Case Study #2 - Forecasting Ahmed is the Sales Manager at a large corporation that manufactures engines for recreational vehicles (four-wheelers and utility vehicles such as those sold under the brand name GatorTM). The company has been in business making engines for over 15 years but has only sold these small engines for the past eight years. After much growth in the industry, the company is questioning whether sales can be sustained at these levels. Recessions tend to impact discretionary spending as the company observed a few years ago. Executives are considering building a new facility, expanding existing facilities, or maintaining the status quo. Of course, they are also concerned that another recession might severely impact sales. To address these strategic questions, Ahmed must prepare a sales forecast and report his best prediction to upper management and the board. Fortunately, there is a significant amount of historical data available. However, Ahmed must choose the most appropriate forecast and make a sales recommendation to the executive committee. He will also need to rely upon his intuition and experience as a sales manager to ensure the conclusions he makes are logical and rational. Year Actual Sales 1 $3,400,000 2 $3,820,000 3 $3,644,000 4 $3,212,000 5 $3,622,000 6 $4,484,000 7 $4,674,000 8 $5,060,000 ??? Next Year Requirements Ahmed will want to compare several forecasts. ● Two-year historical moving average ● Four-year historical moving average ● Exponential smoothing In the case of exponential smoothing, he must choose the best coefficient and will compare: ● α = 0.2, ● α = 0.5, and ● α = 0.8.

Case Study #2 - Forecasting Ahmed is the Sales Manager at a large corporation that manufactures engines for recreational vehicles (four-wheelers and utility vehicles such as those sold under the brand name GatorTM). The company has been in business making engines for over 15 years but has only sold these small engines for the past eight years. After much growth in the industry, the company is questioning whether sales can be sustained at these levels. Recessions tend to impact discretionary spending as the company observed a few years ago. Executives are considering building a new facility, expanding existing facilities, or maintaining the status quo. Of course, they are also concerned that another recession might severely impact sales. To address these strategic questions, Ahmed must prepare a sales forecast and report his best prediction to upper management and the board. Fortunately, there is a significant amount of historical data available. However, Ahmed must choose the most appropriate forecast and make a sales recommendation to the executive committee. He will also need to rely upon his intuition and experience as a sales manager to ensure the conclusions he makes are logical and rational. Year Actual Sales 1 $3,400,000 2 $3,820,000 3 $3,644,000 4 $3,212,000 5 $3,622,000 6 $4,484,000 7 $4,674,000 8 $5,060,000 ??? Next Year Requirements Ahmed will want to compare several forecasts. ● Two-year historical moving average ● Four-year historical moving average ● Exponential smoothing In the case of exponential smoothing, he must choose the best coefficient and will compare: ● α = 0.2, ● α = 0.5, and ● α = 0.8.

Linear Algebra: A Modern Introduction

4th Edition

ISBN:9781285463247

Author:David Poole

Publisher:David Poole

Chapter4: Eigenvalues And Eigenvectors

Section4.6: Applications And The Perron-frobenius Theorem

Problem 22EQ

Related questions

Question

Transcribed Image Text:Case Study Questions

1. Compute the next year's sales based on each of the five different forecasts.

2. Determine the accuracy of each forecast using MAD (mean absolute deviation).

3. What is the sales forecast that Ahmed should present to the executive board for next year?

(Justify your recommendation with appropriate tables, graphs, calculations, etc.)

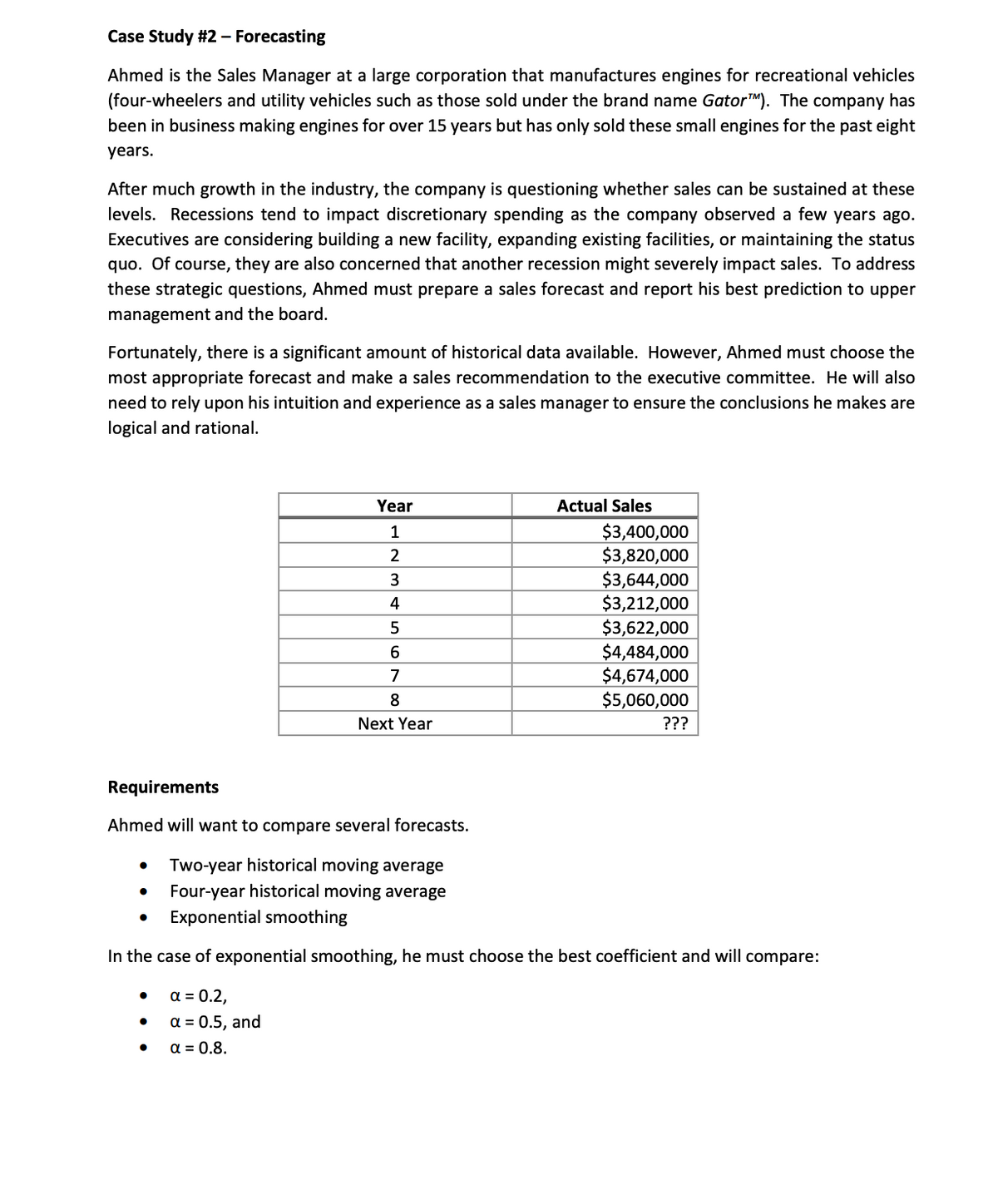

Transcribed Image Text:Case Study #2 - Forecasting

Ahmed is the Sales Manager at a large corporation that manufactures engines for recreational vehicles

(four-wheelers and utility vehicles such as those sold under the brand name Gator™M). The company has

been in business making engines for over 15 years but has only sold these small engines for the past eight

years.

After much growth in the industry, the company is questioning whether sales can be sustained at these

levels. Recessions tend to impact discretionary spending as the company observed a few years ago.

Executives are considering building a new facility, expanding existing facilities, or maintaining the status

quo. Of course, they are also concerned that another recession might severely impact sales. To address

these strategic questions, Ahmed must prepare a sales forecast and report his best prediction to upper

management and the board.

Fortunately, there is a significant amount of historical data available. However, Ahmed must choose the

most appropriate forecast and make a sales recommendation to the executive committee. He will also

need to rely upon his intuition and experience as a sales manager to ensure the conclusions he makes are

logical and rational.

Year

Actual Sales

1

$3,400,000

2

$3,820,000

3

$3,644,000

4

$3,212,000

5

$3,622,000

6

$4,484,000

7

$4,674,000

8

$5,060,000

Next Year

???

Requirements

Ahmed will want to compare several forecasts.

Two-year historical moving average

Four-year historical moving average

Exponential smoothing

In the case of exponential smoothing, he must choose the best coefficient and will compare:

α = 0.2,

a = 0.5, and

α = 0.8.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 6 steps

Recommended textbooks for you

Linear Algebra: A Modern Introduction

Algebra

ISBN:

9781285463247

Author:

David Poole

Publisher:

Cengage Learning

Linear Algebra: A Modern Introduction

Algebra

ISBN:

9781285463247

Author:

David Poole

Publisher:

Cengage Learning