CARMAX has several branches island wide. The company imports and sells motor vehicle parts and accessories to retail customers. With the increase in staff complement, the company has decided to implement a computerised wages system. All employees are required to work eight hours daily. The employees' hours are recorded using the magnetic card which is attached to their identification card. When each employee arrives for work, they hold their card close to the card reader. This must be done, as encoded in the reader is the employee's TRN and NIS number, which is linked to the payroll system. The reader recognizes the magnetic information on the card, identifying the employee as being 'at work!. When the employee leaves work at the end of the day, the employee must log out by ensuring their ID is swiped, as the process is reversed showing that the employee has left work. The information that is used to calculate the employees' weekly salary is obtained directly from the magnetic card information. Overtime is calculated as any excess over the standard hours worked. Any overtime over 15% of standard hours is sent on a computer generated report by email to the Chief Accountant. If necessary, the Payroll Manger overrides overtime payments if the hours worked are incorrect. Statutory deductions and net pay are also computer calculated, with payments being lodged directly into the employee's bank account. The only other manual check, is the Chief Accountant authorising the funding of the salaries bank account form CARMAX main account, having reviewed the list of wages to be paid. Required In the audit of CARMAX wages system, explain how using test data should help the auditors to audit the A wages system, noting any problems with this audit technique

CARMAX has several branches island wide. The company imports and sells motor vehicle parts and accessories to retail customers. With the increase in staff complement, the company has decided to implement a computerised wages system. All employees are required to work eight hours daily. The employees' hours are recorded using the magnetic card which is attached to their identification card. When each employee arrives for work, they hold their card close to the card reader. This must be done, as encoded in the reader is the employee's TRN and NIS number, which is linked to the payroll system. The reader recognizes the magnetic information on the card, identifying the employee as being 'at work!. When the employee leaves work at the end of the day, the employee must log out by ensuring their ID is swiped, as the process is reversed showing that the employee has left work. The information that is used to calculate the employees' weekly salary is obtained directly from the magnetic card information. Overtime is calculated as any excess over the standard hours worked. Any overtime over 15% of standard hours is sent on a computer generated report by email to the Chief Accountant. If necessary, the Payroll Manger overrides overtime payments if the hours worked are incorrect. Statutory deductions and net pay are also computer calculated, with payments being lodged directly into the employee's bank account. The only other manual check, is the Chief Accountant authorising the funding of the salaries bank account form CARMAX main account, having reviewed the list of wages to be paid. Required In the audit of CARMAX wages system, explain how using test data should help the auditors to audit the A wages system, noting any problems with this audit technique

Chapter10: Short-term Decision Making

Section: Chapter Questions

Problem 2TP: You are a management accountant for Time Treasures Company, whose company has recently signed an...

Related questions

Question

100%

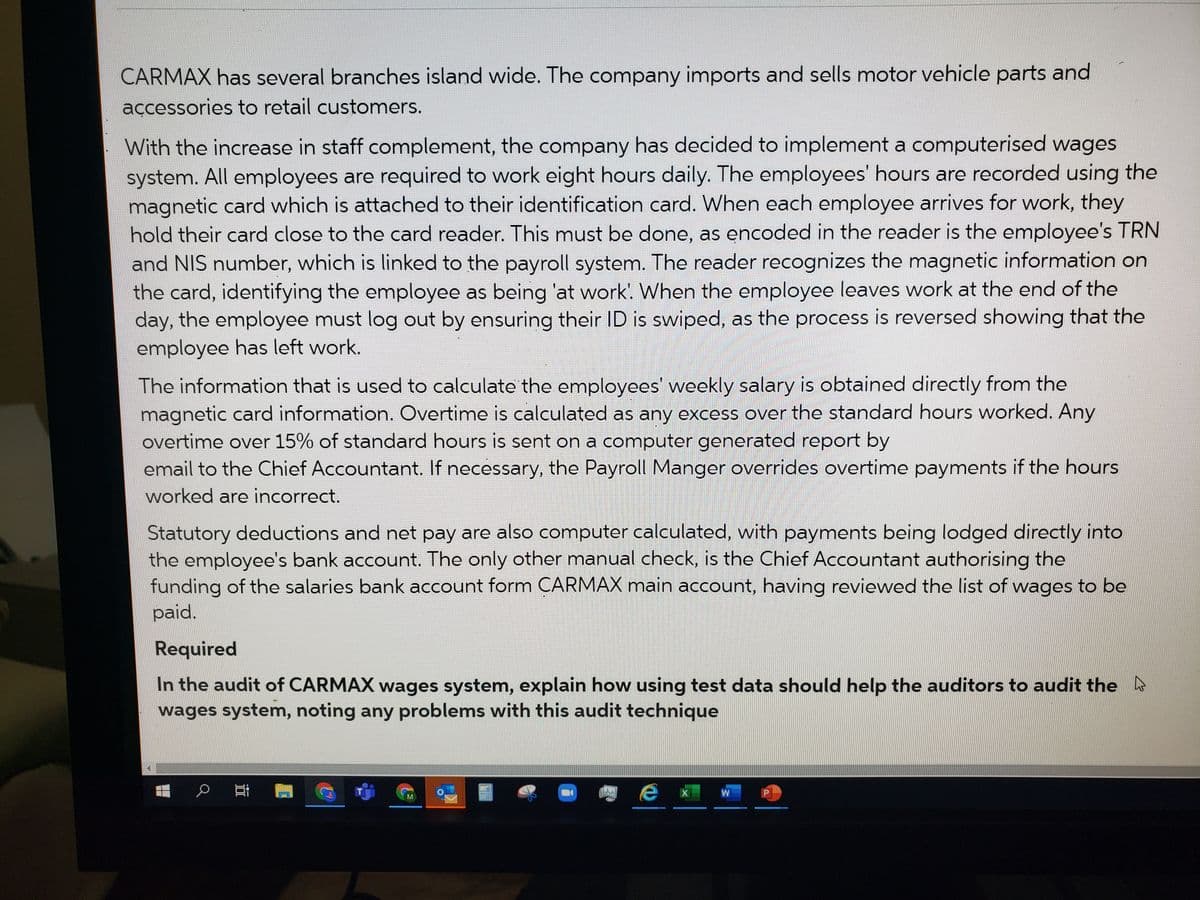

Transcribed Image Text:CARMAX has several branches island wide. The company imports and sells motor vehicle parts and

accessories to retail customers.

With the increase in staff complement, the company has decided to implement a computerised wages

system. All employees are required to work eight hours daily. The employees' hours are recorded using the

magnetic card which is attached to their identification card. When each employee arrives for work, they

hold their card close to the card reader. This must be done, as encoded in the reader is the employee's TRN

and NIS number, which is linked to the payroll system. The reader recognizes the magnetic information on

the card, identifying the employee as being 'at work'. When the employee leaves work at the end of the

day, the employee must log out by ensuring their ID is swiped, as the process is reversed showing that the

employee has left work.

The information that is used to calculate the employees' weekly salary is obtained directly from the

magnetic card information. Overtime is calculated as any excess over the standard hours worked. Any

overtime over 15% of standard hours is sent on a computer generated report by

email to the Chief Accountant. If necessary, the Payroll Manger overrides overtime payments if the hours

worked are incorrect.

Statutory deductions and net pay are also computer calculated, with payments being lodged directly into

the employee's bank account. The only other manual check, is the Chief Accountant authorising the

funding of the salaries bank account form CARMAX main account, having reviewed the list of wages to be

paid.

Required

In the audit of CARMAX wages system, explain how using test data should help the auditors to audit the A

wages system, noting any problems with this audit technique

W

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning