Céline is physically disabled and in order to live independently and productively certain improvements were made to her residence. These improvements included expenditures for constructing entrance and exit ramps to the residence and widening the hallways and doorways to accommodate her wheelchair. Céline incurs and pays the following anmounts during the current year: Doctor and hospital bills $18,000 Expenditures for the improvements referenced above 16,300 Hearing aids 5,500 Cost of certified appraisal 300 In addition, Céline pays $3,200 for prescribed medicines. The improvements have an estimated useful life of 25 years. The appraisal was to determine the value of Céline's residence with and without the improvements. The appraisal states that her residence was worth $125,000 before the improvements and $131,000 after the installation. Céline's AGI for the year was $101,000. What is the total of her qualifying medical expenses for 20197 32,604 X What is her medical expense deduction for the current year? 25,029 X

Céline is physically disabled and in order to live independently and productively certain improvements were made to her residence. These improvements included expenditures for constructing entrance and exit ramps to the residence and widening the hallways and doorways to accommodate her wheelchair. Céline incurs and pays the following anmounts during the current year: Doctor and hospital bills $18,000 Expenditures for the improvements referenced above 16,300 Hearing aids 5,500 Cost of certified appraisal 300 In addition, Céline pays $3,200 for prescribed medicines. The improvements have an estimated useful life of 25 years. The appraisal was to determine the value of Céline's residence with and without the improvements. The appraisal states that her residence was worth $125,000 before the improvements and $131,000 after the installation. Céline's AGI for the year was $101,000. What is the total of her qualifying medical expenses for 20197 32,604 X What is her medical expense deduction for the current year? 25,029 X

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter10: Individuals: Income, Deductions, And Credits

Section: Chapter Questions

Problem 21P

Related questions

Question

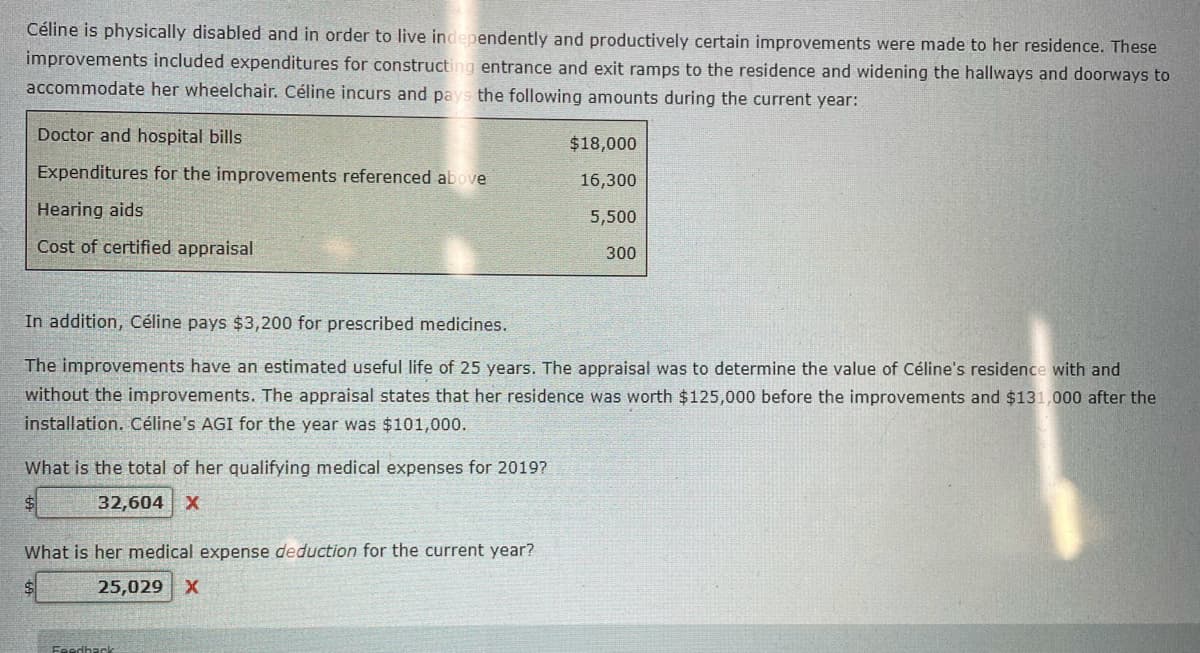

Transcribed Image Text:Céline is physically disabled and in order to live independently and productively certain improvements were made to her residence. These

improvements included expenditures for constructing entrance and exit ramps to the residence and widening the hallways and doorways to

accommodate her wheelchair. Céline incurs and pays the following amounts during the current year:

Doctor and hospital bills

$18,000

Expenditures for the improvements referenced above

16,300

Hearing aids

5,500

Cost of certified appraisal

300

In addition, Céline pays $3,200 for prescribed medicines.

The improvements have an estimated useful life of 25 years. The appraisal was to determine the value of Céline's residence with and

without the improvements. The appraisal states that her residence was worth $125,000 before the improvements and $131,000 after the

installation. Céline's AGI for the year was $101,000.

What is the total of her qualifying medical expenses for 20197

32,604 X

What is her medical expense deduction for the current year?

25,029

Feedbac

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you