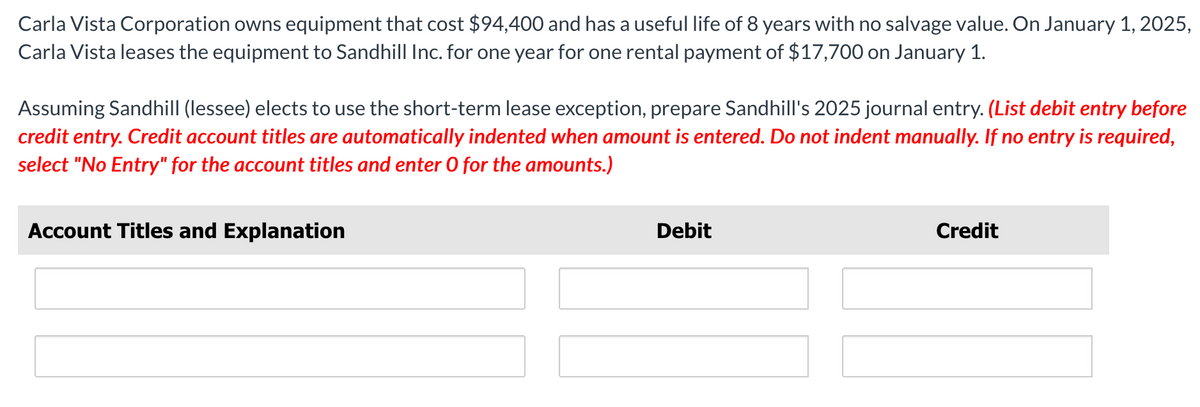

Carla Vista Corporation owns equipment that cost $94,400 and has a useful life of 8 years with no salvage value. On January 1, 2025, Carla Vista leases the equipment to Sandhill Inc. for one year for one rental payment of $17,700 on January 1. Assuming Sandhill (lessee) elects to use the short-term lease exception, prepare Sandhill's 2025 journal entry. (List debit entry before credit entry. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Account Titles and Explanation Debit Credit

Carla Vista Corporation owns equipment that cost $94,400 and has a useful life of 8 years with no salvage value. On January 1, 2025, Carla Vista leases the equipment to Sandhill Inc. for one year for one rental payment of $17,700 on January 1. Assuming Sandhill (lessee) elects to use the short-term lease exception, prepare Sandhill's 2025 journal entry. (List debit entry before credit entry. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Account Titles and Explanation Debit Credit

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter20: Accounting For Leases

Section: Chapter Questions

Problem 13E: Lessee and Lessor Accounting Issues Diego Leasing Company agrees to provide La Jolla Company with...

Related questions

Question

Transcribed Image Text:Carla Vista Corporation owns equipment that cost $94,400 and has a useful life of 8 years with no salvage value. On January 1, 2025,

Carla Vista leases the equipment to Sandhill Inc. for one year for one rental payment of $17,700 on January 1.

Assuming Sandhill (lessee) elects to use the short-term lease exception, prepare Sandhill's 2025 journal entry. (List debit entry before

credit entry. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required,

select "No Entry" for the account titles and enter O for the amounts.)

Account Titles and Explanation

Debit

Credit

AI-Generated Solution

Unlock instant AI solutions

Tap the button

to generate a solution

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning