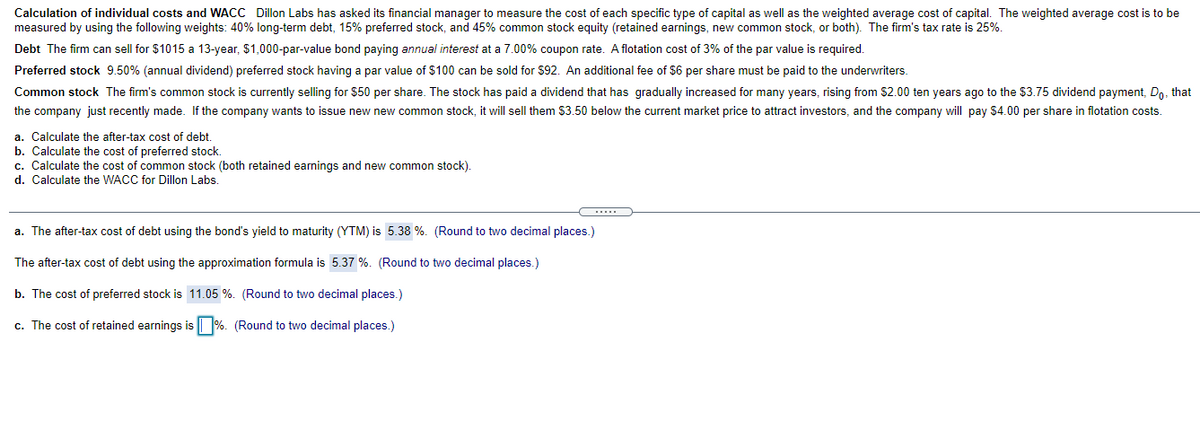

Calculation of individual costs and WACC Dillon Labs has asked its financial manager to measure the cost of each specific type of capital as well as the weighted average cost of capital. The weighted average cost is to be measured by using the following weights: 40% long-term debt, 15% preferred stock, and 45% common stock equity (retained earnings, new common stock, or both). The firm's tax rate is 25%. Debt The firm can sell for $1015 a 13-year, $1,000-par-value bond paying annual interest at a 7.00% coupon rate. A flotation cost of 3% of the par value is required. Preferred stock 9.50% (annual dividend) preferred stock having a par value of $100 can be sold for $92. An additional fee of $6 per share must be paid to the underwriters. Common stock The firm's common stock is currently selling for $50 per share. The stock has paid a dividend that has gradually increased for many years, rising from $2.00 ten years ago to the $3.75 dividend payment, Do, tha the company just recently made. If the company wants to issue new new common stock, it will sell them S3.50 below the current market price to attract investors, and the company will pay $4.00 per share in flotation costs. a. Calculate the after-tax cost of debt. b. Calculate the cost of preferred stock c. Calculate the cost of common stock (both retained earnings and new common stock). d. Calculate the WACC for Dillon Labs. a. The after-tax cost of debt using the bond's yield to maturity (YTM) is 5.38 %. (Round to two decimal places.) The after-tax cost of debt using the approximation formula is 5.37 %. (Round to two decimal places.) b. The cost of preferred stock is 11.05 %. (Round to two decimal places.) c. The cost of retained earnings is %. (Round to two decimal places.)

Calculation of individual costs and WACC Dillon Labs has asked its financial manager to measure the cost of each specific type of capital as well as the weighted average cost of capital. The weighted average cost is to be measured by using the following weights: 40% long-term debt, 15% preferred stock, and 45% common stock equity (retained earnings, new common stock, or both). The firm's tax rate is 25%. Debt The firm can sell for $1015 a 13-year, $1,000-par-value bond paying annual interest at a 7.00% coupon rate. A flotation cost of 3% of the par value is required. Preferred stock 9.50% (annual dividend) preferred stock having a par value of $100 can be sold for $92. An additional fee of $6 per share must be paid to the underwriters. Common stock The firm's common stock is currently selling for $50 per share. The stock has paid a dividend that has gradually increased for many years, rising from $2.00 ten years ago to the $3.75 dividend payment, Do, tha the company just recently made. If the company wants to issue new new common stock, it will sell them S3.50 below the current market price to attract investors, and the company will pay $4.00 per share in flotation costs. a. Calculate the after-tax cost of debt. b. Calculate the cost of preferred stock c. Calculate the cost of common stock (both retained earnings and new common stock). d. Calculate the WACC for Dillon Labs. a. The after-tax cost of debt using the bond's yield to maturity (YTM) is 5.38 %. (Round to two decimal places.) The after-tax cost of debt using the approximation formula is 5.37 %. (Round to two decimal places.) b. The cost of preferred stock is 11.05 %. (Round to two decimal places.) c. The cost of retained earnings is %. (Round to two decimal places.)

Chapter14: Capital Structure Management In Practice

Section: Chapter Questions

Problem 7P

Related questions

Question

I NEED THE SOLUTION FOR PART C AND PART D

Transcribed Image Text:Calculation of individual costs and WACC Dillon Labs has asked its financial manager to measure the cost of each specific type of capital as well as the weighted average cost of capital. The weighted average cost is to be

measured by using the following weights: 40% long-term debt, 15% preferred stock, and 45% common stock equity (retained earnings, new common stock, or both). The firm's tax rate is 25%.

Debt The firm can sell for $1015 a 13-year, $1,000-par-value bond paying annual interest at a 7.00% coupon rate. A flotation cost of 3% of the par value is required.

Preferred stock 9.50% (annual dividend) preferred stock having a par value of $100 can be sold for $92. An additional fee of $6 per share must be paid to the underwriters.

Common stock The firm's common stock is currently selling for $50 per share. The stock has paid a dividend that has gradually increased for many years, rising from $2.00 ten years ago to the $3.75 dividend payment, Do, that

the company just recently made. If the company wants to issue new new common stock, it will sell them $3.50 below the current market price to attract investors, and the company will pay $4.00 per share in flotation costs.

a. Calculate the after-tax cost of debt.

b. Calculate the cost of preferred stock.

c. Calculate the cost of common stock (both retained earnings and new common stock).

d. Calculate the WACC for Dillon Labs.

a. The after-tax cost of debt using the bond's yield to maturity (YTM) is 5.38 %. (Round to two decimal places.)

The after-tax cost of debt using the approximation formula is 5.37 %. (Round to two decimal places.)

b. The cost of preferred stock is 11.05 %. (Round to two decimal places.)

c. The cost of retained earnings is %. (Round to two decimal places.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning