Can you have an investment with DCFRR > MARR, but NPV < $0 (calculating NPV with iry=MARR)?

Q: Which of the following statements is correct? A. If the NPV of a project is greater than 0,…

A: Capital budgeting Capital budgeting is a concept where potential major projects or investments are…

Q: Find expected return for G.

A: Expected Return is the amount of loss or profit an investor expects to receive on an investment.

Q: True or False: In solving a classical capital budgeting problem using binary linear programming…

A: The question is based on the concept of linear programming problem in decision making for long term…

Q: Determine which of the following two alternatives is the most efficient and which is the most…

A: Internal rate of return (IRR) of an alternative refers to the rate at which the Net present value…

Q: . VWhat is your rate of return on this investment? *

A: "Since you have posted multiple questions, we will solve first question for you. If you want any…

Q: A project’s IRR is the discount rate that causes the PV of the inflows to equal the project’s cost.…

A: The given statement is true.

Q: As you can see in the graph below, two alternatives of A and B are compared to each other. What do…

A: Analysis of Graph: At x%, PWA and PWB intersects. At y%, PWA touches the axis Cross over…

Q: With the given information, find the Net Present Value (NPV).

A: The net worth of the project after the deduction of the current worth of the cash outflows from the…

Q: greater than the discount r als 0, then the projects init

A: Net Present Value ("NPV"), Internal Rate of Return ("IRR") and Profitability Index ("PI") are all…

Q: r expected return on this investment?

A: Expected return on investment refers to the rate of return that an investor is expecting on an…

Q: I'm struggling with the area "indicate how the internal rate of return is calculated using the…

A: Equation needed Present value FACTOR =1-(1+r)-n/r i=interest rate =internal rate of return n=6…

Q: what is meant by the required rate of return

A: The return which is expected to be earned by investing in a security is known as Required Rate of…

Q: An investor has the utility function: U = E(r) - (A/2)o2 where A = 4. Which of the following…

A: Given Utility functio=E(r) -(A/2)(SD)^2

Q: The most liquid money aggregate is? Select one alternative: M0 M1 M2

A: Solution Step (1) M0, M1 M2 In the united states, the money supply is classified by various…

Q: Compute for the payback periód öf éåch project hich project will you choose and why? Show solution.…

A: The payback period for all the three project can be calculated as follows:

Q: If someone computes for the MARR using AW Method and AW becomes positive at a certain fixed interest…

A: The minimum acceptable rate of return (MARR) is the minimum rate of return on an investment that is…

Q: n WACC can be used as the project's required return

A: Required rate of return is the minimum benefits that can be obtained from undertaking a project.

Q: Consider IRR on Incremental Investment when Initial IRR Flows are equal?

A: Answer: IRR is a measure in capital budgeting used to measure the value of the predicted…

Q: Click the icon to see the Worked Solution. a. The risk-free rate of return is %. (Round to one…

A: Answer a. The risk-free rate is the rate that accounts for inflation. Since the real rate of…

Q: An NPV analysis is one part of a complete captial investment analysis. What is the second part that…

A: Introduction: An analysis of capital investment is the mechanism by which management prepares,…

Q: How can we calculate the Rate-of-Return with Excel?

A: The question is based on the concept of calculation of rate of return (ROR), (ROR) is percentage…

Q: Calculate the following: Payback Period NPV IRR

A: Information Provided: Initial Investment = $225,000 Year 1 CF = $95,000 Year 2 CF = $80,000 Year 3…

Q: e Internal rate of return

A: The following problem can be solved using XIRR function in excel.

Q: what is the key deference between Value - at - Risk ( VaR ) and volatility ? More specifically, what…

A: Volatility is a traditional measure of risk. Because of certain disadvantages in using volatility as…

Q: When npv is negative, the discount rate is greater than the actual return on investment. A.…

A: Net present value is the method used in capital budgeting to analyse various investments, projects,…

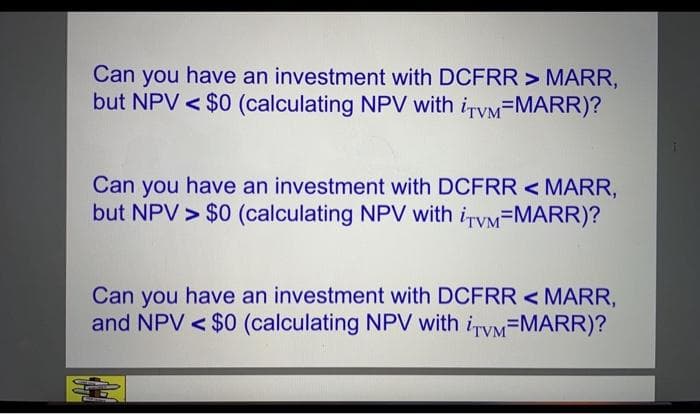

Q: Can you have an investment with DCFRR > MARR, but NPV $0 (calculating NPV with iTyM=MARR)? Can you…

A: Since you have asked multiple questions, we will solve the first question for you. Please ask…

Q: what is the NPV of this investment?

A: Net Present Value: It is the value generated by the firm for taking on a project. It is calculated…

Q: What are some reasons that net PP&E might grow proportionally tosales, and what are some reasons…

A: Property, plant & equipment are company's long term assets important for the company's…

Q: Which project below would you consider acceptable? One whose IRR is greater than the MARR One whose…

A: Solution: Internal Rate of Return (IRR) is the rate of return which the project yields ie. the…

Q: Does the Present Value (PV) technique is based on return?

A: One of the important decisions that are taken by the management is to make the investment decisions…

Q: What does it mean to be at the optimal capitalstructure? What is optimized? What is maximizedand…

A: Introduction: Capital structure is nothing but the debt and securities that are included in the…

Q: The size of the investment required in Y is $ The rate of return on Y is | %.

A: Rate of Return: It is the return over a period of time made on the investment. Information…

Q: nually. Investors required rate of return is ce

A: Coupon rate =8.47% T=7 Face value=50,000 Price=45,000 Yield to maturity = C +(face value…

Q: Formulate the model on a spread and solve using Solver. Give the following: i. Objective function:…

A: NPV stands for net present value. It is one of the often used capital budgeting tool that companies…

Q: Please answer again - Calculate the payback period for above - Calculate the NPV for abov

A: Payback period is period required to initial amount of investment in the project that was done…

Q: a. Find the NPV at 15% effective. b. Find the internal rate of return.

A: Information Provided: Initial outflow = -$205,000 ($130,000 + $75,000) Year 1 - Year CF = $50,000…

Q: "Quadratic utility is the best form of the utility function to assume for any investor".Enumerate…

A: Quadratic utility is the utility function which describes the behavior of an investor. The function…

Q: What is Net Present Value (NPV)?

A: Time value of money: Time value of money refers to the concept that the value of money available at…

Q: Please Calculate the Following using the Table Given. Beta Internal Rate of Return (IRR). Gamma’s…

A: Internal ROR is discounts all subsequent inflows equal to initial outlay related to investment…

Q: Show that for an initial wealth w and a linear utility function u(w) = w, then P= E[X].

A: Linear utility functions maximize the predicted total benefit and are associated with risk-averse…

Q: I just want the formulas Question D: • Rs / Rd • Ws / Wd •the cost of capital •wacc

A: WACC (Weighted Average Cost of Capital): It is the cost of raising the various sources of capital…

Q: Another term for return is ..................

A: Return means money which is earned or lost in the process of investment. Return can be in the form…

Step by step

Solved in 3 steps

- How can I calculate the NPV of an investment?An advantage of the internal rate of return method is that a.it considers the time value of money. b.it can rank proposals of equal lives. c.it considers the cash flows of the investment. d.All of these choices are correct.If the internal rate of return (IRR) of a well-behaved investment alternative is equal to MARR, which of the following statements about the other measures of worth for this alternative must be true? i. PW = 0 ii. AW = 0. Solve, a. I onlyb. II only c. Neither I nor II d. Both I and II.

- Give an example of a liquid investment and an illiquid investment. Discuss why you consider each of them to be liquid or illiquid.When using the NPV method for a particular investment decision, if the present value of all cash Inflows Is greater than the present value of all cash outflows, then _______ . A. the discount rate used was too high B. the investment provides an actual rate of return greater than the discount rate C. the investment provides an actual rate of return equal to the discount rate D. the discount rate is too lowAlternatives X and Y have rates of return of 10% and 18%, respectively. What is known about the rate of return on the increment between X and Y if the investment required in Y is (a) larger than that required for X, and (b) smaller than that required for X? (c) Develop two spreadsheet examples that illustrate your responses to parts (a) and (b).

- Which of the following methods does not consider the investment’s profitability? a. ARR b. Payback c. NPV d. IRRWhich of the following statements is true? Multiple Choice When NPV is 0, the IRR is equal to the discount rate. When NPV is 0, the investment is not making a profit. In calculating IRR, we make the assumption all cash flows are reinvested at the discount rate. NPV is a good measure to use when comparing investments of different sizes.The relationship between NPV and IRR is such thata. both approaches always provide the same ranking of alternative investment projects.b. the IRR of a project is equal to the firm's cost of capital if the NPV of a project is $0.c. if the NPV of a project is negative, the IRR must be greater than the cost of capital.d. none of the above

- Which of the following statements is correct? A. If the NPV of a project is greater than 0, its PI will equal 0. B. If the IRR of a project is 0%, its NPV, using a discount rate, k, greater than 0, will be 0. C. If the PI of a project is less than 1, its NPV should be less than 0. D. NoneWhen using present worth to evaluate the attractiveness of a single investment alternative, what value is the calculated PW compared to? a. 0.0b. MARR c. 1.0 d. WACC.n is the number of periods of an investment, PV is the starting value, FVn is the future value n periods ahead, and ^ means 'to the power of'. What is the correct formula for calculating return? a)(PV/FVn)^n - 1 b)(FVn/PV)^n c)1 - (FVn/PV)^n d)(FVn/PV)^n - 1