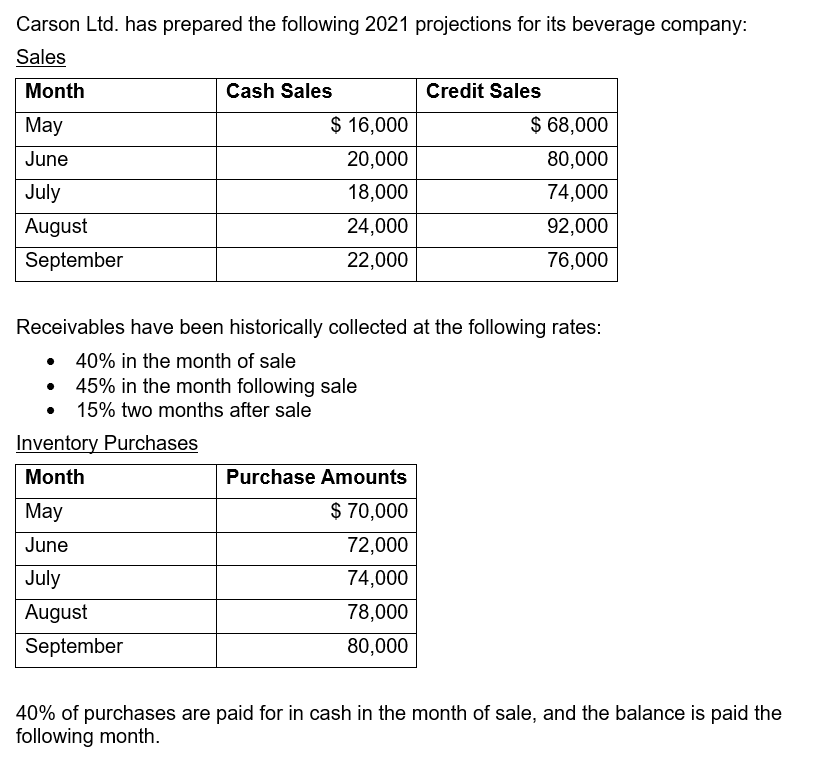

Carson Ltd. has prepared the following 2021 projections for its beverage company: Sales Month Cash Sales Credit Sales $ 16,000 20,000 May $ 68,000 June 80,000 July 18,000 74,000 August 24,000 92,000 September 22,000 76,000 Receivables have been historically collected at the following rates: • 40% in the month of sale 45% in the month following sale 15% two months after sale Inventory Purchases Month Purchase Amounts May $ 70,000 June 72,000 July 74,000 August 78,000 September 80,000 40% of purchases are paid for in cash in the month of sale, and the balance is paid the following month.

Carson Ltd. has prepared the following 2021 projections for its beverage company: Sales Month Cash Sales Credit Sales $ 16,000 20,000 May $ 68,000 June 80,000 July 18,000 74,000 August 24,000 92,000 September 22,000 76,000 Receivables have been historically collected at the following rates: • 40% in the month of sale 45% in the month following sale 15% two months after sale Inventory Purchases Month Purchase Amounts May $ 70,000 June 72,000 July 74,000 August 78,000 September 80,000 40% of purchases are paid for in cash in the month of sale, and the balance is paid the following month.

Chapter15: Managing Short-term Assets

Section: Chapter Questions

Problem 1PROB

Related questions

Question

100%

Transcribed Image Text:Carson Ltd. has prepared the following 2021 projections for its beverage company:

Sales

Month

Cash Sales

Credit Sales

Мay

$ 16,000

$ 68,000

June

20,000

80,000

July

18,000

74,000

August

24,000

92,000

September

22,000

76,000

Receivables have been historically collected at the following rates:

• 40% in the month of sale

45% in the month following sale

15% two months after sale

Inventory Purchases

Month

Purchase Amounts

May

$ 70,000

June

72,000

July

74,000

August

78,000

September

80,000

40% of purchases are paid for in cash in the month of sale, and the balance is paid the

following month.

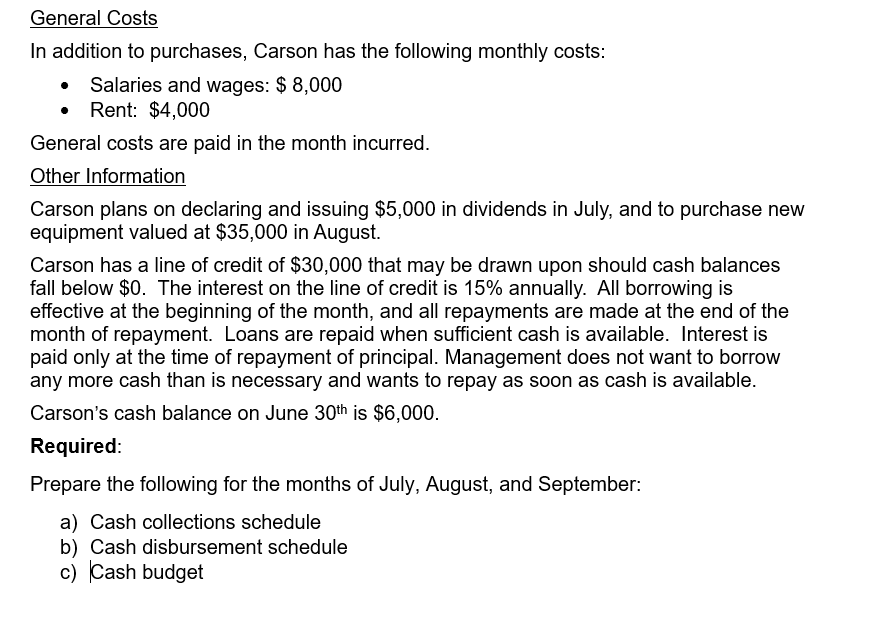

Transcribed Image Text:General Costs

In addition to purchases, Carson has the following monthly costs:

Salaries and wages: $ 8,000

• Rent: $4,000

General costs are paid in the month incurred.

Other Information

Carson plans on declaring and issuing $5,000 in dividends in July, and to purchase new

equipment valued at $35,000 in August.

Carson has a line of credit of $30,000 that may be drawn upon should cash balances

fall below $0. The interest on the line of credit is 15% annually. All borrowing is

effective at the beginning of the month, and all repayments are made at the end of the

month of repayment. Loans are repaid when sufficient cash is available. Interest is

paid only at the time of repayment of principal. Management does not want to borrow

any more cash than is necessary and wants to repay as soon as cash is available.

Carson's cash balance on June 30th is $6,000.

Required:

Prepare the following for the months of July, August, and September:

a) Cash collections schedule

b) Cash disbursement schedule

c) Cash budget

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning