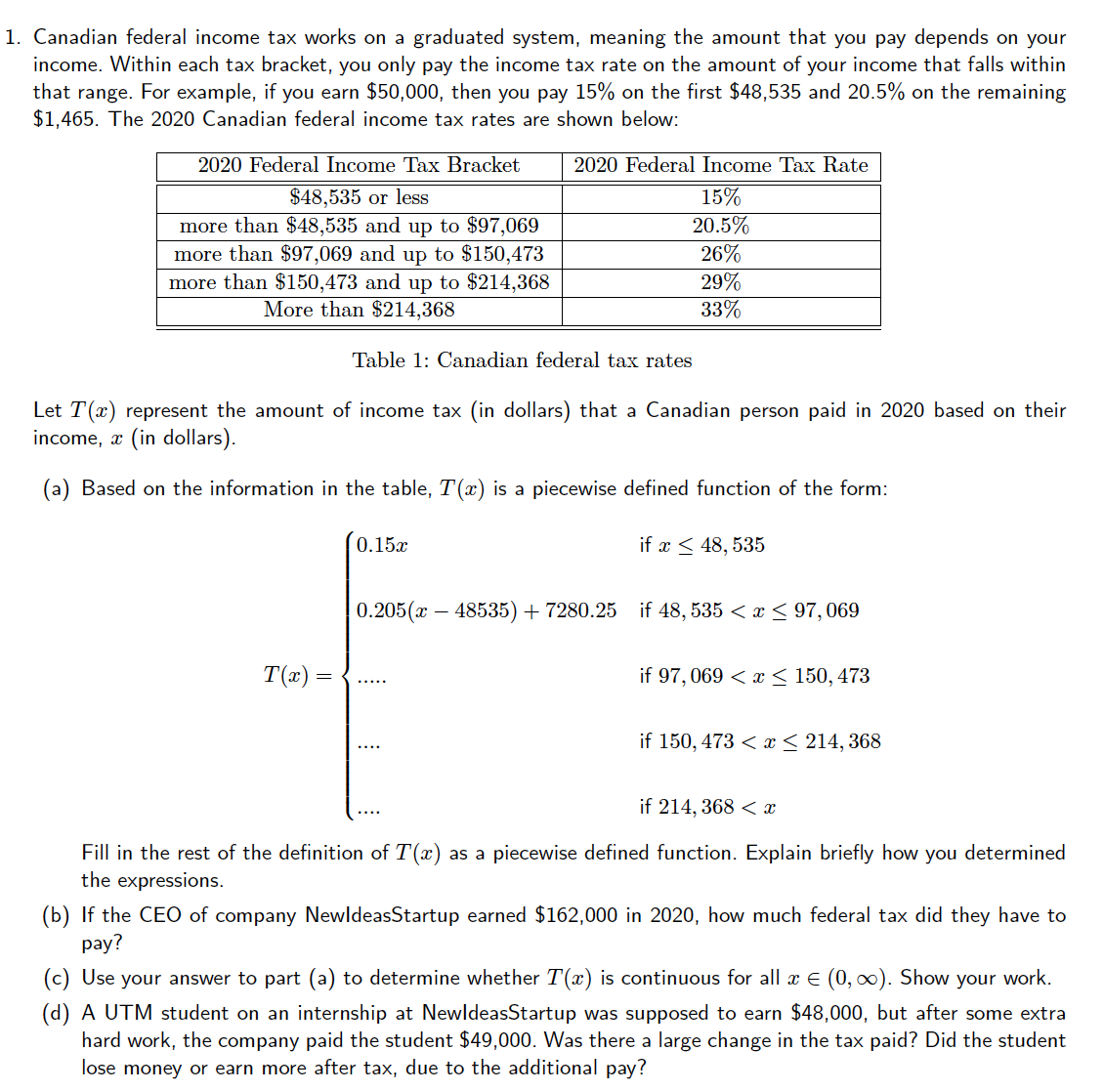

Canadian federal income tax works on a graduated system, meaning the amount that you pay depends on your income. Within each tax bracket, you only pay the income tax rate on the amount of your income that falls within that range. For example, if you earn $50,000, then you pay 15% on the first $48,535 and 20.5% on the remaining $1,465. The 2020 Canadian federal income tax rates are shown below: 2020 Federal Income Tax Bracket 2020 Federal Income Tax Rate $48,535 or less more than $48,535 and up to $97,069 more than $97,069 and up to $150,473 more than $150,473 and up to $214,368 More than $214,368 15% 20.5% 26% 29% 33% Table 1: Canadian federal tax rates Let T(x) represent the amount of income tax (in dollars) that a Canadian person paid in 2020 based on their income, x (in dollars). (a) Based on the information in the table, T(x) is a piecewise defined function of the form: 0.15x if x < 48, 535 0.205(x – 48535) + 7280.25 if 48, 535 < x < 97,069 T(x) : if 97, 069 < x < 150, 473 if 150, 473 < x < 214, 368 if 214, 368 < x Fill in the rest of the definition of T(x) as a piecewise defined function. Explain briefly how the expressions. you determined (b) If the CEO of company NewldeasStartup earned $162,000 in 2020, how much federal tax did they have to рay? (c) Use your answer to part (a) to determine whether T(x) is continuous for all æ E (0, 0). Show your work.

Canadian federal income tax works on a graduated system, meaning the amount that you pay depends on your income. Within each tax bracket, you only pay the income tax rate on the amount of your income that falls within that range. For example, if you earn $50,000, then you pay 15% on the first $48,535 and 20.5% on the remaining $1,465. The 2020 Canadian federal income tax rates are shown below: 2020 Federal Income Tax Bracket 2020 Federal Income Tax Rate $48,535 or less more than $48,535 and up to $97,069 more than $97,069 and up to $150,473 more than $150,473 and up to $214,368 More than $214,368 15% 20.5% 26% 29% 33% Table 1: Canadian federal tax rates Let T(x) represent the amount of income tax (in dollars) that a Canadian person paid in 2020 based on their income, x (in dollars). (a) Based on the information in the table, T(x) is a piecewise defined function of the form: 0.15x if x < 48, 535 0.205(x – 48535) + 7280.25 if 48, 535 < x < 97,069 T(x) : if 97, 069 < x < 150, 473 if 150, 473 < x < 214, 368 if 214, 368 < x Fill in the rest of the definition of T(x) as a piecewise defined function. Explain briefly how the expressions. you determined (b) If the CEO of company NewldeasStartup earned $162,000 in 2020, how much federal tax did they have to рay? (c) Use your answer to part (a) to determine whether T(x) is continuous for all æ E (0, 0). Show your work.

Calculus: Early Transcendentals

8th Edition

ISBN:9781285741550

Author:James Stewart

Publisher:James Stewart

Chapter1: Functions And Models

Section: Chapter Questions

Problem 1RCC: (a) What is a function? What are its domain and range? (b) What is the graph of a function? (c) How...

Related questions

Question

Transcribed Image Text:1. Canadian federal income tax works on a graduated system, meaning the amount that you pay depends on your

income. Within each tax bracket, you only pay the income tax rate on the amount of your income that falls within

that range. For example, if you earn $50,000, then you pay 15% on the first $48,535 and 20.5% on the remaining

$1,465. The 2020 Canadian federal income tax rates are shown below:

2020 Federal Income Tax Bracket

2020 Federal Income Tax Rate

15%

$48,535 or less

more than $48,535 and up to $97,069

more than $97,069 and up to $150,473

more than $150,473 and up to $214,368

More than $214,368

20.5%

26%

29%

33%

Table 1: Canadian federal tax rates

Let T(x) represent the amount of income tax (in dollars) that a Canadian person paid in 2020 based on their

income, x (in dollars).

(a) Based on the information in the table, T(x) is a piecewise defined function of the form:

0.15x

if x < 48, 535

0.205(x – 48535)+ 7280.25 if 48, 535 < x < 97,069

T(x) =

if 97, 069 < x < 150, 473

if 150, 473 < х< 214, 368

if 214, 368 < x

Fill in the rest of the definition of T(x) as a piecewise defined function. Explain briefly how you determined

the expressions.

(b) If the CEO of company NewldeasStartup earned $162,000 in 2020, how much federal tax did they have to

рay?

(c) Use your answer to part (a) to determine whether T(x) is continuous for all x E (0, 0). Show your work.

(d) A UTM student on an internship at NewldeasStartup was supposed to earn $48,000, but after some extra

hard work, the company paid the student $49,000. Was there a large change in the tax paid? Did the student

lose money or earn more after tax, due to the additional pay?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 6 steps with 3 images

Recommended textbooks for you

Calculus: Early Transcendentals

Calculus

ISBN:

9781285741550

Author:

James Stewart

Publisher:

Cengage Learning

Thomas' Calculus (14th Edition)

Calculus

ISBN:

9780134438986

Author:

Joel R. Hass, Christopher E. Heil, Maurice D. Weir

Publisher:

PEARSON

Calculus: Early Transcendentals (3rd Edition)

Calculus

ISBN:

9780134763644

Author:

William L. Briggs, Lyle Cochran, Bernard Gillett, Eric Schulz

Publisher:

PEARSON

Calculus: Early Transcendentals

Calculus

ISBN:

9781285741550

Author:

James Stewart

Publisher:

Cengage Learning

Thomas' Calculus (14th Edition)

Calculus

ISBN:

9780134438986

Author:

Joel R. Hass, Christopher E. Heil, Maurice D. Weir

Publisher:

PEARSON

Calculus: Early Transcendentals (3rd Edition)

Calculus

ISBN:

9780134763644

Author:

William L. Briggs, Lyle Cochran, Bernard Gillett, Eric Schulz

Publisher:

PEARSON

Calculus: Early Transcendentals

Calculus

ISBN:

9781319050740

Author:

Jon Rogawski, Colin Adams, Robert Franzosa

Publisher:

W. H. Freeman

Calculus: Early Transcendental Functions

Calculus

ISBN:

9781337552516

Author:

Ron Larson, Bruce H. Edwards

Publisher:

Cengage Learning