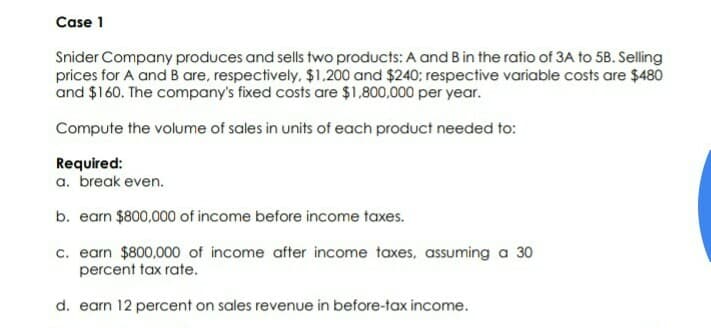

Case 1 Snider Company produces and sells two products: A and B in the ratio of 3A to 5B. Selling prices for A and B are, respectively, $1,200 and $240; respective variable costs are $480 and $160. The company's fixed costs are $1.800,000 per year. Compute the volume of sales in units of each product needed to: Required: a. break even. b. earn $800,000 of income before income taxes. c. earn $800,000 of income after income taxes, assuming a 30 percent tax rate. d. earn 12 percent on sales revenue in before-tax income.

Case 1 Snider Company produces and sells two products: A and B in the ratio of 3A to 5B. Selling prices for A and B are, respectively, $1,200 and $240; respective variable costs are $480 and $160. The company's fixed costs are $1.800,000 per year. Compute the volume of sales in units of each product needed to: Required: a. break even. b. earn $800,000 of income before income taxes. c. earn $800,000 of income after income taxes, assuming a 30 percent tax rate. d. earn 12 percent on sales revenue in before-tax income.

Chapter3: Cost-volume-profit Analysis

Section: Chapter Questions

Problem 8MC: A company has wants to earn an income of $60,000 after-taxes. If the tax rate is 32%, what must be...

Related questions

Question

100%

Hi, I only need the answer in letter E, thankyou in advance. The both picture are connected question pls bare with pic :)

Transcribed Image Text:Case 1

Snider Company produces and sells two products: A and Bin the ratio of 3A to 5B. Selling

prices for A and B are, respectively, $1,200 and $240; respective variable costs are $480

and $160. The company's fixed costs are $1,800,000 per year.

Compute the volume of sales in units of each product needed to:

Required:

a. break even.

b. earn $800,000 of income before income taxes.

c. earn $800,000 of income after income taxes, assuming a 30

percent tax rate.

d. earn 12 percent on sales revenue in before-tax income.

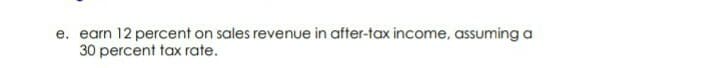

Transcribed Image Text:e. earn 12 percent on sales revenue in after-tax income, assuming a

30 percent tax rate.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College