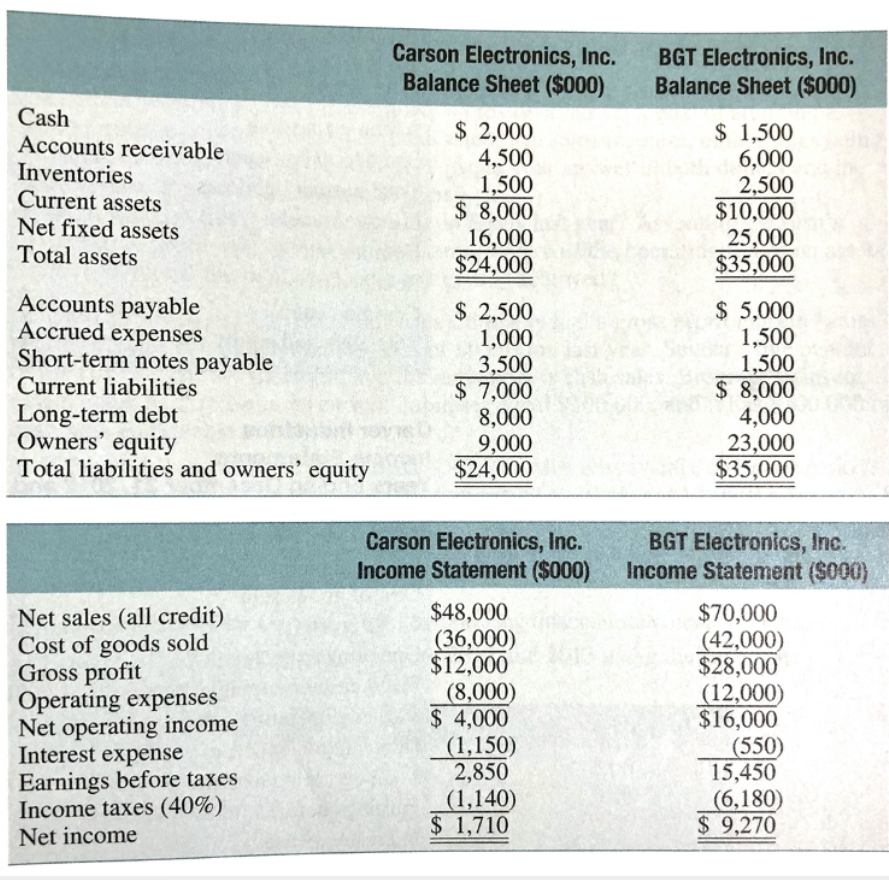

Carson Electronics’ management has long viewed BGT Electronics as an industry leader and uses this firm as a model firm for analyzing its own performance. The balance sheet and income statements for the two firms are as follows: Calculate the following ratios for both Carson and BGT: a)Total asset turnover: b) Operating profit margin: c) Operating return on assets

Carson Electronics’ management has long viewed BGT Electronics as an industry leader and uses this firm as a model firm for analyzing its own performance. The balance sheet and income statements for the two firms are as follows: Calculate the following ratios for both Carson and BGT: a)Total asset turnover: b) Operating profit margin: c) Operating return on assets

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter11: The Statement Of Cash Flows

Section: Chapter Questions

Problem 13MCQ

Related questions

Question

Carson Electronics’ management has long viewed BGT Electronics as an industry leader and uses this firm as a model firm for analyzing its own performance. The balance sheet and income statements for the two firms are as follows:

Calculate the following ratios for both Carson and BGT:

a)Total asset turnover:

b) Operating profit margin:

c) Operating

Transcribed Image Text:Carson Electronics, Inc.

Balance Sheet ($000)

BGT Electronics, Inc.

Balance Sheet ($000)

Cash

Accounts receivable

Inventories

Current assets

Net fixed assets

Total assets

$ 2,000

4,500

1,500

$ 8,000

16,000

$24,000

$ 1,500

6,000

2,500

$10,000

25,000

$35,000

Accounts payable

Accrued expenses

Short-term notes payable

Current liabilities

$ 2,500

1,000

3,500

$ 7,000

8,000

9,000

$24,000

$ 5,000

1,500

1,500

$ 8,000

4,000

23,000

$35,000

Long-term debt

Owners' equity

Total liabilities and owners' equity

Carson Electronics, Inc.

Income Statement ($000)

BGT Electronics, Inc.

Income Statement ($000)

Net sales (all credit)

Cost of goods sold

Gross profit

Operating expenses

Net operating income

Interest expense

Earnings before taxes

Income taxes (40%)

$48,000

(36,000)

$12,000

(8,000)

$ 4,000

(1,150)

2,850

(1,140)

$ 1,710

$70,000

(42,000)

$28,000

(12,000)

$16,000

(550)

15,450

(6,180)

$ 9,270

Net income

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub