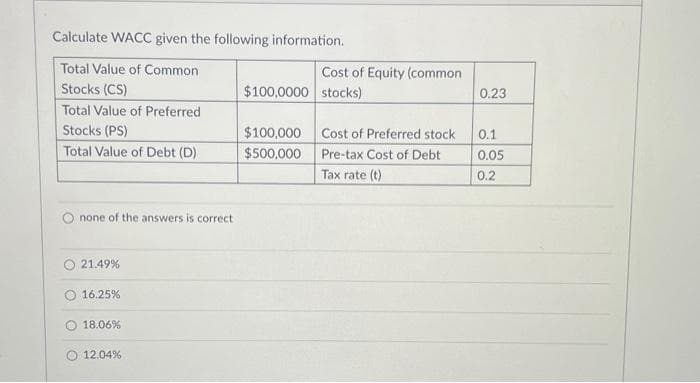

Calculate WACC given the following information. Total Value of Common Stocks (CS) Total Value of Preferred Stocks (PS) Total Value of Debt (D) none of the answers is correct Cost of Equity (common $100,0000 stocks) $100,000 $500,000 Cost of Preferred stock Pre-tax Cost of Debt Tax rate (t) 0.23 0.1 0.05 0.2

Q: After graduating, you are offered a position in the compliance department at Telco LTD. The company…

A: In the corporate setting, an annual general meeting (AGM) serves as a crucial event where directors,…

Q: Other 1. PRUDENTIAL REGULATION Descriptions (How is policy formulated and implemented in INDONESIA)…

A: Prudential regulations are defined as the set of guidelines, practices, and regulations that are…

Q: An investor wants to build a portfolio with the following four stocks. With the given details, find…

A: In finance, building a well-diversified portfolio is essential for investors to manage risk and…

Q: Enron The Smartest Guys In the Room - Did anything in the documentary surprise you? What was it? OR…

A: The compelling documentary "Enron: The Smartest Guys in the Room" explores the growth and collapse…

Q: Discuss the elements of contracts under the Law of Contract of Malaysia

A: Contracts are legally binding agreements between two or more parties, and they serve as the…

Q: Giordana borrows $225,000 for Hearthstone Credit Union to buy a home, which secures the loan. Five…

A: In this given scenario, Hearthstone Credit Union provided Giordana with a loan of $225,000 to…

Q: How does employment law address issues related to employee benefits, compensation, and workplace…

A: Employment law refers to the body of legal regulations and principles that govern the relationship…

Q: In the case of Intel, the European Courts overturned the Commission's decision to fine Intel for a…

A: Disclaimer: Since you have posted a question with multiple sub-parts, so we will solve first three…

Q: prenuptial contract must be in writing. Question 16 options: True False Some offers will…

A: 16. A prenuptial contract must be in writing. True. A prenuptial agreement is a binding contract…

Q: Discuss at least three skills from your personal inventory assessments that are a good match for a…

A: Right here are the 3 skills that are generally considered valuable inside the early adolescence…

Q: How does gender intersect with other identity categories (such as race and class) to reinforce…

A: Treating someone unfairly based on their identity categories like race, class, and gender can result…

Q: What do you think Teleflex’s specific theory of infringement was? Direct, Indirect, or Vicarious…

A: Teleflex's specific theory of infringement is not entirely clear from the scenario provided, but it…

Q: The Coal Strike of 1902 was unusual because O coal miners did not unionize O strikes in coal mines…

A: The Coal Strike of 1902 was a pivotal moment in American labor history, a conflict that pitted coal…

Q: Management . Informed by this week's HBR articles, create and offer a list of 10-12 practical tips…

A: Note: As per the guidelines experts are not allowed to provide citations. All the individuals would…

Q: Appraisal right of dissenting stockholder does NOT apply to- a. Amendment of the articles to…

A: Appraisal right, also known as dissenters' rights or appraisal remedy, is a legal protection…

Q: occurs when a person interested in a particular career follows along someone who performs that job.…

A: Job shadowing is actually considered to be as sort of mini-internship, where a person need to spend…

Q: P r e p a r e a n i n d i v i d u a l p o i n t e r s p r e s e n t a t i o n a b o u t…

A: To prepare a short pointers presentation about the CREATE Law per sections. Here are some important…

Q: You are offered a 10 percent wage increase and the inflation rate for the year turns out to be 20…

A: Given the scenario where an individual is offered a 10 percent wage increase and the inflation rate…

Q: Explain the concept of product liability and the legal obligations of businesses to ensure the…

A: Product liability refers to the legal responsibility held by manufacturers, distributors, suppliers,…

Q: Monty Inc. started operations in January 2025. The company produces and sells cabinets for $6000…

A:

Q: Flowers by Irene Inc. is a small company and is considering a project that will require $700,000 in…

A: 1. To calculate the Return on Equity (ROE) for the project with 100% equity financing, you can use…

Q: With ITAM, an organization tracks technology assets only for the first two years it owns them. True…

A: ITAM (Information Technology Asset Management) and asset management are critical activities for…

Q: LEGAL ASPECTS OF PURCHASING Q.4. a) It is known that a seller is said to be unpaid when the whole…

A: In any transaction involving the sale of goods or services, it is crucial to understand the legal…

Q: The theory of corporate social responsibility proposed by Milton Friedman says a corporation is part…

A: The theory of corporate social responsibility proposed by economist Milton Friedman takes a…

Q: After graduating, you are offered a position in the compliance department at Telco LTD. The company…

A: Telco LTD is a newly registered company that has recently appointed directors to manage its…

Q: Analyze the conceptual framework of accounting and its role in guiding the preparation and…

A: The conceptual framework of accounting is a set of principles, assumptions, and concepts that guide…

Q: In at least 6 sentences, share what you believe would be your greatest challenge as an early…

A: Let's first understand who are referred to be as childhood adolescent. An early childhood…

Q: The New York Court of Appeals is cited in Table T1 as N.Y.

A: The New York Court of Appeals serves as the state's ultimate court. It is responsible for…

Q: Assuming that the same engraving machine is used for all products (new and existing ones), what will…

A: Introduction: Engraving machines are used to personalize chocolate bars for specific customers. When…

Q: is it actionable if breach on promise to marry produces financial, compensatory and punitive…

A: Breach of marriage commitment can be a complicated and emotionally sensitive subject with legal…

Q: How does antitrust law protect against monopolies and unfair business practices?

A: Antitrust laws, also known as competition laws, are a set of legal rules and regulations that aim to…

Q: rovision in a contract determines a. which state's laws will be used to interpret the contract. D.…

A: Contracts are legally binding agreements between two or more parties that outline the terms and…

Q: management Review the six basic skills listed on pages 1450. Outline how you will display…

A: Note: The answer has been framed in a generalized manner. Individuals acquire skills by means of…

Q: Use the four-step method in problem solving to solve the problem. A car rents for $300 per week plus…

A: This problem involves using a four-step method for problem-solving to determine the rental cost for…

Q: M A K E A P O I N T E R S ( B U L L E T F O R M ) O F R E P U B L I C A C T N O . 1…

A: The Create Act is the acronym for Corporate Recovery and Tax Incentives for Enterprises Act. This…

Q: Oldham, Incorporated conducts business in State M and State N, which both use the UDITPA…

A: …

Q: Maxie is leaving the Goucher Basketball jersey making business and is closing three of her…

A: Maxie is closing three of her factories and reassigning her best workers to Bianca's remaining…

Q: The following salaried employees of Mountain Stone Brewery in Fort Collins, Colorado, are paid…

A: To calculate the net pay for each employee, we need to follow the steps below: Calculate the…

Q: How does intellectual property law protect a company's patents, trademarks, and copyrights?

A: Intellectual property (IP) law refers to the legal protection of creations of the human mind,…

Q: Japanese manufacturers often pursue a strategy that is part collaboration, part purchasing from a…

A: In the realm of Japanese manufacturing, there exists a distinctive approach that combines elements…

Q: is a breach of promise to marry your fiancee actionable?

A: Breach of promise to marry claims can be complicated and vary depending on jurisdiction, they…

Q: 194. The threat to commit suicide amounts to A. Coercion B. Undue influence C. Misrepresentation D.…

A: Threatening suicide to impel someone to act in a certain way can be a serious issue and may bear…

Q: 1.Present an ethical issue about lgbtq+ and its context. 2. Provide own stance on the issue. 3.…

A: There are a lot of ethical concerns confronting LGBTQIA+ presently. However, this community manages…

Q: Distinguish between the Ultramares and the Restatement Rule regarding an accountant's liability to…

A: Accountant's liability is the term used to describe the obligation that an accountant or accounting…

Q: .Explain the defense of assumption of risk in tort law.

A: Tort law is a branch of civil law that deals with civil wrongs and provides a legal framework for…

Q: When is an agency by operation of law created? Please give an example.

A: A basic legal theory known as the operation of law controls how certain rights, obligations, or…

Q: Discuss the role of government regulations and agencies in overseeing and regulating business…

A: In order to monitor and control corporate operations across numerous sectors, government rules and…

Q: For a situation to qualify as a class-action suit, it must: Multiple Choice 1. involve several…

A: A class-action suit is a legal action brought by one or more plaintiffs on behalf of a larger group…

Q: 9. According to the LMST methodology, a. The official exchange rate has to be adjusted because of…

A: The LMST (Local Market Specific Terms) methodology is a device utilized in Cost-Benefit Analysis…

Q: What are the legal considerations when engaging in international business transactions, including…

A: International business refers to groups of activities where business sale goods and services to its…

Subject :- Finance

Trending now

This is a popular solution!

Step by step

Solved in 3 steps