Calculating the risk premium on bonds The text presents a formula where (1+) = (1-pX1+i+x)+ p(0) where i is the nominal interest rate on a riskless bond x is the risk premium p is the probability of default (bankruptcy) If the probability of bankruptcy is zero, the rate of interest on the risky bond is When the nominal interest rate for a risky borrower is 8% and the nominal policy rate of interest is 3%, the probability of bankruptcy is %. (Round your response to two decimal places.) When the probability of bankruptcy is 6% and the nominal policy rate of interest is 4%, the nominal interest rate for a risky borrower is %. (Round your response to two decimal places.) When the probability of bankruptcy is 11% and the nominal policy rate of interest is 4%, the nominal interest rate for a risky borrower is %. (Round your response to two decimal places.) The formula assumes that payment upon default zero. In fact, it is often positive. How would you change the formula this case? O A. The final term would become p "times" some fraction of (1+i+x). O B. The final term would become p "times" 1. O c. The final term would become some fraction of (1+i+ x). O D. The final term would become p "times" some fraction of /+x.

Calculating the risk premium on bonds The text presents a formula where (1+) = (1-pX1+i+x)+ p(0) where i is the nominal interest rate on a riskless bond x is the risk premium p is the probability of default (bankruptcy) If the probability of bankruptcy is zero, the rate of interest on the risky bond is When the nominal interest rate for a risky borrower is 8% and the nominal policy rate of interest is 3%, the probability of bankruptcy is %. (Round your response to two decimal places.) When the probability of bankruptcy is 6% and the nominal policy rate of interest is 4%, the nominal interest rate for a risky borrower is %. (Round your response to two decimal places.) When the probability of bankruptcy is 11% and the nominal policy rate of interest is 4%, the nominal interest rate for a risky borrower is %. (Round your response to two decimal places.) The formula assumes that payment upon default zero. In fact, it is often positive. How would you change the formula this case? O A. The final term would become p "times" some fraction of (1+i+x). O B. The final term would become p "times" 1. O c. The final term would become some fraction of (1+i+ x). O D. The final term would become p "times" some fraction of /+x.

Excel Applications for Accounting Principles

4th Edition

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Gaylord N. Smith

Chapter11: Bond Pricing And Amortization (bonds)

Section: Chapter Questions

Problem 3R

Related questions

Question

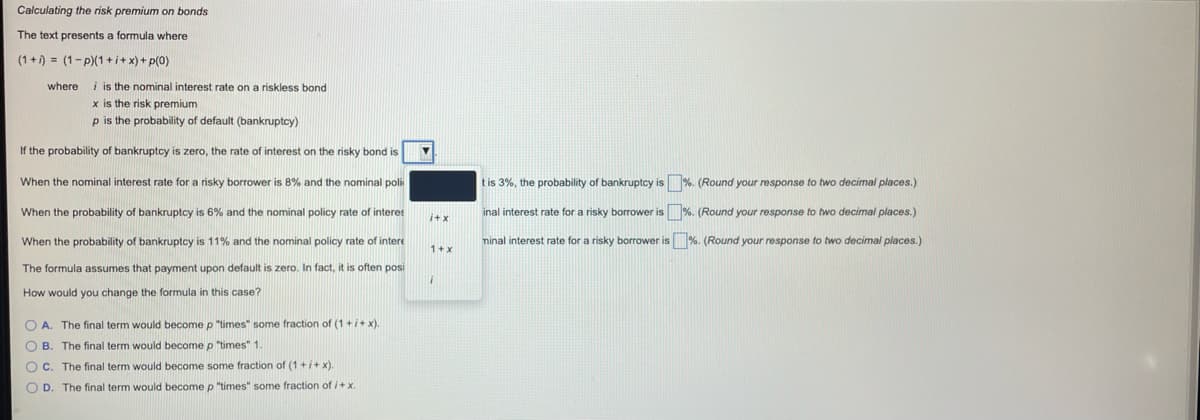

Transcribed Image Text:Calculating the risk premium on bonds

The text presents a formula where

(1+) = (1-p)(1 +i+x) + p(0)

where

i is the nominal interest rate on a riskless bond

x is the risk premium

p is the probability of default (bankruptcy)

If the probability of bankruptcy is zero, the rate of interest on the risky bond is

When the nominal interest rate for a risky borrower is 8% and the nominal poli

tis 3%, the probability of bankruptcy is %. (Round your response to two decimal places.)

When the probability of bankruptcy is 6% and the nominal policy rate of interes

inal interest rate for a risky borrower is %. (Round your response to two decimal places.)

i+x

When the probability of bankruptcy is 11% and the nominal policy rate of intere

minal interest rate for a risky borrower is %. (Round your response to two decimal places.)

The formula assumes that payment upon default is zero. In fact, it is often posi

How would you change the formula in this case?

O A. The final term would become p "times" some fraction of (1 +i+ x).

O B

The final term would become p "times" 1.

O C. The final term would become some fraction of (1+i+x).

O D. The final term would become p "times" some fraction of i+x

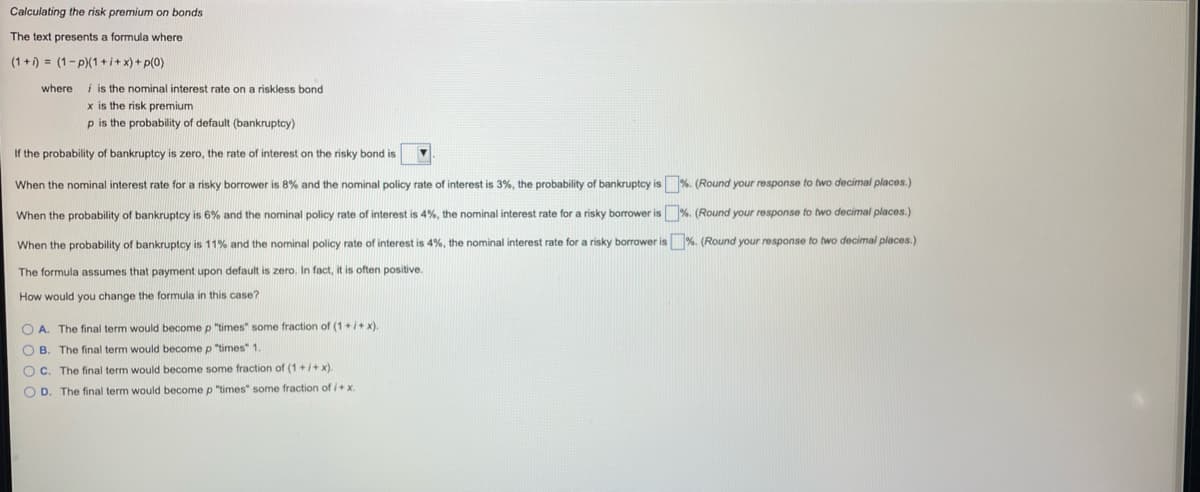

Transcribed Image Text:Calculating the risk premium on bonds

The text presents a formula where

(1+1) = (1-p)(1 +i+x) + p(0)

where i is the nominal interest rate on a riskless bond

x is the risk premium

p is the probability of default (bankruptcy)

If the probability of bankruptcy is zero, the rate of interest on the risky bond is

When the nominal interest rate for a risky borrower is 8% and the nominal policy rate of interest is 3%, the probability of bankruptcy is %. (Round your response to two decimal places.)

When the probability of bankruptcy is 6% and the nominal policy rate of interest is 4%, the nominal interest rate for a risky borrower is %. (Round your response to two decimal places.)

When the probability of bankruptcy is 11% and the nominal policy rate of interest is 4%, the nominal interest rate for a risky borrower is %. (Round your response to two decimal places.)

The formula assumes that payment upon default is zero. In fact, it is often positive.

How would you change the formula in this case?

O A. The final term would become p "times" some fraction of (1+i+x).

O B. The final term would become p "times" 1.

O C. The final term would become some fraction of (1+i+ x).

OD.

The final term would become p "times" some fraction of i+x.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT