Cash Payback Period, Net Present Value Analysis, and Qualitative Considerations The plant manager of Shenzhen Electronics Company is considering the purchase of new automated assembly equipment. The new equipment will cost $102,000. manager believes that the new investment will result in direct labor savings of $34,000 per year for 10 years. Present Value of an Annuity of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 1.833 1.736 1.690 1.626 1.528 2.673 2.487 2.402 2.283 2.106 3.465 3.170 3.037 2.855 2.589 4.212 3.791 3.605 3.353 2.991 6. 4.917 4.355 4.111 3.785 3.326 7. 5.582 4.868 4.564 4.160 3.605 8 6.210 5.335 4.968 4.487 3.837 9. 6.802 5.759 5.328 4.772 4.031 10 7.360 6.145 5.650 5.019 4.192 a. What is the payback period on this project? years b. What is the net present value, assuming a 12% rate of return? Use the table provided above. Round to the nearest whole dollar. Net present value c. What else should the manager consider in the analysis? Previous Check My Work 3 more Check My Work uses remaining. Save and Exit Submit Assignment f Email Instructor

Cash Payback Period, Net Present Value Analysis, and Qualitative Considerations The plant manager of Shenzhen Electronics Company is considering the purchase of new automated assembly equipment. The new equipment will cost $102,000. manager believes that the new investment will result in direct labor savings of $34,000 per year for 10 years. Present Value of an Annuity of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 1.833 1.736 1.690 1.626 1.528 2.673 2.487 2.402 2.283 2.106 3.465 3.170 3.037 2.855 2.589 4.212 3.791 3.605 3.353 2.991 6. 4.917 4.355 4.111 3.785 3.326 7. 5.582 4.868 4.564 4.160 3.605 8 6.210 5.335 4.968 4.487 3.837 9. 6.802 5.759 5.328 4.772 4.031 10 7.360 6.145 5.650 5.019 4.192 a. What is the payback period on this project? years b. What is the net present value, assuming a 12% rate of return? Use the table provided above. Round to the nearest whole dollar. Net present value c. What else should the manager consider in the analysis? Previous Check My Work 3 more Check My Work uses remaining. Save and Exit Submit Assignment f Email Instructor

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter12: Capital Investment Analysis

Section: Chapter Questions

Problem 15E

Related questions

Question

Transcribed Image Text:еBook

Print Item

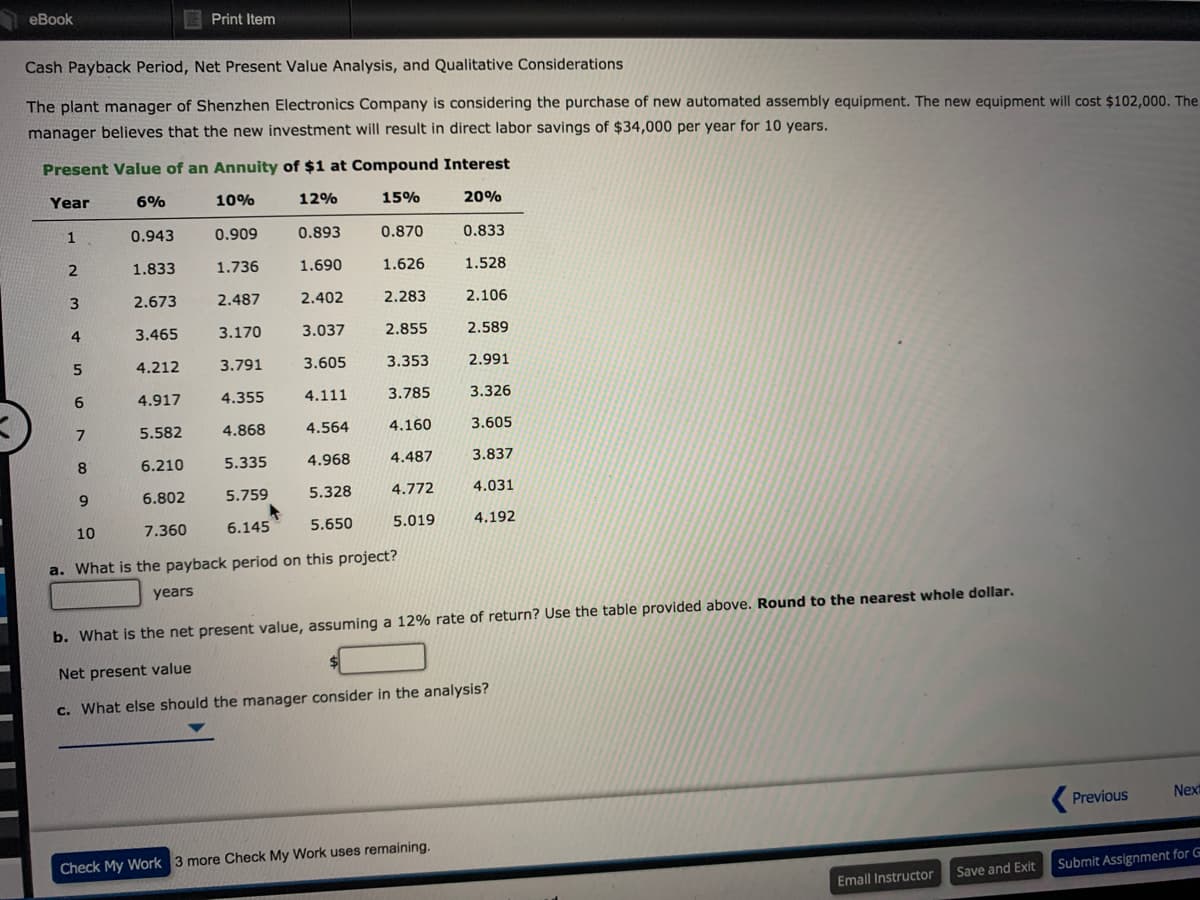

Cash Payback Period, Net Present Value Analysis, and Qualitative Considerations

The plant manager of Shenzhen Electronics Company is considering the purchase of new automated assembly equipment. The new equipment will cost $102,000. The

manager believes that the new investment will result in direct labor savings of $34,000 per year for 10 years.

Present Value of an Annuity of $1 at Compound Interest

Year

6%

10%

12%

15%

20%

1

0.943

0.909

0.893

0.870

0.833

1.833

1.736

1.690

1.626

1.528

3

2.673

2.487

2.402

2.283

2.106

3.465

3.170

3.037

2.855

2.589

4.212

3.791

3.605

3.353

2.991

6.

4.917

4.355

4.111

3.785

3.326

5.582

4.868

4.564

4.160

3.605

8

6.210

5.335

4.968

4.487

3.837

9.

6.802

5.759

5.328

4.772

4.031

10

7.360

6.145

5.650

5.019

4.192

a. What is the payback period on this project?

years

b. What is the net present value, assuming a 12% rate of return? Use the table provided above. Round to the nearest whole dollar.

Net present value

c. What else should the manager consider in the analysis?

Previous

Next

Check My Work 3 more Check My Work uses remaining.

Save and Exit

|Submit Assignment for G

Emal Instructor

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT