Higgins Production which has the following information about its capital structures: Debt - 1,500, 5 percent coupon bonds outstanding, $1,000 par value, 7 years to maturity, selling for 80 percent of par, the bonds make semiannual payments Common Stock - 100,000 shares outstanding, selling for $45 per share; the beta is 0.80 Preferred Stock - 25,000 shares of 6 percent preferred stock outstanding, currently selling for $150 per share Market Information - 6 percent market risk premium and 4 percent risk-free rate. The WACC of the company is: a. 5.67% b. 8.8% c. 6.57% d. 6.23%Consider Higgins Production which has the following information about its capital structures: Debt - 1,500, 5 percent coupon bonds outstanding, $1,000 par value, 7 years to maturity, selling for 80 percent of par, the bonds make semiannual payments Common Stock - 100,000 shares outstanding, selling for $45 per share; the beta is 0.80 Preferred Stock - 25,000 shares of 6 percent preferred stock outstanding, currently selling for $150 per share Market Information - 6 percent market risk premium and 4 percent risk-free rate. The WACC of the company is: