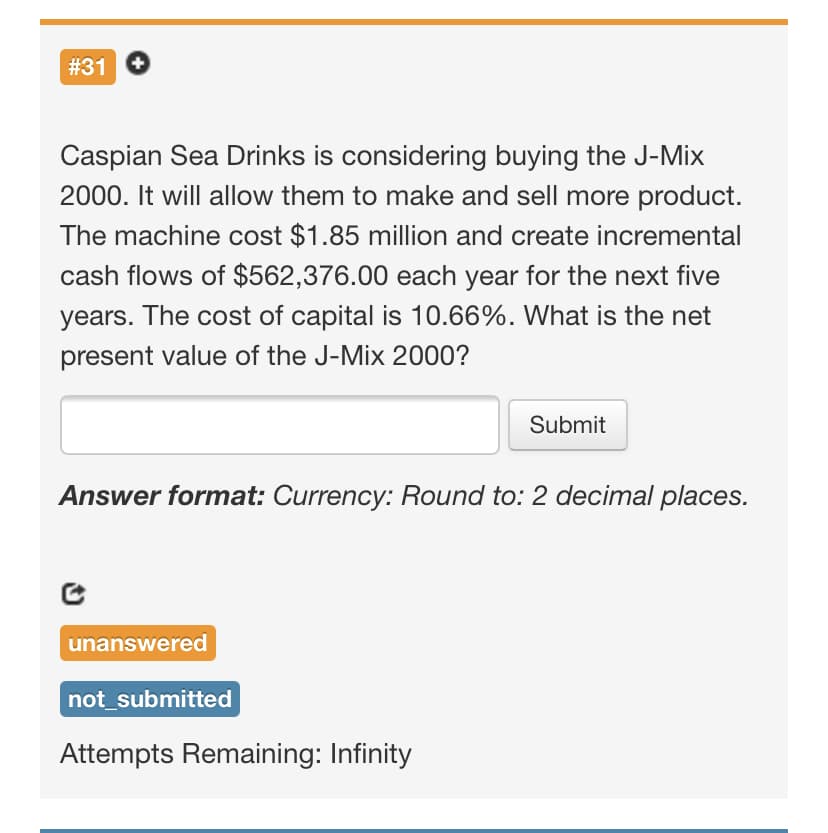

Caspian Sea Drinks is considering buying the J-Mix 2000. It will allow them to make and sell more product. The machine cost $1.85 million and create incremental cash flows of $562,376.00 each year for the next five years. The cost of capital is 10.66%. What is the net present value of the J-Mix 2000? Submit Answer format: Currency: Round to: 2 decimal places.

Caspian Sea Drinks is considering buying the J-Mix 2000. It will allow them to make and sell more product. The machine cost $1.85 million and create incremental cash flows of $562,376.00 each year for the next five years. The cost of capital is 10.66%. What is the net present value of the J-Mix 2000? Submit Answer format: Currency: Round to: 2 decimal places.

Chapter11: Capital Budgeting Decisions

Section: Chapter Questions

Problem 13EA: Jullo Company is considering the purchase of a new bubble packaging machine. If the machine will...

Related questions

Question

Transcribed Image Text:#31

Caspian Sea Drinks is considering buying the J-Mix

2000. It will allow them to make and sell more product.

The machine cost $1.85 million and create incremental

cash flows of $562,376.00 each year for the next five

years. The cost of capital is 10.66%. What is the net

present value of the J-Mix 2000?

Submit

Answer format: Currency: Round to: 2 decimal places.

unanswered

not_submitted

Attempts Remaining: Infinity

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning