Q: Question#1:Yam-Hash Corporation is expanding rapidly, and it does not pay any dividends because it c...

A: P0 = D0 (1+g) or D1 / (Ke - g)

Q: 4. A ₱75,000, at 11% bond pays coupon semiannually redeemable at ₱90,000 on January 13, 2017 is boug...

A: The Purchase price can be calculated as follows using excel :

Q: Please answer the following question.

A: Annuity refers to series of equalized payments that are paid or received at start or ending of speci...

Q: JOTARO started saving $2,000 each year for 25 years until his retirement at 65 years old. A year aft...

A: Sometimes, some cash inflows or cash outflows are unknown in the savings or withdrawal schedule. The...

Q: Twelve payments of $10,000 each are to be repaid monthly at the end ofeach month. The monthly intere...

A: Payment at the end means ordinary annuity. Hence formula to calculate present value of ordinary annu...

Q: Solve the problem. Suppose your father deposited in your bank account P10,000 at an annual interest ...

A: FV is the future worth of cash flows that have occurred in the past or present.

Q: Compaq Ltd has a net income after tax of $2 000 000 for the year ended 30 June 2018. At the beginnin...

A: Formula for EPS is:' Earnings per share = Earnings or profit/no of outstanding shares.

Q: Building a Balance Sheet Alesha, Inc., has current assets of $4,300, net fixed assets of $24,000, cu...

A: The shareholders' equity is calculated by subtracting the liabilities from the assets. Whereas, net ...

Q: Indicate why you agree with justifications to the following statements: “An investor should be compe...

A: Risk are of systematic and unsystematic.

Q: Recently, the owner of KFC Franchise decided to change how she compensated her top manager. Last yea...

A: Computation:

Q: Why is it smart to remain cool when making a claim and how should you go about it

A: Keeping cool while claiming your insurance is very important and making emotions high or low create ...

Q: Kelly buys a computer system for $2400 and makes a 15% down payment. If Kelly agrees to repay the ba...

A: Simple interest is interest calculated on the principal portion of a loan or the original contributi...

Q: A series of equal quarterly payments of $5,000 for 10 years is equivalent to what future lump-sum am...

A: The present value is the value of the sum received at time 0 or the current period. It is the value ...

Q: What is the price of the following semi-annual bond?i. face value: $1,300ii. maturity: 12 yearsiii. ...

A: Bonds are units of corporate debt issued by companies and securitized as traded assets.

Q: ICICIDirect is the first service in India to provide complete end-to-end integration for seamless el...

A:

Q: 1. Suppose a proposed new road to be constructed in North Carolina between Raleigh and Morehead City...

A: increase in TRIPS =600000-500000 increase in TRIPS =100000 Decrease in cost=5-4=1 Total annual benef...

Q: XYZ Company holds 30% Debt, 30% Preferred stock, 40% Common stock. Interest rate on debt is 7.50%. P...

A: Weighted Average Cost of Capital (WACC) is the overall cost of capital from all the sources of finan...

Q: James Madison was brought in as assistant to Computron’s chairman, who had the task of getting the c...

A: Du Pont: It is an equation that divides a company’s ROE into three parts, namely, profit margin, ass...

Q: . The Federal Reserve has tools at its disposal to implement monetary policy, which does NOT include...

A: The term ‘Monetary policy’ refers to what the nation’s central banks do to influence the amount of m...

Q: 1. When is compound interest your friend? 2. When is compound interest your enemy? Reflection about...

A: Compound interest is the interest calculated on the initial principal amount as well as the interest...

Q: Little Book LTD has total assets of $860,000. There are 75,000 shares of stock outstanding, total bo...

A: The term earnings per share (EPS) refers to the earnings that are generated by the company on a per ...

Q: a) Suppose you save $4,000 per year at the beginning of each year for 10 years and earn 8.5% interes...

A: Future Value is the value of current investments at a certain future date at the assumed interest-ea...

Q: Please answer both exercise 17 and 18

A: Present value is the sum of money that must be invested in order to achieve a specific future goal. ...

Q: What will be the amount accumulated by eachof these present investments?(a) $12,250 in 15 years at 8...

A: Formula to caalculate compound interest is: A = P(1+r)^n Where A is the future value, P is the princ...

Q: What are the steps involved in valuation of supernormal growth stock?

A: Supernormal growth stock is a stock which experiences a robust growth at initial levels and later re...

Q: A company is planning to install a new automated plastic-molding press. Four different presses are a...

A: Answer:

Q: What are the rights and privileges of Common Stockholders?

A: Common Stockholders: Common stockholder can be defined as someone who has purchased common shares of...

Q: -) The net present value of the project is $323,819.26 ) The net present value of the project is $41...

A: sales =400000 Fixed cost =50000 variable cost =40000 Net income =400000-90000=310000 Annual deprecia...

Q: Question Assume that after completion of your MBA you have started working as a financial planner at...

A:

Q: Exercise 6. Compounding More Than Once a Year. Use the appropriate compound interest formula to comp...

A: Because you have posted multiple questions, we will answer the first question only . For the remaini...

Q: Question 3 Hong Sdn Bhd makes a patented rubber tapping machine that sells for RM6. Each machine h...

A: “Since you have posted a question with multiple sub-parts, we will solve first three subparts for yo...

Q: For the cash flow series shown, determine the future worth in year 5 at an interest rate of 10% per ...

A: Time value of money- It is based on the concept that money earned today is worth more than similar d...

Q: Sain and Lewis Investment Management (SLIM), Inc. is considering the purchase of a number of bonds t...

A: GIVEN, par =$10,000 Coupon rate = 7.5% coupon = 7.5% x 10,000 = $750 price of bond = $8750 n=10

Q: Ron Sample is the grand prize winner in a college tuition essay contest awarded through a local orga...

A: The present value is the present worth of the amount that will be paid or received in the future.

Q: Auditing. Please use own sentence Explain ( 6 ) six Elements of Substantive Test in Purchase Cycle S...

A: Substantive Tests may be of following types 1. Risk Assessment 2. Analysis of the processes in the f...

Q: hi there, i need answer for a and b. thankssss

A: a. yes, it is reasonable to assume that treasury bonds wil provide higer returns in recession than i...

Q: Complex Systems has an outstanding issue of $1,000- par-value bonds with a 12% couponinterest rate. ...

A: Present value of any bond is the sum total of discounted coupon and the redemption value.

Q: A person borrows $15,000 at an interest rate of 6%, compounded monthly, to be paid with payments of ...

A: A concept through which it is studied that the current worth of money is higher than its future wort...

Q: Cash Flow to Stockholders The 2018 balance sheet of Spieth’s Golf Shop, Inc., showed $490,000 in the...

A: given, 2018, common stock $490,000 2018, additional paid in surplus $3400,000 2019, commo...

Q: Metropolitan Water Utility is planning to upgrade its SCADA system for controlling well pumps, boost...

A: Present worth is the present value of cash flows that are expected to occur in the future.

Q: Which of the following statements is NOT CORRECT? "Going public" establishes a firm's true intrinsic...

A: The correct and incorrect options and their explanations have been given in the next step.

Q: In business quantitative analysis, what is suitable decision tools applied?

A: Quantitative analysis : Quantitative analysis is a tool used in business to understand the course of...

Q: Mr. Karim is an investment banking analyst at Benchmark Financial, and hewants to calculate the expe...

A: The capital asset pricing model describes the relationship between systematic risk and the expected ...

Q: Find the value of a retiroment savings account paying an APR of 58% after 30 yoars (contributions ma...

A: The value of the retirement savings account at the end can be calculated using the following formula...

Q: A 75 300 pesos, at 11% bond pays coupon semi-annually redeemable at 90,000 pesos on january 13, 2017...

A: The purchase price of the bond is equivalent to the sum of the present value of the payment and the ...

Q: James Madison was brought in as assistant to Computron’s chairman, who had the task of getting the c...

A: The current ratio and quick ratio are measures of a company's liquidity. They define the ability of ...

Q: An initial investment of $8,320,000 on plant and machinery is expected to generate net cash flows of...

A: Initial investment=$8320000 discount rate= 18% Net cash flow=1st year $3,410,000, 2nd year $4,070,00...

Q: Hong Sdn Bhd makes a patented rubber tapping machine that sells for RM6. Each machine has a variable...

A: Ans 1. Leverage is defined as an investment strategy that is used to borrow the funds that used for ...

Q: Isaac Nuamah is the financial manager for Asonoma Micro Dryer Company, a company that manufactures m...

A: NPV is the net current worth of cash flows that are expected to occur in the future. It is calculate...

Q: A bond with $40 coupons every 6 months is purchased at a discount to yield ja- 8%. Ifthe absolute va...

A: The question gives the following information:

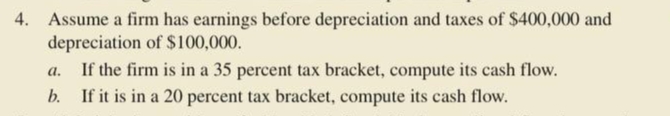

4. Assume a firm has earnings before

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- The Berndt Corporation expects to have sales of 12 million. Costs other than depreciation are expected to be 75% of sales, and depreciation is expected to be 1.5 million. All sales revenues will be collected in cash, and costs other than depreciation must be paid for during the year. Berndts federal-plus-state tax rate is 40%. Berndt has no debt. a. Set up an income statement. What is Berndts expected net income? Its expected net cash flow? b. Suppose Congress changed the tax laws so that Berndts depreciation expenses doubled. No changes in operations occurred. What would happen to reported profit and to net cash flow? c. Now suppose that Congress changed the tax laws such that, instead of doubling Berndts depreciation, it was reduced by 50%. How would profit and net cash flow be affected? d. If this were your company, would you prefer Congress to cause your depreciation expense to be doubled or halved? Why?Assume Plainfield Manufacturing has debt of $6,500,000 with a cost of capital of 9.5% and equity of $4,500,000 with a cost of capital of 11.5%. What is Tylers weighted average cost of capital?Assume Skyler Industries has debt of $4,500,000 with a cost of capital of 7.5% and equity of $5,500,000 with a cost of capital of 10.5%. What is Skylers weighted average cost of capital?

- A firm's net income is $36 million, depreciation is $3 million, its investments in fixed capital totals $13 million, its AFTER-TAX interest totals $4 million and its investment in working capital totals $5 million. The tax rate is 40%. What is its Free Cash Flow to the Firm? a.$27.00 million b. $25.00 million c. $23.40 million d. $25.40 million Give typing answer with explanation and conclusionWhat is the operating cash flow for a firm with $500,000 profit before tax, $100,000 depreciation expense, and a 21% tax rate? Select one: a.$260,000 b.$325,000 c.$360,000 d.$495,000Assume that a firm has a cost of debt capital of 0.06, a company tax rate of 0.2, a market value of debt of $10 million, a cost of equity capital of 0.14, and a market value of equity of $10 million. Also assume that the proportion of company taxes claimed by shareholders is 0.5. Which of the following values is the closest to this firm's weighted average cost of capital?

- Assume a company has 10 million of total assets: the market value of equity is 8 million and market value of debt is 2 million. The company has a 12% cost of equity and a 7% cost of debt. The company has a tax rate of 30%. What is the company’s weighted average cost of capital?Assume a corporation has earnings before depreciation and taxes of $82,000, depreciation of $45,000, and that it has a 25% combined tax bracket. What are the after-tax cash flows for the company?It is known that a firm’s Net Operating Profit After Tax (NOPAT) is $58,000 and its Economic Value Added (EVA) is $18,000. What is the firm’s Weighted Average Cost of Capital (WACC) if its debt is $150,000 and equity is $250,000?

- A firm has a tax burden ratio of .75, a leverage ratio of 1.25, an interest burden of .6, and a return on sales of 10%. The firm generates $2.40 in sales per dollar of assets. What is the firm’s ROE?Assume a corporation has earnings before depreciation and taxes of $100,000, depreciation of $50,000, and that it has a 30 percent tax bracket. Compute its cash flow using the format below. Earnings before depreciation and taxes Depreciation Earnings before taxes Taxes @ 30% Earnings after taxes DepreciationA firm has EBIT of $30 million. It has debt of $100 million and the cost of debt is 7%. Its unlevered cost of capital is 10% and tax rate at 35%. a) What’s its unlevered firm value? b) What’s its levered firm value? c) What’s its equity value?