Category Prior Year Current Yea Accounts payable 3,197.00 5,955.00 Accounts receivable 6,865.00 8,934.00 Accruals 5,613.00 6,074.00 Additional paid in capital 19,604.00 13,954.00 Cash ??? ??? Common Stock 2,850 2,850 СOGS 22,484.00 18,643.00 Current portion long-term debt 500 500 Depreciation expense 971.00 991.00 Interest expense 1,251.00 1,152.00 Inventories 3,006.00 6,686.00 Long-term debt 16,550.00 22,155.00 Net fixed assets 75,765.00 74,086.00 Notes payable 4,063.00 6,516.00 Operating expenses (excl. depr.) 19,950 20,000 Retained earnings 35,910.00 34,812.00 Sales 46,360 45,120.00 Тахes 350 920

Category Prior Year Current Yea Accounts payable 3,197.00 5,955.00 Accounts receivable 6,865.00 8,934.00 Accruals 5,613.00 6,074.00 Additional paid in capital 19,604.00 13,954.00 Cash ??? ??? Common Stock 2,850 2,850 СOGS 22,484.00 18,643.00 Current portion long-term debt 500 500 Depreciation expense 971.00 991.00 Interest expense 1,251.00 1,152.00 Inventories 3,006.00 6,686.00 Long-term debt 16,550.00 22,155.00 Net fixed assets 75,765.00 74,086.00 Notes payable 4,063.00 6,516.00 Operating expenses (excl. depr.) 19,950 20,000 Retained earnings 35,910.00 34,812.00 Sales 46,360 45,120.00 Тахes 350 920

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter8: Liabilities And Stockholders' Equity

Section: Chapter Questions

Problem 8.1.2MBA

Related questions

Question

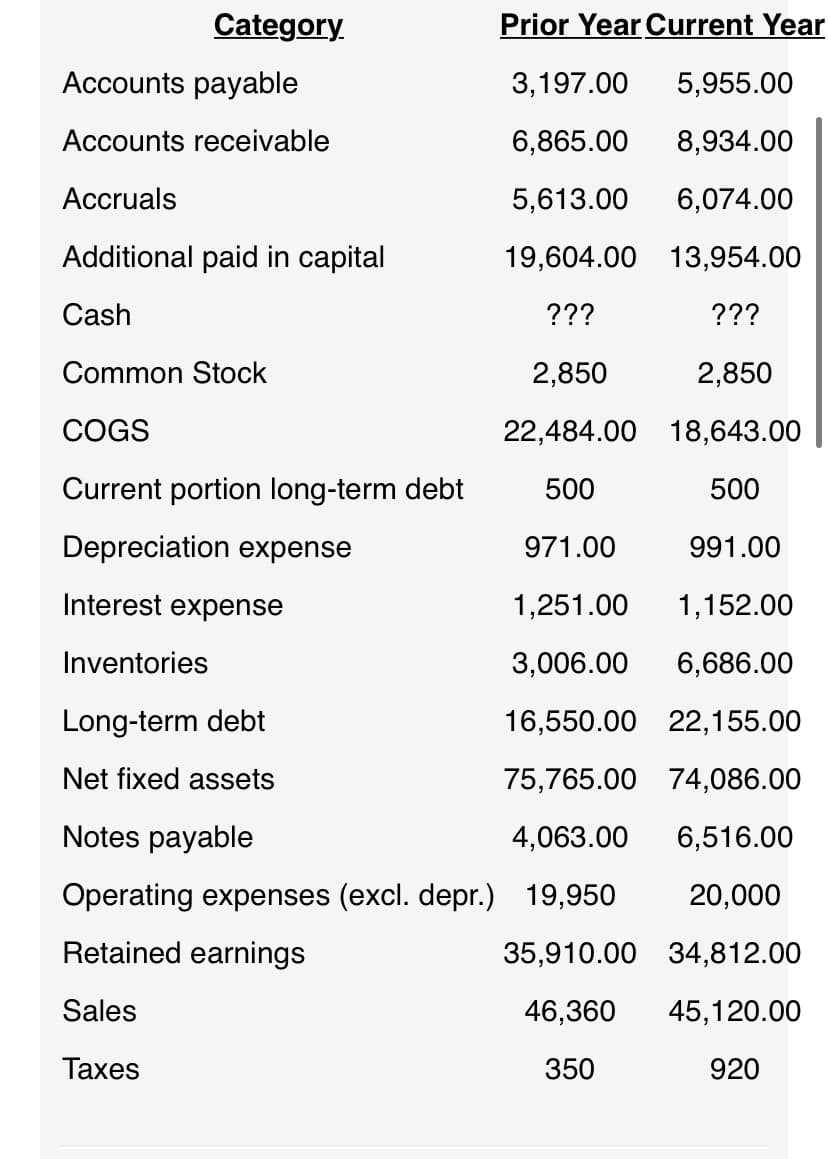

What is the firm's cash flow from financing?

What is the firm's cash flow from investing?

What is the firm's total change in cash from the prior year to the current year?

Transcribed Image Text:Category

Prior Year Current Year

Accounts payable

3,197.00

5,955.00

Accounts receivable

6,865.00

8,934.00

Accruals

5,613.00

6,074.00

Additional paid in capital

19,604.00 13,954.00

Cash

???

???

Common Stock

2,850

2,850

COGS

22,484.00 18,643.00

Current portion long-term debt

500

500

Depreciation expense

971.00

991.00

Interest expense

1,251.00

1,152.00

Inventories

3,006.00

6,686.00

Long-term debt

16,550.00 22,155.00

Net fixed assets

75,765.00 74,086.00

Notes payable

4,063.00

6,516.00

Operating expenses (excl. depr.) 19,950

20,000

Retained earnings

35,910.00 34,812.00

Sales

46,360

45,120.00

Тахes

350

920

Expert Solution

Step 1 Introduction

Cash flow Statement: This statement showing the inflows and outflows of cash and cash equivalents during the particular year. It measures how well the company generates cash to pay its debt obligations and fund its operating expenses.

Cash flow statement divided into three different activities:

1) Cash flow from operating activities.

2) Cash flow from investing activities.

3) Cash flow from Financing activities.

Trending now

This is a popular solution!

Step by step

Solved in 8 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Why is long term debt the only financing activity? What about current debt, dividends, and current stock?

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning