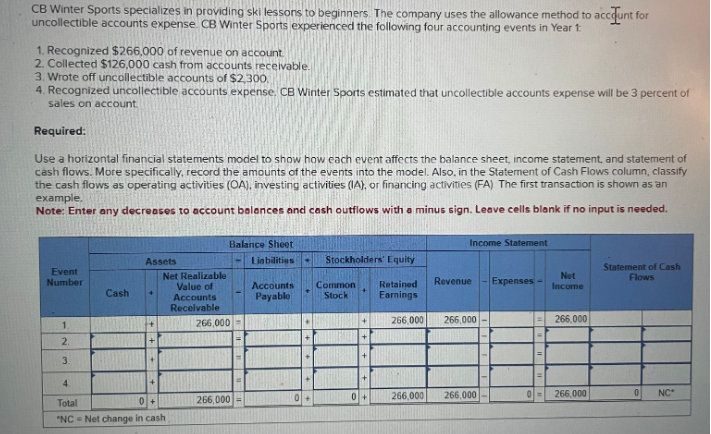

CB Winter Sports specializes in providing ski lessons to beginners. The company uses the allowance method to account for uncollectible accounts expense CB Winter Sports experienced the following four accounting events in Year 1: 1. Recognized $266,000 of revenue on account. 2. Collected $126,000 cash from accounts receivable. 3. Wrote off uncollectible accounts of $2,300, 4. Recognized uncollectible accounts expense, CB Winter Sports estimated that uncollectible accounts expense will be 3 percent of sales on account Required: Use a horizontal financial statements model to show how each event affects the balance sheet, income statement, and statement of cash flows. More specifically, record the amounts of the events into the model. Also, in the Statement of Cash Flows column, classify the cash flows as operating activities (OA), investing activities (IA), or financing activities (FA) The first transaction is shown as an example. Note: Enter any decreases to account balances and cash outflows with a minus sign. Leave cells blank if no input is needed. Balance Sheet Income Statement Assets Liabilities Stockholders' Equity Event Number Net Realizable Value of Accounts Cash Accounts Payable Common Stock Retained Earnings Revenue Expenses- Net Income Statement of Cash Flows Receivable 1. + 266,000 266,000 266,000 266,000 = 2. 3. 4. Total + 0+ 266,000 = 266,000 266,000 0= 266,000 0 NC "NC Net change in cash

CB Winter Sports specializes in providing ski lessons to beginners. The company uses the allowance method to account for uncollectible accounts expense CB Winter Sports experienced the following four accounting events in Year 1: 1. Recognized $266,000 of revenue on account. 2. Collected $126,000 cash from accounts receivable. 3. Wrote off uncollectible accounts of $2,300, 4. Recognized uncollectible accounts expense, CB Winter Sports estimated that uncollectible accounts expense will be 3 percent of sales on account Required: Use a horizontal financial statements model to show how each event affects the balance sheet, income statement, and statement of cash flows. More specifically, record the amounts of the events into the model. Also, in the Statement of Cash Flows column, classify the cash flows as operating activities (OA), investing activities (IA), or financing activities (FA) The first transaction is shown as an example. Note: Enter any decreases to account balances and cash outflows with a minus sign. Leave cells blank if no input is needed. Balance Sheet Income Statement Assets Liabilities Stockholders' Equity Event Number Net Realizable Value of Accounts Cash Accounts Payable Common Stock Retained Earnings Revenue Expenses- Net Income Statement of Cash Flows Receivable 1. + 266,000 266,000 266,000 266,000 = 2. 3. 4. Total + 0+ 266,000 = 266,000 266,000 0= 266,000 0 NC "NC Net change in cash

Related questions

Question

Transcribed Image Text:CB Winter Sports specializes in providing ski lessons to beginners. The company uses the allowance method to account for

uncollectible accounts expense CB Winter Sports experienced the following four accounting events in Year 1:

1. Recognized $266,000 of revenue on account.

2. Collected $126,000 cash from accounts receivable.

3. Wrote off uncollectible accounts of $2,300,

4. Recognized uncollectible accounts expense, CB Winter Sports estimated that uncollectible accounts expense will be 3 percent of

sales on account

Required:

Use a horizontal financial statements model to show how each event affects the balance sheet, income statement, and statement of

cash flows. More specifically, record the amounts of the events into the model. Also, in the Statement of Cash Flows column, classify

the cash flows as operating activities (OA), investing activities (IA), or financing activities (FA) The first transaction is shown as an

example.

Note: Enter any decreases to account balances and cash outflows with a minus sign. Leave cells blank if no input is needed.

Balance Sheet

Income Statement

Assets

Liabilities

Stockholders' Equity

Event

Number

Net Realizable

Value of

Accounts

Cash

Accounts

Payable

Common

Stock

Retained

Earnings

Revenue

Expenses-

Net

Income

Statement of Cash

Flows

Receivable

1.

+

266,000

266,000

266,000

266,000

=

2.

3.

4.

Total

+

0+

266,000 =

266,000 266,000

0=

266,000

0

NC

"NC Net change in cash

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps