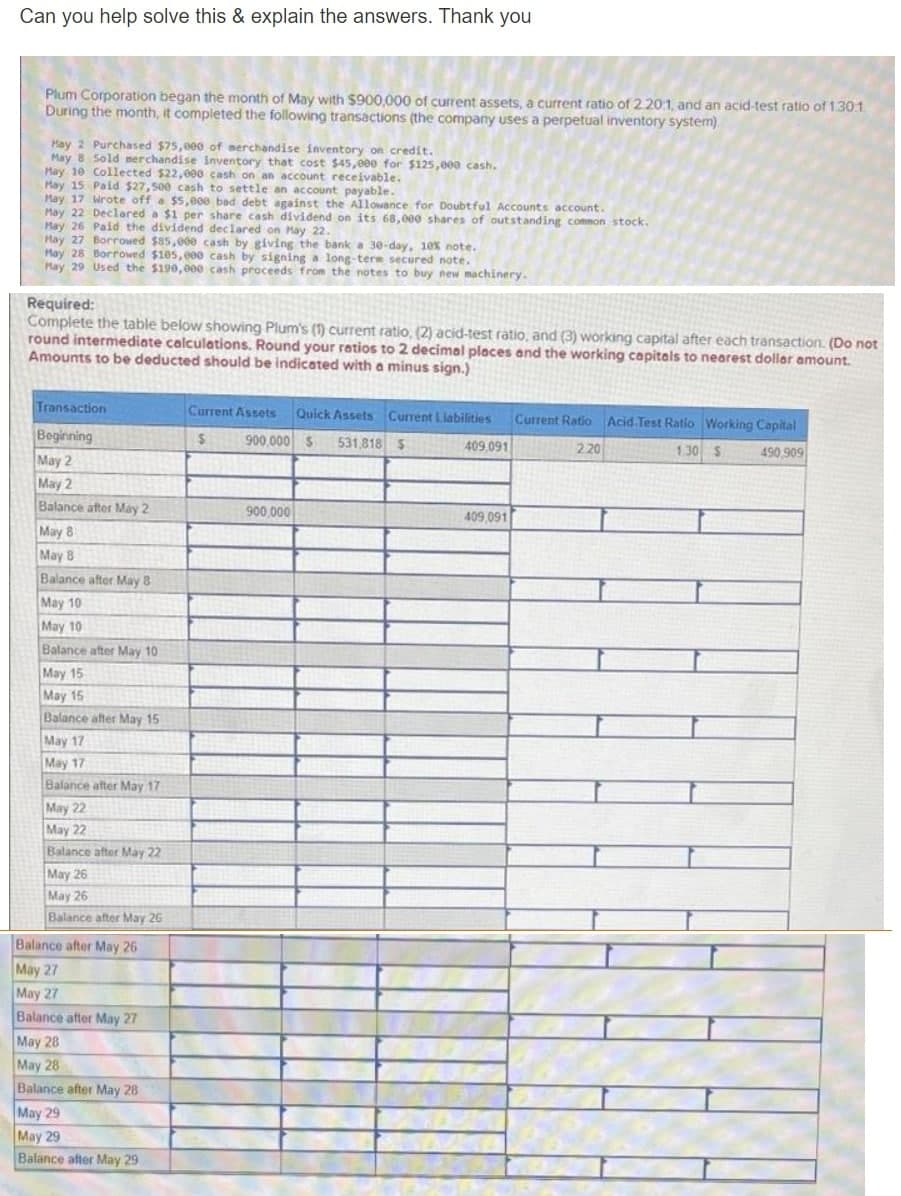

Can you help solve this & explain the answers. Thank you Plum Corporation began the month of May with $900,000 of current assets, a current ratio of 2 201, and an acid-test ratio of 1.30.1 During the month, it completed the following transactions (the company uses a perpetual inventory system) Hay 2 Purchased $75,000 of aerchandise inventory on credit. May 8 Sold merchandise Inventory that cost $45,000 for $125,000 cash. May 10 Collected $22,00o cash on an account receivable. May 15 Paid $27,500 cash to settle an account payable. May 17 Wrote off a $5,0ee bad debt against the Alowance for Doubtful Accounts account. May 22 Declared a $1 per share cash dividend on its 68,000 shares of outstanding common stock. Hay 26 Paid the dividend declared on May 22. May 27 Borrowed $85,000 cash by giving the bank a 30-day, 10% note. May 28 Borrowed $105,000 cash by signing a long-tere secured note. May 29 Used the $190,000 cash proceeds from the notes to buy new machinery. Required: Complete the table below showing Plum's (1) current ratio, (2) acid-test ratio, and (3) working capital after each transaction. (Do not round intermediate calculations. Round your ratios to 2 decimal places and the working capitals to nearest doller amount. Amounts to be deducted should be indicated with a minus sign.) Transaction Current Assets Quick Assets Current Liabilities Current Ratio Acid Test Ratio Working Capital Beginning May 2 May 2 900,000 $ 531,818 $ 409.091 220 1.30 S 490 909 Balance after May 2 900,000 409 091 May 8 May 8 Balance after May 8 May 10 May 10 Balance after May 10 May 15 May 15 Balance after May 15 May 17 May 17 Balance after May 17 May 22 May 22 Balance after May 22 May 26 May 26 Balance after May 26 Balance after May 26 May 27 May 27 Balance after May 27 May 28 May 28 Balance after May 28 May 29 May 29 Balance after May 29

Can you help solve this & explain the answers. Thank you Plum Corporation began the month of May with $900,000 of current assets, a current ratio of 2 201, and an acid-test ratio of 1.30.1 During the month, it completed the following transactions (the company uses a perpetual inventory system) Hay 2 Purchased $75,000 of aerchandise inventory on credit. May 8 Sold merchandise Inventory that cost $45,000 for $125,000 cash. May 10 Collected $22,00o cash on an account receivable. May 15 Paid $27,500 cash to settle an account payable. May 17 Wrote off a $5,0ee bad debt against the Alowance for Doubtful Accounts account. May 22 Declared a $1 per share cash dividend on its 68,000 shares of outstanding common stock. Hay 26 Paid the dividend declared on May 22. May 27 Borrowed $85,000 cash by giving the bank a 30-day, 10% note. May 28 Borrowed $105,000 cash by signing a long-tere secured note. May 29 Used the $190,000 cash proceeds from the notes to buy new machinery. Required: Complete the table below showing Plum's (1) current ratio, (2) acid-test ratio, and (3) working capital after each transaction. (Do not round intermediate calculations. Round your ratios to 2 decimal places and the working capitals to nearest doller amount. Amounts to be deducted should be indicated with a minus sign.) Transaction Current Assets Quick Assets Current Liabilities Current Ratio Acid Test Ratio Working Capital Beginning May 2 May 2 900,000 $ 531,818 $ 409.091 220 1.30 S 490 909 Balance after May 2 900,000 409 091 May 8 May 8 Balance after May 8 May 10 May 10 Balance after May 10 May 15 May 15 Balance after May 15 May 17 May 17 Balance after May 17 May 22 May 22 Balance after May 22 May 26 May 26 Balance after May 26 Balance after May 26 May 27 May 27 Balance after May 27 May 28 May 28 Balance after May 28 May 29 May 29 Balance after May 29

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter11: The Statement Of Cash Flows

Section: Chapter Questions

Problem 37E: Analyzing the Accounts Casey Company uses a perpetual inventory system and engaged in the following...

Related questions

Question

Transcribed Image Text:Can you help solve this & explain the answers. Thank you

Plum Corporation began the month of May with $900,000 of current assets, a current ratio of 2201, and an acid-test ratio of 1.30.1.

During the month, it completed the following transactions (the company uses a perpetual inventory system).

Hay 2 Purchased $75,000 of merchandise inventory on credit.

May 8 Sold merchandise inventory that cost $45,0e0 for $125,000 cash.

May 10 Collected $22,000 cash on an account receivable.

May 15 Paid $27,500 cash to settle an account payable.

May 17 Wrote off a $5,0e0 bad debt against the Alilowance for Doubtful Accounts account.

May 22 Declared a $1 per share cash dividend on its 68,000 shares of outstanding common stock.

May 26 Paid the dividend declared on May 22.

May 27 Borrowed $85,000 cash by giving the bank a 30-day, 10% note.

May 28 Borrowed $105,e00 cash by signing a long-tere secured note.

May 29 Used the $190,000 cash proceeds from the notes to buy new machinery.

Required:

Complete the table below showing Plum's (1) current ratio, (2) acid-test ratio, and (3) working capital after each transaction. (Do not

round intermediate calculations. Round your ratios to 2 decimal places and the working capitals to nearest dollar amount.

Amounts to be deducted should be indicated with a minus sign.)

Transaction

Current Assets

Quick Assets Current Liabilities

Current Ratio Acid Test Ratio Working Capital

Beginning

May 2

May 2

Balance after May 2

900,000 $

531,818 5

409.091

2 20

1.30 $

490,909

900,000

409,091

May 8

May 8

Balance after May 8

May 10

May 10

Balance after May 10

May 15

May 15

Balance after May 15

May 17

May 17

Balance ater May 17

May 22

May 22

Balance after May 22

May 26

May 26

Balance after May 26

Balance after May 26

May 27

May 27

Balance after May 27

May 28

May 28

Balance after May 28

May 29

May 29

Balance after May 29

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning