Carolina Enterprise operates three product segments: sinks, bathtubs, and toilet bowls. Below are the figures showing how each product segment performed in 2022. If Carolina drops any segment, it can avoid 40% of the fixed costs allocated to the dropped segment. In 2023, should the sink segment be dropped in order to improve Carolina’s financial performance? A. No, because dropping the sink segment will cause Carolina's total net operating income to decrease by P150,000. B. Yes, because dropping the sink segment will cause Carolina's total net operating income to increase by P150,000. C. Yes, because dropping the sink segment will cause Carolina's total net operating income to increase by P130,000. D. No, because dropping the sink segment will cause Carolina's total net operating income to decrease by P130,000.

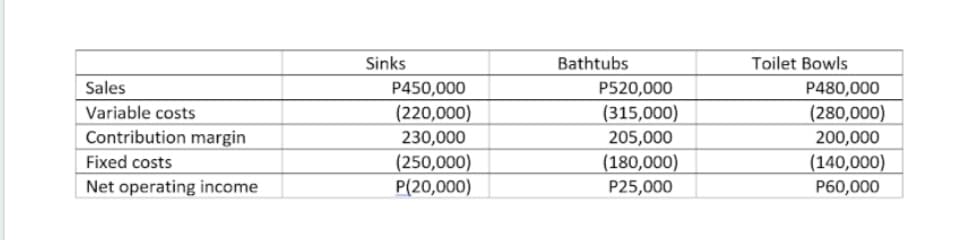

Carolina Enterprise operates three product segments: sinks, bathtubs, and toilet bowls. Below are the figures showing how each product segment performed in 2022.

If Carolina drops any segment, it can avoid 40% of the fixed costs allocated to the dropped segment. In 2023, should the sink segment be dropped in order to improve Carolina’s financial performance?

A. No, because dropping the sink segment will cause Carolina's total net operating income to decrease by P150,000.

B. Yes, because dropping the sink segment will cause Carolina's total net operating income to increase by P150,000.

C. Yes, because dropping the sink segment will cause Carolina's total net operating income to increase by P130,000.

D. No, because dropping the sink segment will cause Carolina's total net operating income to decrease by P130,000.

Step by step

Solved in 2 steps with 1 images