Campbell, Inc. produces and sells outdoor equipment. On July 1, 20Y1. Campbell issued $30,000,000 of 10-year, 10% bonds at a market (effective) interest rate of 9%, receiving cash of $31,951,110. Interest on the bonds is payable semiannually on December 31 and June 30. The fiscal year of the company is the calendar year. Required: 1. Journalize the entry to record the amount of cash proceeds from the issuance of the bonds.* 2. Journalize the entries to record the following:* a. The first semiannual interest payment on December 31, 20Y1, and the amortization of the bond premium, using the interest method. (Round to the nearest dollar.) b. The interest payment on June 30, 20Y2, and the amortization of the bond premium, using the interest method. (Round to the nearest dollar.) 3. Determine the total interest expense for 20Y1. *Refer to the Chart of Accounts for exact wording of account titles.

Campbell, Inc. produces and sells outdoor equipment. On July 1, 20Y1. Campbell issued $30,000,000 of 10-year, 10% bonds at a market (effective) interest rate of 9%, receiving cash of $31,951,110. Interest on the bonds is payable semiannually on December 31 and June 30. The fiscal year of the company is the calendar year. Required: 1. Journalize the entry to record the amount of cash proceeds from the issuance of the bonds.* 2. Journalize the entries to record the following:* a. The first semiannual interest payment on December 31, 20Y1, and the amortization of the bond premium, using the interest method. (Round to the nearest dollar.) b. The interest payment on June 30, 20Y2, and the amortization of the bond premium, using the interest method. (Round to the nearest dollar.) 3. Determine the total interest expense for 20Y1. *Refer to the Chart of Accounts for exact wording of account titles.

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter14: Long-term Liabilities: Bonds And Notes

Section: Chapter Questions

Problem 6PA: Saverin, Inc. produces and sells outdoor equipment. On July 1, 2016, Saverin, Inc. issued 62,500,000...

Related questions

Question

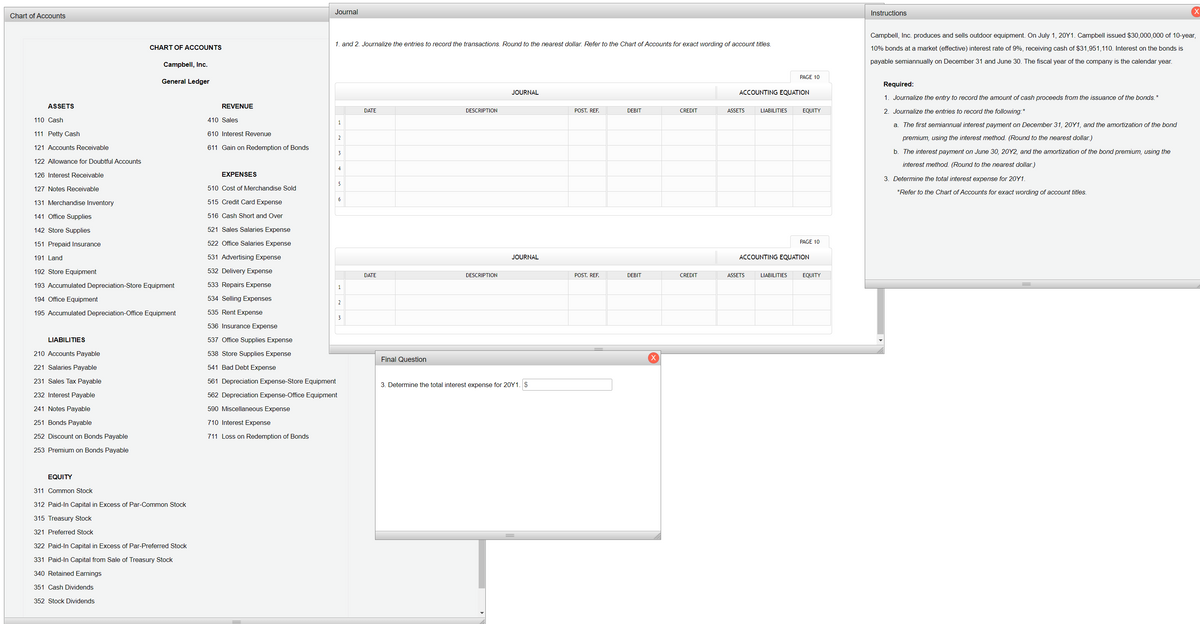

Campbell, Inc. produces and sells outdoor equipment. On July 1, 20Y1. Campbell issued $30,000,000 of 10-year, 10% bonds at a market (effective) interest rate of 9%, receiving cash of $31,951,110. Interest on the bonds is payable semiannually on December 31 and June 30. The fiscal year of the company is the calendar year.

Required: 1. Journalize the entry to record the amount of cash proceeds from the issuance of the bonds.*

2. Journalize the entries to record the following:* a. The first semiannual interest payment on December 31, 20Y1, and the amortization of the bond premium, using the interest method. (Round to the nearest dollar.) b. The interest payment on June 30, 20Y2, and the amortization of the bond premium, using the interest method. (Round to the nearest dollar.)

3. Determine the total interest expense for 20Y1. *Refer to the Chart of Accounts for exact wording of account titles.

Transcribed Image Text:Journal

Instructions

Chart of Accounts

Campbell, Inc. produces and sells outdoor equipment. On July 1, 20Y1. Campbell issued $30,000,000 of 10-year,

1. and 2. Journalize the entries to record the transactions. Round to the nearest dollar. Refer to the Chart of Accounts for exact wording of account titles.

CHART OF ACCOUNTS

10% bonds at a market (effective) interest rate of 9%, receiving cash of $31,951,110. Interest on the bonds is

payable semiannually on December 31 and June 30. The fiscal year of the company is the calendar year.

Campbell, Inc.

PAGE 10

General Ledger

Required:

JOURNAL

ACCOUNTING EQUATION

1. Journalize the entry to record the amount of cash proceeds from the issuance of the bonds. *

ASSETS

REVENUE

DATE

DESCRIPTION

POST. REF.

DEBIT

CREDIT

ASSETS

LIABILITIES

EQUITY

2. Journalize the entries to record the following:*

110 Cash

410 Sales

1

a. The first semiannual interest payment on December 31, 20Y1, and the amortization of the bond

111 Petty Cash

610 Interest Revenue

2

premium, using the interest method. (Round to the nearest dollar.)

121 Accounts Receivable

611 Gain on Redemption of Bonds

3

b. The interest payment on June 30, 20Y2, and the amortization of the bond premium, using the

122 Allowance for Doubtful Accounts

interest method. (Round to the nearest dollar.)

4

126 Interest Receivable

EXPENSES

3. Determine the total interest expense for 20Y1.

5

127 Notes Receivable

510 Cost of Merchandise Sold

*Refer to the Chart of Accounts for exact wording of account titles.

6.

131 Merchandise Inventory

515 Credit Card Expense

141 Office Supplies

516 Cash Short and Over

142 Store Supplies

521 Sales Salaries Expense

151 Prepaid Insurance

522 Office Salaries Expense

PAGE 10

191 Land

531 Advertising Expense

JOURNAL

ACCOUNTING EQUATION

192 Store Equipment

532 Delivery Expense

POST. REF.

DATE

DESCRIPTION

DEBIT

CREDIT

ASSETS

LIABILITIES

EQUITY

193 Accumulated Depreciation-Store Equipment

533 Repairs Expense

=

1

194 Office Equipment

534 Selling Expenses

2

195 Accumulated Depreciation-Office Equipment

535 Rent Expense

3

536 Insurance Expense

LIABILITIES

537 Office Supplies Expense

210 Accounts Payable

538 Store Supplies Expense

Final Question

221 Salaries Payable

541 Bad Debt Expense

231 Sales Tax Payable

561 Depreciation Expense-Store Equipment

3. Determine the total interest expense for 2OY1. $

232 Interest Payable

562 Depreciation Expense-Office Equipment

241 Notes Payable

590 Miscellaneous Expense

251 Bonds Payable

710 Interest Expense

252 Discount on Bonds Payable

711 Loss on Redemption of Bonds

253 Premium on Bonds Payable

EQUITY

311 Common Stock

312 Paid-In Capital in Excess of Par-Common Stock

315 Treasury Stock

321 Preferred Stock

322 Paid-In Capital in Excess of Par-Preferred Stock

331 Paid-In Capital from Sale of Treasury Stock

340 Retained Earnings

351 Cash Dividends

352 Stock Dividends

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning