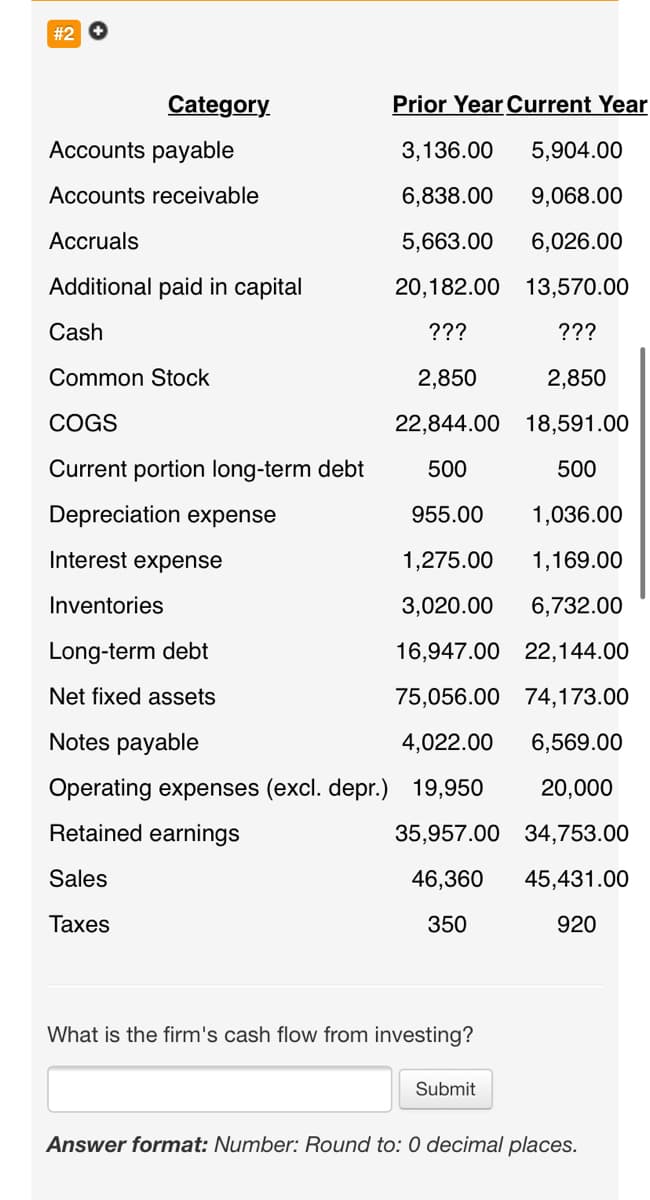

Category. Prior Year Current Yea Accounts payable 3,136.00 5,904.00 Accounts receivable 6,838.00 9,068.00 Accruals 5,663.00 6,026.00 Additional paid in capital 20,182.00 13,570.00 Cash ??? ??? Common Stock 2,850 2,850 COGS 22,844.00 18,591.00 Current portion long-term debt 500 500 Depreciation expense 955.00 1,036.00

Q: y 1 is P300,000; Uncollectible accounts written off is P20,000; and accounts receivable at December…

A: Financial Statements can be prepared either on accrual basis of accounting or cash basis. In accrual…

Q: Item Prior year Current year Accounts payable 8,191.00 7,813.00 Accounts receivable 6,005.00…

A: Balance sheet shows the assets, liabilities and shareholders equity of the company during the…

Q: Current Position Analysis The following items are reported on a company's balance sheet: Cash…

A: Current ratio and quick ratio are important financial ratios that we look at when assessing the…

Q: The following data were taken from the balance sheet of Nilo Company at the end of two recent fiscal…

A: Ratio analysis helps to analyze the financial statements of the company. The management can take…

Q: Item Prior year Current year Accounts payable 8,198.00 7,775.00 Accounts receivable 6,030.00…

A: In the Given question we require to calculate the firm's total changes in cash from the prior year…

Q: The following items are reported on a company's balance sheet: Cash $248,600 Marketable securities…

A: Current Ratio and Quick Ratio are the liquidity ratios which test if the company is in liquid state…

Q: BALANCE SHEET Cash $ 140.0 Accounts payable $ 800 .0 Accts. receivable 880 .0 Notes payable 600.0…

A: The question is related to Ratio Analysis. 1. Debt Ratio is calculated by dividing total debts by…

Q: Wilmington Corporation’s liabilities to equity ratio in Year 7 was: Select one: a. 1.58 b. 0.51 c.…

A: Liabilities to equity ratio is a measure of how much debt and equity is used to finance the…

Q: Item Prior year Current year Accounts payable 8,101.00 7,904.00 Accounts receivable 6,019.00…

A: Change in cash: It is the difference between the prior years and current year when the current cash…

Q: Summa Company revealed the following account balances on December 31, 2020: Accounts payable…

A: Financial statement: Financial information is a written record of an organization and individual…

Q: What is the firm's cash flow from financing?

A: Cash Flow from Financing Activities Cash Flow from Financing Activities is the net amount of funding…

Q: Presented below are summary financial data from Pompeo's annual report: Amounts in millions Balance…

A: Quick ratio = Quick assets / Current liabilities where, Quick assets = Total current assets -…

Q: A recent balance sheet of Sweet Tooth, Inc., included the following items, among others. (Dollar…

A: "Since you have posted a question with multiple sub parts, we will solve first three sub parts for…

Q: Use the financial ratios of company A and company B to answer the questions below.…

A: Note: Since there are multiple questions posted, we will answer first three questions. If you want…

Q: ALANCE SHEET Cash $ 140.0 Accounts payable $ 800 .0 Accts. receivable 880 .0 Notes payable 600.0…

A: 1.Earning par share will be calculated by dividing the net income by number of shares outstanding…

Q: tem Prior year Current year Accounts payable 8,126.00 7,784.00 Accounts receivable 6,078.00 6,607.00…

A: The cash flow statement is an essential part of the financial statements of the organization. It is…

Q: ABC CO had cash and marketable securities worth $1,276,591 accounts payables worth $4,134,425,…

A: The net working capital is calculated as the difference of current assets and current liabilities

Q: The following items are reported on a company's balance sheet: Cash $550,800 Marketable securities…

A: Ratio analysis helps to analyze the financial statements of the company. The management can take…

Q: Category Prior Year Current Year Accounts payable ??? ??? Accounts receivable 320,715 397,400…

A: Return on assets refers to the profit attained by the company through generating income. It is…

Q: Item Prior year Current year Accounts payable 8,142.00 7,800.00 Accounts receivable 6,080.00…

A: The question is based on the concept of Cashflow statements.

Q: The following data are available for Marigold Company. Increase in accounts $120300 payable Increase…

A: Cash flow from Financing activities: It include transactions relating to the debt, equity, and…

Q: Selected information taken from the financial statements of Wiley Company for two successibe years…

A: Percentage change = (Amount for comparision year - Amount for Base year) / Amount for Base year

Q: Accounts payable 3,144.00 5,906.00 Accounts receivable 6,924.00 9,016.00 Accruals 5,723.00 6,027.00…

A: To know the cash balance for two years, we have to prepare a trial balance for two years using the…

Q: What is the firm's total change in cash from the prior year to the current year?

A: Cash: Cash is an asset that is shown in the balance sheet under current assets. Income statement: An…

Q: Category Prior Year Current Year Accounts payable 3,134.00 5,904.00 Accounts receivable 6,978.00…

A: Cash flow statement shows cash flows from three activities i.e. operating activities, investment…

Q: Item Prior year Current year Accounts payable 8,122.00 7,930.00 Accounts receivable 6,011.00…

A: Cash flow from investing activity includes all those cash outflows and inflows which are related to…

Q: BALANCE SHEET Cash $ 140.0 Accounts payable $ 800 .0 Accts. receivable 880 .0 Notes payable 600.0…

A: The question is related to the Ratio Analysis. He Return on Equity is calculated with the help of…

Q: The Balance Sheet of the XYZ Corporation XYZ CORPORATION Balance Sheet 20X2 and 20X1 (in $ millions)…

A: Balance sheet shows the financial position of the entity by the assets and liabilities so that…

Q: Below data extracted from the balance sheets of ABC company Particulars 2019 2020 Cash & Bank Trade…

A: "Since you have posted a question with multiple sub-parts, we will solve only first three sub-parts…

Q: Amounts in millions Balance Sheet Cash and Cash Equivalents $1,850 Marketable Securities 19,100…

A: Current Ratio is a measure of liquidity of the firm and whether it can meet its short term…

Q: current liabilities accounta payable $620,000 notes payables to bank $ 130,000 accrued wages.....?…

A: I would request you to post the question clearly or the snapshot of the question would suffice. I…

Q: Current Position Analysis The following items are reported on a company's balance sheet: Cash…

A: The current ratio and quick ratio are the liquidity ratios that are calculated to know about the…

Q: Category. Prior Year Current Year Accounts payable 3,135.00 5,967.00 Accounts receivable 6,961.00…

A: Cash flow from operations is the amount earned from the regular operating activities of the firm.

Q: Hannah Company has current assets equal to $3,800,000. Of these, $1,200,000 is cash, $1,800,000 is…

A: Current ratio is one of the liquidity ratio of the business. It is ratio between current assets and…

Q: The following information is available in respect of Vegas plc for the last 2 years ended 31…

A: Cash Flow Statement :— A cash flow statement explains the reasons for change in the cash and cash…

Q: Item Prior year Current year Accounts payable 8,113.00 7,909.00 Accounts receivable 6,029.00…

A: Cash Flow from investing activity only includes details of Investment made in shares or fixed…

Q: pany for the year ended December 31, 19--, appeared as: bs. The condensed financial statements of…

A: "Since you have posted a question with multiple sub parts, we will solve first three sub parts for…

Q: Item Prior year Current year Accounts payable 8,123.00 7,716.00 Accounts receivable 6,048.00…

A: Cash flow referred as the net value of cash and cash equivalent transferred as in and out of…

Q: Presented below are summary financial data from Pompeo's annual report: Amounts in millions Balance…

A: Ratio analysis helps to analyze the financial statements of the company. The management can take…

Q: A recent balance sheet of Sweet Tooth, Ic., included the following items, among others. (Dollar…

A: Definition of Quick Assets: Quick assets refer to assets owned by a company with a commercial or…

Q: Determine the quick ratio for RCE and John K, Inc. What’s the liquidity difference between the two…

A: Liquidity Ratios: Liquidity Ration shows companies' ability to maintain enough cash to pay immediate…

Q: The summarized trial balance of XYZ Corporation includes the following accounts on December 31,2022:…

A: Statement of financial position is one of the important financial statement being prepared by the…

Q: Item Prior year Current year Accounts payable 8,100.00 7,786.00 Accounts receivable 6,081.00…

A: Indirect method of cash flow statement involves a reconciliation from profit before tax, adjusting…

Q: iven the information below, calculate the Working Capital and Current Ratio 1 Cash and marketable…

A:

Q: Item Prior year Current year Accounts payable 8,118.00 7,921.00 Accounts receivable 6,037.00…

A: Statement of Cash Flows Cash Flow from Financing Activities Issue of Common…

Q: Item Prior year Current year Accounts payable 8,109.00 7,758.00 Accounts receivable 6,059.00…

A: Cash refers to the current asset that comprises currency that is used to buy goods and services in…

Q: ratio. Deana Company's working capital accounts at December P17-11 Effect of various tran given…

A: Hi student Since there are multiple subparts,we will answer only first three subparts. If you want…

Q: Item Prior year Current year Accounts payable 8,109.00 7,758.00 Accounts receivable 6,059.00…

A: Cash flows from investing activities: Investing activity includes the acquisition and disposal of…

Q: Current Position Analysis The following items are reported on a company's balance sheet: Cash…

A:

Step by step

Solved in 2 steps

- Category Prior Year Current Year Accounts payable 3,123.00 5,969.00 Accounts receivable 6,987.00 8,940.00 Accruals 5,642.00 6,108.00 Additional paid in capital 19,885.00 13,325.00 Cash ??? ??? Common Stock 2,850 2,850 COGS 22,986.00 18,120.00 Current portion long-term debt 500 500 Depreciation expense 1,035.00 988.00 Interest expense 1,290.00 1,167.00 Inventories 3,006.00 6,743.00 Long-term debt 16,856.00 22,001.00 Net fixed assets 75,521.00 74,000.00 Notes payable 4,072.00 6,540.00 Operating expenses (excl. depr.) 19,950 20,000 Retained earnings 35,244.00 34,874.00 Sales 46,360 45,055.00 Taxes 350 920 What is the firm's cash flow from financing?Category Prior Year Current Year Accounts payable 3,147.00 5,976.00 Accounts receivable 6,925.00 8,910.00 Accruals 5,635.00 6,187.00 Additional paid in capital 19,527.00 13,950.00 Cash ??? ??? Common Stock 2,850 2,850 COGS 22,974.00 18,270.00 Current portion long-term debt 500 500 Depreciation expense 975.00 976.00 Interest expense 1,278.00 1,155.00 Inventories 3,048.00 6,717.00 Long-term debt 16,569.00 22,919.00 Net fixed assets 75,968.00 73,882.00 Notes payable 4,045.00 6,584.00 Operating expenses (excl. depr.) 19,950 20,000 Retained earnings 35,870.00 34,759.00 Sales 46,360 45,347.00 Taxes 350 920 What is the firm's cash flow from operations? What is the firm's dividend payment in the current year? What is the firm's net income in the current year?Category Prior Year Current Year Accounts payable ??? ??? Accounts receivable 320,715 397,400 Accruals 40,500 33,750 Additional paid in capital 500,000 541,650 Cash 17,500 47,500 Common Stock 94,000 105,000 COGS 328,500 431,139.00 Current portion long-term debt 33,750 35,000 Depreciation expense 54,000 54,349.00 Interest expense 40,500 41,741.00 Inventories 279,000 288,000 Long-term debt 337,728.00 398,725.00 Net fixed assets 946,535 999,000 Notes payable 148,500 162,000 Operating expenses (excl. depr.) 126,000 162,280.00 Retained earnings 306,000 342,000 Sales 639,000 847,106.00 Taxes 24,750 48,618.00 What is the current year's return on assets (ROA)? (Round to 4 decimal places.)

- Category Prior Year Current Year Accounts payable ??? ??? Accounts receivable 320,715 397,400 Accruals 40,500 33,750 Additional paid in capital 500,000 541,650 Cash 17,500 47,500 Common Stock 94,000 105,000 COGS 328,500 428,571.00 Current portion long-term debt 33,750 35,000 Depreciation expense 54,000 54,035.00 Interest expense 40,500 42,155.00 Inventories 279,000 288,000 Long-term debt 339,577.00 401,377.00 Net fixed assets 946,535 999,000 Notes payable 148,500 162,000 Operating expenses (excl. depr.) 126,000 162,171.00 Retained earnings 306,000 342,000 Sales 639,000 849,094.00 Taxes 24,750 47,192.00 What is the current year's entry for long-term debt on a common-sized balance sheet? (ROUND TO 4 DECIMAL PLACES.)Item Prior year Current year Accounts payable 8,126.00 7,784.00 Accounts receivable 6,078.00 6,607.00 Accruals 994.00 1,452.00 Cash ??? ??? Common Stock 10,696.00 12,040.00 COGS 12,650.00 18,346.00 Current portion long-term debt 5,031.00 5,088.00 Depreciation expense 2,500 2,797.00 Interest expense 733 417 Inventories 4,240.00 4,781.00 Long-term debt 14,366.00 13,914.00 Net fixed assets 51,539.00 54,520.00 Notes payable 4,323.00 9,909.00 Operating expenses (excl. depr.) 13,977 18,172 Retained earnings 28,408.00 29,699.00 Sales 35,119 45,984.00 Taxes 2,084 2,775 What is the firm's cash flow from financing?Item Prior year Current year Accounts payable 8,194.00 7,893.00 Accounts receivable 6,066.00 6,786.00 Accruals 977.00 1,572.00 Cash ??? ??? Common Stock 11,869.00 12,264.00 COGS 12,616.00 18,108.00 Current portion long-term debt 5,038.00 5,064.00 Depreciation expense 2,500 2,825.00 Interest expense 733 417 Inventories 4,145.00 4,778.00 Long-term debt 13,680.00 14,055.00 Net fixed assets 50,966.00 54,551.00 Notes payable 4,331.00 9,956.00 Operating expenses (excl. depr.) 13,977 18,172 Retained earnings 28,104.00 29,983.00 Sales 35,119 45,456.00 Taxes 2,084 2,775 What is the firm's net income in the current year? . .

- Item Prior year Current year Accounts payable 8,101.00 7,904.00 Accounts receivable 6,019.00 6,552.00 Accruals 1,040.00 1,528.00 Cash ??? ??? Common Stock 11,291.00 12,618.00 COGS 12,748.00 18,034.00 Current portion long-term debt 5,099.00 4,934.00 Depreciation expense 2,500 2,811.00 Interest expense 733 417 Inventories 4,253.00 4,792.00 Long-term debt 14,116.00 13,147.00 Net fixed assets 50,495.00 54,147.00 Notes payable 4,377.00 9,813.00 Operating expenses (excl. depr.) 13,977 18,172 Retained earnings 28,298.00 29,819.00 Sales 35,119 46,964.00 Taxes 2,084 2,775 What is the firm's total change in cash from the prior year to the current year?Item Prior year Current year Accounts payable 8,142.00 7,800.00 Accounts receivable 6,080.00 6,533.00 Accruals 1,000.00 1,591.00 Cash ??? ??? Common Stock 10,841.00 12,035.00 COGS 12,636.00 18,261.00 Current portion long-term debt 5,012.00 4,989.00 Depreciation expense 2,500 2,763.00 Interest expense 733 417 Inventories 4,255.00 4,779.00 Long-term debt 14,380.00 13,783.00 Net fixed assets 51,230.00 54,549.00 Notes payable 4,365.00 9,899.00 Operating expenses (excl. depr.) 13,977 18,172 Retained earnings 28,008.00 30,075.00 Sales 35,119 45,203.00 Taxes 2,084 2,775 What is the firm's cash flow from operations?Reference is made to the 2022 Balance Sheet of Tram-Ropes limited.Tram-Ropes Limited Balance Sheet 2022Cash 1,000,000.00 Accounts Payable 8,000,000.00Acc. Receivable 12,000,000.00 Notes Payable 8,500,000.00Marketable securities 3,000,000.00 Long-term Debt 20,000,000.00Inventories 7,500,000.00 Common stock 7,500,000.00Fixed Assets 26,500,000.00 Preferred Stock 6,000,000.00Total Assets 50,000,000.00 Total Liabilities and Equity 50,000,000.00Additional Information:i. The Long-Term debt consists of 8% annual coupon bonds, with15 years to maturity and are currently selling for 95% ofpar.ii. The company’s common shares which have a book value of $20per share are currently selling at $25 per share.PREPARED BY THE CI, MGMT2023 4iii. Preferred shares have a book value of $100 per share. Theseshares are currently selling at $120 per share and paysdividends of 6% per annum on book value.iv. The dividend growth rate is expected to be 3%, and dividendfor 2023 is projected to be $5.00 per…

- #10 Item Prior year Current year Accounts payable 8,123.00 7,716.00 Accounts receivable 6,048.00 6,607.00 Accruals 997.00 1,500.00 Cash ??? ??? Common Stock 10,094.00 11,603.00 COGS 12,653.00 18,393.00 Current portion long-term debt 4,911.00 5,090.00 Depreciation expense 2,500 2,763.00 Interest expense 733 417 Inventories 4,245.00 4,824.00 Long-term debt 14,141.00 13,226.00 Net fixed assets 51,826.00 54,004.00 Notes payable 4,339.00 9,940.00 Operating expenses (excl. depr.) 13,977 18,172 Retained earnings 28,688.00 30,532.00 Sales 35,119 45,044.00 Taxes 2,084 2,775 What is the firm's total change in cash from the prior year to the current year? Answer format: Number: Round to: 0 decimal places.#9 Item Prior year Current year Accounts payable 8,123.00 7,716.00 Accounts receivable 6,048.00 6,607.00 Accruals 997.00 1,500.00 Cash ??? ??? Common Stock 10,094.00 11,603.00 COGS 12,653.00 18,393.00 Current portion long-term debt 4,911.00 5,090.00 Depreciation expense 2,500 2,763.00 Interest expense 733 417 Inventories 4,245.00 4,824.00 Long-term debt 14,141.00 13,226.00 Net fixed assets 51,826.00 54,004.00 Notes payable 4,339.00 9,940.00 Operating expenses (excl. depr.) 13,977 18,172 Retained earnings 28,688.00 30,532.00 Sales 35,119 45,044.00 Taxes 2,084 2,775 What is the firm's cash flow from financing? Answer format: Number: Round to: 0 decimal places.JUBILEE’s trial balance from the general ledger at 31 December 2012 showed the following balances:GH¢’mGH¢’mRevenue 2,648Loan note interest paid3Purchases1,669Distribution costs514Administrative expenses345Interim dividend paid6Inventories at 1 January 2012444Trade receivables545Trade payables434Cash and cash equivalents2850Gp ordinary shares100Capital surplus814Retained earnings at 1 January 20123494% loan note repayable 2018 (issued 2010)150Land and buildings: Cost (including GH¢60m land) 380 Accumulated depreciation at 1/1/201264Plant and equipment: Cost 258 Accumulated depreciation at 1/1/2012126Investment property at 1 January 2012548Rental income48Proceeds from sale of equipment7,4,7404,740Further information to be taken into account:i. Closing inventories were counted and amounted to GH¢388m at cost. However, shortly after the year end out-of-date inventories with a cost of GH15m were sold for GH¢8m.ii. The company decided to change its accounting policy with respect to its 10…