Q: Describe Capital Asset Pricing Model. Assume Max stock has a beta of 1.2. If the risk free rate is…

A: The Capital Asset Pricing Model (CAPM) is used to forecast market movements. The approach is based…

Q: With risk free rate of 5%, Beta of 1.5, market return of 8%, prevailing credit spread of 3%, tax…

A: Risk free rate = 5% Beta = 1.50 Market return = 8% Credit spread = 3% Tax rate = 30% Equity ratio =…

Q: Capital asset pricing model (CAPM) For the asset shown in the following table, use the capital asset…

A: Using CAPM Model

Q: Security X has an expected rate of return of 13% and a beta of 1.15. The risk-free rate is 5% and…

A: Overpriced securities are those securities whose required rate of return is more than the expected…

Q: Alpha Inc.'s beta is 1.2, the risk-free rate is 10 percent, and the market risk premium is 5…

A: Given details are : Risk free rate = 10% Beta = 1.2 Market risk premium = 5% From these details we…

Q: Determine, using Capital Assets Pricing Model (CAPM), the Expected Rate of Return Risk free rate was…

A: In this question we need to calculate the expected return of Asset B from following details : Risk…

Q: The current risk-free rate of return is 4.2%. The market risk premium is 6.6%. Allen Co. has a beta…

A: In the given question we require to calculate the Allen's Cost of Equity from the following details:…

Q: Determine, using Capital Assets Pricing Model (CAPM), the Expected Rate of Return Risk free rate was…

A: We need to compute the expected rate of return for asset E in this question.

Q: With risk-free rate of 5%, Beta of 1.5, market return of 8%, prevailing credit spread of 3%, tax…

A: Risk free rate (Rf) = 5% Beta = 1.5 Market return (Rm) = 8% Credit spread = 3% Tax rate (T) = 30%…

Q: 9. Using Capital Asset Pricing Method (CAPM), compute for the cost of capital (equity) with…

A: Solution Note Dear student as per the Q&A guideline we are required to answer the first question…

Q: Capital Asset Pricing Model (CAPM) - Risk Free rate Risk free rate (Rf)* Beta (B)* Market risk…

A: Following details are given to us in the question : Beta (B) = 1.10 Market Risk Premium (Rm-Rf) = 7%…

Q: For each of the cases shown in the following table, use the capital asset pricing model to find the…

A: CAPM is Capital Asset Pricing Model which considers the risk-free rate of return, Market return and…

Q: The risk-free rate and the expected market return are 5% and 12%, respectively. According to the…

A: The model that explains the association between expected return and systematic risk is called the…

Q: The Treasury bill rate is 3.1%, and the expected return on the market portfolio is 10.2%. Use the…

A: According to CAPM model: rate of return =risk free rate+beta ×market return - risk free rate

Q: If the expected return on State Farm from the Capital Asset Pricing Model (the CAPM) is 0.20, and if…

A: Expected Return on State Farm = 0.20 Risk Free Rate = 0.05 Expected Return on market portfolio =…

Q: The current risk-free rate of return (rRf) is 4.67% while the market risk premium is 5.75%. The…

A: According to the CAPM model the cost of equity is the sum of the risk free rate plus the product of…

Q: Suppose the market risk premium is 4.0 % and the risk-free interest rate is 3.0%. Use the data below…

A: Given details are : Market risk premium = 4% Risk free rate = 3% Beta = 2.28 From above details we…

Q: Suppose the market risk premium is 4.0 % and the risk-free interest rate is 3.0%. Use the data below…

A: In this Question we need to compute the expected return of investing in General Electric company. We…

Q: Calculate the firm's expected return using the capital asset pricing model: Risk Free Rate: 3%…

A: In the given question we are required to calculate firm's expected return using capital asset…

Q: 12. With risk-free rate of 6%, Beta of 1.5, market return of 8%, prevailing credit spread of 3%, tax…

A: Risk free rate = 6℅ Market return = 8℅ Beta = 1.5

Q: Determine, using Capital Assets Pricing Model (CAPM), the Expected Rate of Return Risk free rate was…

A: In given question we need to compute the expected rate of return for asset F.

Q: Within the context of the capital asset pricing model (CAPM), assume: ∙ Expected return on the…

A: The capital asset pricing model is a financial technique that helps to determine the return required…

Q: If the annual geometric mean for the equity risk premium is 8.4 percent, what percentage of the…

A: Calculation of Percentage of Equity Risk Premium:

Q: Using CAPM, compute for the cost of capital (equity) with risk-free rate of 5%, market return of 12%…

A: The cost of equity capital can be computed by using the CAPM equation

Q: 10f

A: Calculate the expected return as follows: Expected return = Risk free rate + (beta * Market risk…

Q: What is the required rate of return for Stock X based on the capital asset pricing model (CAPM)?

A: Required Rate of Return for Stock: It is a minimum acceptable rate of return for equity investors…

Q: Determine, using Capital Assets Pricing Model (CAPM), the Expected Rate of Return Risk free rate was…

A: In given question we need to compute the expected rate of return for asset K.

Q: Determine, using Capital Assets Pricing Model (CAPM), the Expected Rate of Return Risk free rate was…

A: We need to find the expected rate of return of Asset J from following details: Risk free rate = 10%…

Q: The Capital Asset Pricing Model (CAPM) says that the risk premium on a stock is equal to its beta…

A: Capital asset pricing model is a formula that projects the relationship between systematic risk and…

Q: For each of the cases shown in the following table, use the capital asset pricing model (CAPM) to…

A: While making investment decisions, investors, be it individuals or firms will have to perform an…

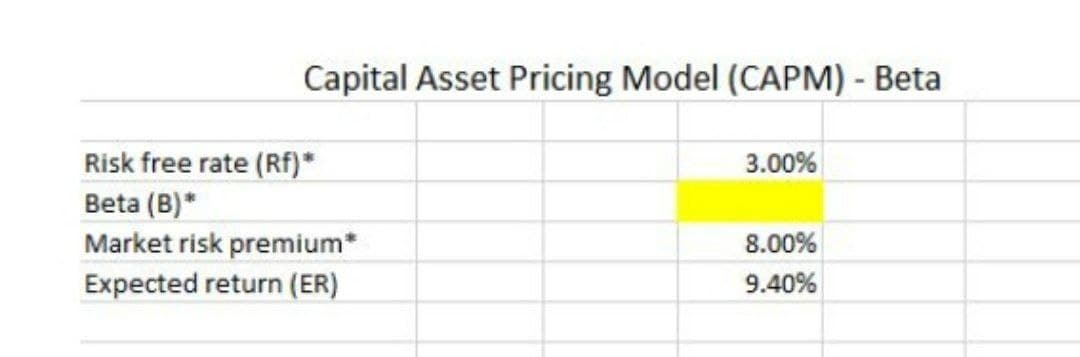

Q: Capital Asset Pricing Model (CAPM) - Based on Market Risk Premium Risk free rate (Rf)* 3.00% Beta…

A: In the given question we are require to calculate the Expected Return (ER): We can calculate the…

Q: Determine, using Capital Assets Pricing Model (CAPM), the Expected Rate of Return Risk free rate was…

A: we need to compute the expected rate of return for asset H in the given question from following…

Q: Required Return If the risk-free rate is 11.8 percent and the market risk premium is 7.6 percent,…

A: Formula: Required rate of return = Risk free rate + [Beta X Risk Premium] Note: Beta for Market is…

Q: (SINGLEJ Your opinion is that ABF has an expected rate of return of -10%. It has a beta of 1.1. The…

A: given information expected rate of return = -10 risk free rate = 1% beta = 1.1 market expected rate…

Q: Determine, using Capital Assets Pricing Model (CAPM), the Expected Rate of Return Risk free rate was…

A: In given question we need to compute the expected rate of return for asset G.

Q: (Capital asset pricing model) Grace Corporation is considering the following investments. The…

A: The Capital Asset Pricing Model is used to determine the expected return of security. As per Capital…

Q: Explain the following terms in the Capital Asset Pricing Model (CAPM): 1. Risk-Free Rate 2. Beta…

A: The Capital Asset Pricing Model (CAPM) is a mathematical model that expresses the relationship…

Q: The return on market portfolio is 12% and the risk-free is 6%. The beta coefficient is 1.3.Using the…

A: Market return (MR) = 12% Risk free rate (RF) = 6% Beta (B) = 1.3

Q: As per Capital Asset Pricing Model (CAPM) : Re=Rf+(Rm-Rf)βwhere, Re= Required rate of returnRf=…

A: 4.092% was obtained using the CAPM model. CAPM model refers to the capital asset pricing model.

Q: Suppose you are given the following inputs for the Fama-Frech-3-Factor model. Required Return for…

A: Required Return on Stock = ? Risk Free Rate = 8% Beta of Stock = 0.8 Market Risk Premium = 6%…

Q: Use the basic equation for the capital asset pricing model (CAPM) to work each of the following…

A: Hi! Thank you for the question, As per the honor code, we are allowed to answer three sub-parts at a…

Q: The beta of Phillips Equipment is 1.2. Market risk premium is 7% and the risk free rate is 3%. What…

A: Details given in the question for Phillips equipment are : Beta = 1.2 Market Risk premium = 7% Risk…

Q: Within the context of the capital asset pricing model (CAPM), assume:∙ Expected return on the market…

A: Capital asset pricing model (CAPM) represents the relationship between the risk and return of an…

Q: Consider a portfolio consisting of the below securities with the below characteristics:…

A: Portfolio refers to group of investment. Beta refers to the measure of a stock volatility in…

Q: Determine, using Capital Assets Pricing Model (CAPM), the Expected Rate of Return Risk free rate was…

A: We require to calculate expected rate of return as per CAPM in this question for Asset I.

Q: Determine, using Capital Assets Pricing Model (CAPM), the Expected Rate of Return Risk free rate was…

A: In given question we need to compute the expected rate of return for asset C.

Step by step

Solved in 2 steps

- Using Capital Asset Pricing Method (CAPM), compute for the cost of capital (equity) with risk-free rate of 4%, market return of 8% and Beta of 1.75 a. 13.00% b. 12.00% c. 11.00% d. 10.00%Within the context of the capital asset pricing model (CAPM), assume:∙ Expected return on the market = 15%∙ Risk-free rate = 8%∙ Expected rate of return on XYZ security = 17%∙ Beta of XYZ security = 1.25Which one of the following is correct?a. XYZ is overpriced.b. XYZ is fairly priced.c. XYZ’s alpha is −.25%.d. XYZ’s alpha is .25%. Please explain in detail the calculationWithin the context of the capital asset pricing model (CAPM), assume:∙ Expected return on the market = 15%∙ Risk-free rate = 8%∙ Expected rate of return on XYZ security = 17%∙ Beta of XYZ security = 1.25Which one of the following is correct?a. XYZ is overpriced.b. XYZ is fairly priced.c. XYZ’s alpha is −.25%.d. XYZ’s alpha is .25%.

- As per Capital Asset Pricing Model (CAPM) : Re=Rf+(Rm-Rf)βwhere, Re= Required rate of returnRf= Risk free rate of return = 0%Rm = Market return or Expected return on market = 3.3%β = Beta of the stock = 1.24Now, Re= Rf + Rm - Rf βRe= 0 + 3.3 - 0 ×1.24Re= 4.092% To calculate the abnormal return we will use the formula: = E(R) - Re= 3% - 4.092% = -1.092% or - 0.01092 How did you get the 4.092%?The current risk-free rate of return (rRf) is 4.67% while the market risk premium is 5.75%. The Burris Company has a beta of 0.92. Using the capital asset pricing model (CAPM) approach, Burris’s cost of equity is? A 9.96 B) 8.964 C) 11.952 D) 10.458Suppose you are given the following inputs for the Fama-Frech-3-Factor model. Required Return for Stock i: bi=0.8, kRF=8%, the market risk premium is 6%, ci=-0.6, the expected value for the size factor is 5%, di=-0.4, and the expected value for the book-to-market factor is 4%. Task: Estimate the required rate of return of this asset using the Capital asset pricing model and compare it with the Fama-French-3-factor model.

- For each of the cases shown in the following table, use the capital asset pricing model to find the required return. case risk free rate market return beta A 5% 8% 1.30 B 8% 13% 0.90 C 9% 12% -0.20 D 10% 15% 1.00 E 6% 10% 0.60 (solve using excel)The Treasury bill rate is 6% and the market risk premium is 7%. Which of the capital investments shown above have positive (non-zero) NPV's? Project Beta Internal Rate of Return, % P 1.00 14 Q 0.00 10 R 2.00 20 S 0.40 11 T 1.70 22(Capital Asset Pricing Model) The expected return for the general market is 10.5 percent, and the risk premium in the market is 6.8 percent. Tasaco, LBM, and Exxos have betas of 0.809, 0.677, and 0.578, respectively. What are the appropriate expected rates of return for the three securities? Question content area bottom Part 1 The appropriate expected return of Tasaco is enter your response here%. (Round to two decimal places.) Part 2 The appropriate expected return of LBM is enter your response here%. (Round to two decimal places.) Part 3 The appropriate expected return of Exxos is enter your response here%. (Round to two decimal places.)

- Assume for parts (a) to (h) that the Capital Asset Pricing Model holds. The marketportfolio has an expected return of 5%. Stock A’s return has a market beta of 1.5, anexpected value of 7% and a standard deviation of 10%. Stock B’s return has amarket beta of 0.5 and a standard deviation of 20%. The correlation between stockA’s and stock B’s return is 0.5.Required:a) Explain the term ‘capital asset pricing model.’b) What is the risk-free rate?c) What is the expected return on stock B?d) Draw a graph with expected return on the y-axis and beta on the x-axis. Indicate the approximate position of the risk-free asset, the market portfolio and stocks A and B on this graph. Draw the line, which connects these four points.e) Explain the term ‘Securities Market Line’, and what is the slope of the SML for this economy?f) Consider a portfolio with a weight of 50% in stock A and 50% in stock B. What are its variance and expected return?g) Where would under-priced and over-priced securities plot on…Suppose that the capital asset pricing model (CAPM) applies. The risk premium of a stock is 3 percent and the risk premium of the market portfolio is 2. The standard deviation of the market portfo- lio is 6. Compute the covariance between the stock and the market portfolio.CAPM: The Treasury bill rate is 5%, and the expected return on the market portfolio is 12%. On the basis of Capital Asset Pricing Model: Draw a graph (Security Market Line) showing how the return varies with beta. Label the graph.