calculate weighted average cost of capital if: 1) share of debt from total capital is 25% and cost of debt is 8% 2)share of preference shares from total capital is 25% and the cost of preference shares is 10% 3)share of equity shares from total capital is 35% and the cost of equity shares is 15% 4)share of retained earning from total capital is 15% and the cost of retained earning is 6% Select one: a. 10.1% b. 11.1% c. None of them is correct d. 10.7%

calculate weighted average cost of capital if: 1) share of debt from total capital is 25% and cost of debt is 8% 2)share of preference shares from total capital is 25% and the cost of preference shares is 10% 3)share of equity shares from total capital is 35% and the cost of equity shares is 15% 4)share of retained earning from total capital is 15% and the cost of retained earning is 6% Select one: a. 10.1% b. 11.1% c. None of them is correct d. 10.7%

Chapter12: Capital Structure

Section: Chapter Questions

Problem 9PROB

Related questions

Question

Transcribed Image Text:00

LO

4.

%24

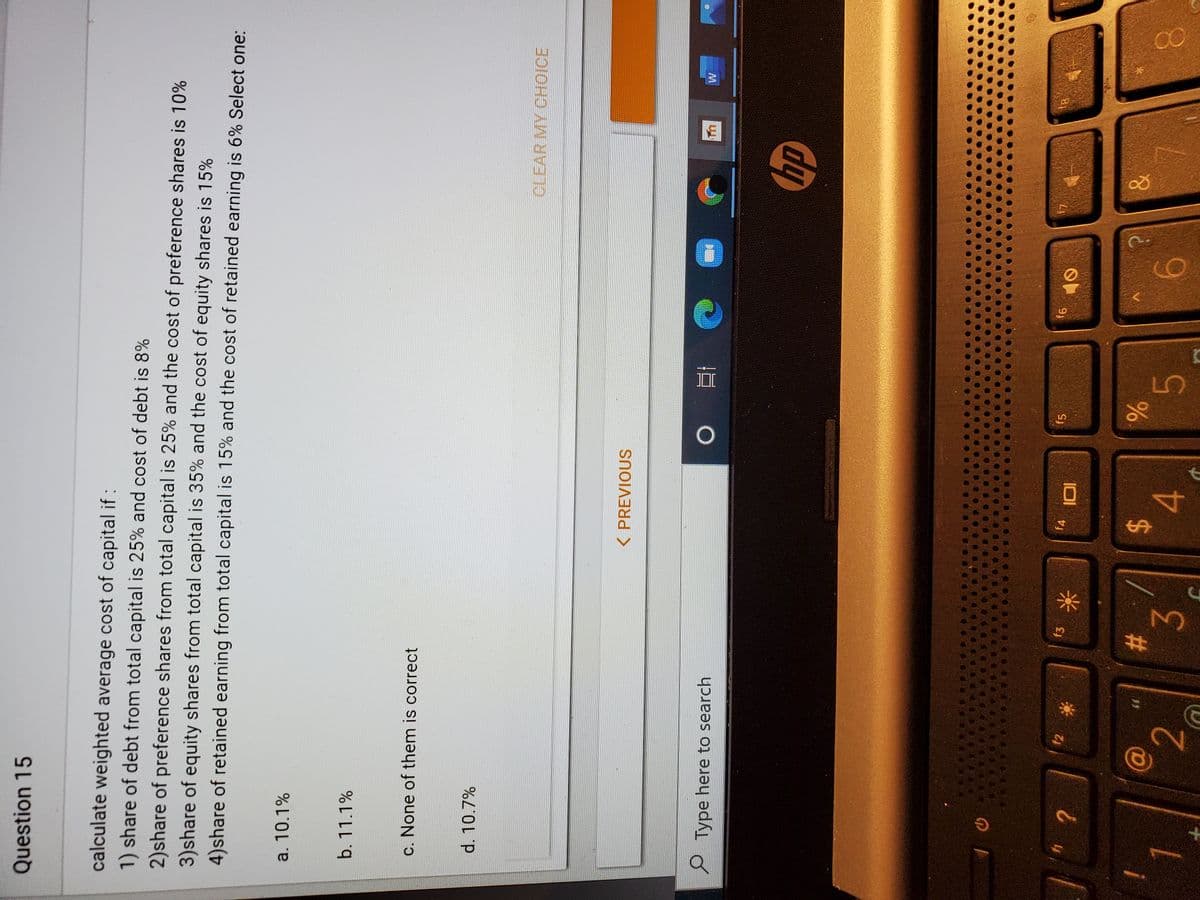

Question 15

calculate weighted average cost of capital if :

1) share of debt from total capital is 25% and cost of debt is 8%

2)share of preference shares from total capital is 25% and the cost of preference shares is 10%

3)share of equity shares from total capital is 35% and the cost of equity shares is 15%

4)share of retained earning from total capital is 15% and the cost of retained earning is 6% Select one:

a. 10.1%

b. 11.1%

c. None of them is correct

d. 10.7%

CLEAR MY CHOICE

< PREVIOUS

e Type here to search

f2

f4

f5

84

2.

米

%23

3.

2.

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you