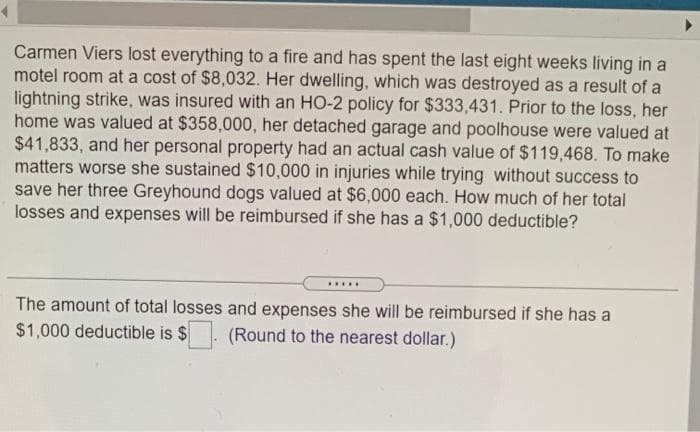

Carmen Viers lost everything to a fire and has spent the last eight weeks living in a motel room at a cost of $8,032. Her dwelling, which was destroyed as a result of a lightning strike, was insured with an HO-2 policy for $333,431. Prior to the loss, her home was valued at $358,000, her detached garage and poolhouse were valued at $41,833, and her personal property had an actual cash value of $119,468. To make matters worse she sustained $10,000 in injuries while trying without success to save her three Greyhound dogs valued at $6,000 each. How much of her total losses and expenses will be reimbursed if she has a $1,000 deductible? ..... The amount of total losses and expenses she will be reimbursed if she has a $1,000 deductible is $ (Round to the nearest dollar.)

Carmen Viers lost everything to a fire and has spent the last eight weeks living in a motel room at a cost of $8,032. Her dwelling, which was destroyed as a result of a lightning strike, was insured with an HO-2 policy for $333,431. Prior to the loss, her home was valued at $358,000, her detached garage and poolhouse were valued at $41,833, and her personal property had an actual cash value of $119,468. To make matters worse she sustained $10,000 in injuries while trying without success to save her three Greyhound dogs valued at $6,000 each. How much of her total losses and expenses will be reimbursed if she has a $1,000 deductible? ..... The amount of total losses and expenses she will be reimbursed if she has a $1,000 deductible is $ (Round to the nearest dollar.)

Chapter7: Losses—deductions And Limitations

Section: Chapter Questions

Problem 66P

Related questions

Question

3

Transcribed Image Text:Carmen Viers lost everything to a fire and has spent the last eight weeks living in a

motel room at a cost of $8,032. Her dwelling, which was destroyed as a result of a

lightning strike, was insured with an HO-2 policy for $333,431. Prior to the loss, her

home was valued at $358,000, her detached garage and poolhouse were valued at

$41,833, and her personal property had an actual cash value of $119,468. To make

matters worse she sustained $10,000 in injuries while trying without success to

save her three Greyhound dogs valued at $6,000 each. How much of her total

losses and expenses will be reimbursed if she has a $1,000 deductible?

.....

The amount of total losses and expenses she will be reimbursed if she has a

$1,000 deductible is $

(Round to the nearest dollar.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT