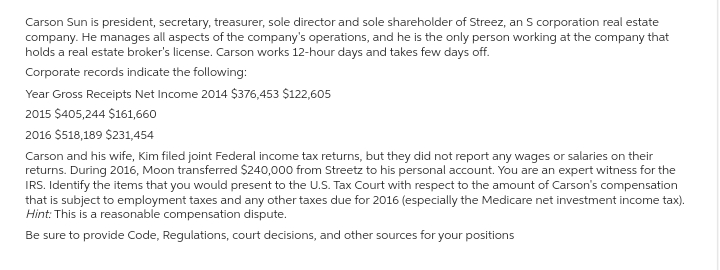

Carson Sun is president, secretary, treasurer, sole director and sole shareholder of Streez, an S corporation real estate company. He manages all aspects of the company's operations, and he is the only person working at the company that holds a real estate broker's license. Carson works 12-hour days and takes few days off. Corporate records indicate the following: Year Gross Receipts Net Income 2014 $376,453 $122,605 2015 $405,244 $161,660 2016 $518,189 $231,454 Carson and his wife, Kim filed joint Federal income tax returns, but they did not report any wages or salaries on their returns. During 2016, Moon transferred $240,000 from Streetz to his personal account. You are an expert witness for the IRS. Identify the items that you would present to the U.S. Tax Court with respect to the amount of Carson's compensation that is subject to employment taxes and any other taxes due for 2016 (especially the Medicare net investment income tax). Hint: This is a reasonable compensation dispute. Be sure to provide Code, Regulations, court decisions, and other sources for your positions

Carson Sun is president, secretary, treasurer, sole director and sole shareholder of Streez, an S corporation real estate company. He manages all aspects of the company's operations, and he is the only person working at the company that holds a real estate broker's license. Carson works 12-hour days and takes few days off. Corporate records indicate the following: Year Gross Receipts Net Income 2014 $376,453 $122,605 2015 $405,244 $161,660 2016 $518,189 $231,454 Carson and his wife, Kim filed joint Federal income tax returns, but they did not report any wages or salaries on their returns. During 2016, Moon transferred $240,000 from Streetz to his personal account. You are an expert witness for the IRS. Identify the items that you would present to the U.S. Tax Court with respect to the amount of Carson's compensation that is subject to employment taxes and any other taxes due for 2016 (especially the Medicare net investment income tax). Hint: This is a reasonable compensation dispute. Be sure to provide Code, Regulations, court decisions, and other sources for your positions

Related questions

Question

am.121.

Transcribed Image Text:Carson Sun is president, secretary, treasurer, sole director and sole shareholder of Streez, an S corporation real estate

company. He manages all aspects of the company's operations, and he is the only person working at the company that

holds a real estate broker's license. Carson works 12-hour days and takes few days off.

Corporate records indicate the following:

Year Gross Receipts Net Income 2014 $376,453 $122,605

2015 $405,244 $161,660

2016 $518,189 $231,454

Carson and his wife, Kim filed joint Federal income tax returns, but they did not report any wages or salaries on their

returns. During 2016, Moon transferred $240,000 from Streetz to his personal account. You are an expert witness for the

IRS. Identify the items that you would present to the U.S. Tax Court with respect to the amount of Carson's compensation

that is subject to employment taxes and any other taxes due for 2016 (especially the Medicare net investment income tax).

Hint: This is a reasonable compensation dispute.

Be sure to provide Code, Regulations, court decisions, and other sources for your positions

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps