Carrylng Amounts Falr Values Sand Dollar $180,000 170,000 90,000 120,000 (30,000) $190,000 150,000 100,000 Tangible assets Trademark Customer list Goodwill Liabilities Salty Dog Tangible assets Unpatented technology Licenses (30,000) $200,000 170,000 $200,000 125,000 100,000 ? 90,000 150,000 Goodwill Baytowne Tangible assets Unpatented technology Copyrights $140,000 $150,000 --0- 100,000 80,000 50,000 Goodwill 90,000

Destin Company recently acquired several businesses and recognized

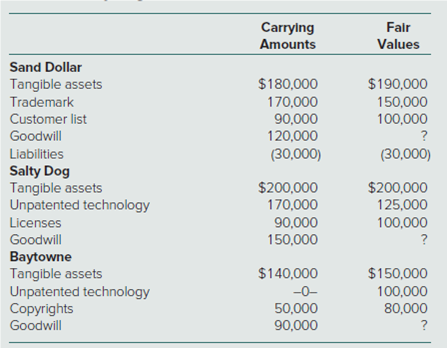

In its current year assessment of goodwill, Destin provides the following individual asset and liability values for each reporting unit:

The fair values for each reporting unit (including goodwill) are $510,000 for Sand Dollar, $580,000 for Salty Dog, and $560,000 for Baytowne. To date, Destin has reported no goodwill impairments.

a. How much goodwill impairment should Destin report this year?

b. What changes to the valuations of Destin’s tangible assets and identified intangible assets should be reported based on the goodwill impairment tests?

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images