Capital Budgeting (NPV) Year Cash Flows -5,969 1,516 1,656 1,738 2,094 Currently, the investor's required rate of return 4.7% Please compute the project's NPV (hint: it is positive). What if interest rates in the broad economy went up. and also the firm became riskier? Investors would require a higher rate of return. 1. Suppose the required rate increases 2%. How much would the NPV drop? A Between 200 and 270 B Between 270 and 280 C Between 280 and 290 D Between 290 and 300 -234

Capital Budgeting (NPV) Year Cash Flows -5,969 1,516 1,656 1,738 2,094 Currently, the investor's required rate of return 4.7% Please compute the project's NPV (hint: it is positive). What if interest rates in the broad economy went up. and also the firm became riskier? Investors would require a higher rate of return. 1. Suppose the required rate increases 2%. How much would the NPV drop? A Between 200 and 270 B Between 270 and 280 C Between 280 and 290 D Between 290 and 300 -234

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter13: Capital Budgeting: Estimating Cash Flows And Analyzing Risk

Section: Chapter Questions

Problem 11P: Scenario Analysis Shao Industries is considering a proposed project for its capital budget. The...

Related questions

Question

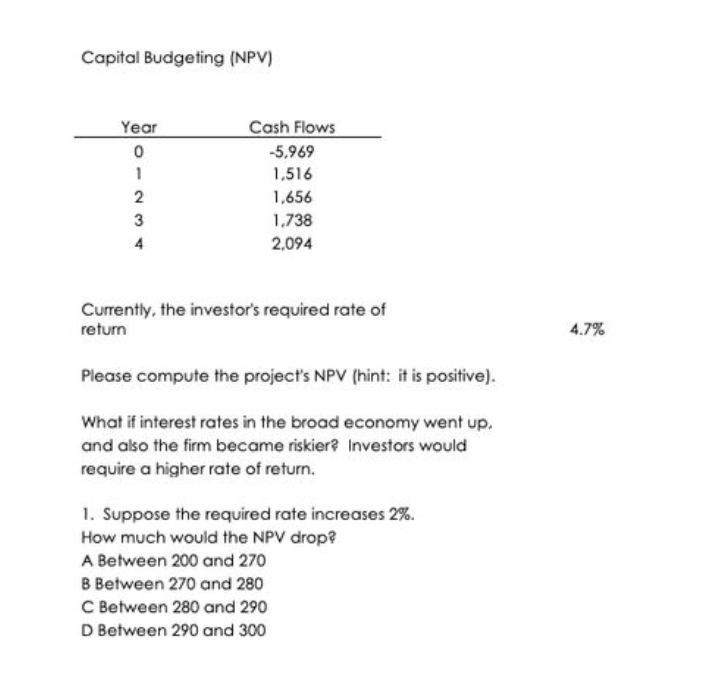

Transcribed Image Text:Capital Budgeting (NPV)

Year

Cash Flows

-5,969

1,516

1,656

1,738

2,094

Currently, the investor's required rate of

return

4.7%

Please compute the project's NPV (hint: it is positive).

What if interest rates in the broad economy went up.

and also the firm became riskier? Investors would

require a higher rate of return.

1. Suppose the required rate increases 2%.

How much would the NPV drop?

A Between 200 and 270

B Between 270 and 280

C Between 280 and 290

D Between 290 and 300

-234

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning