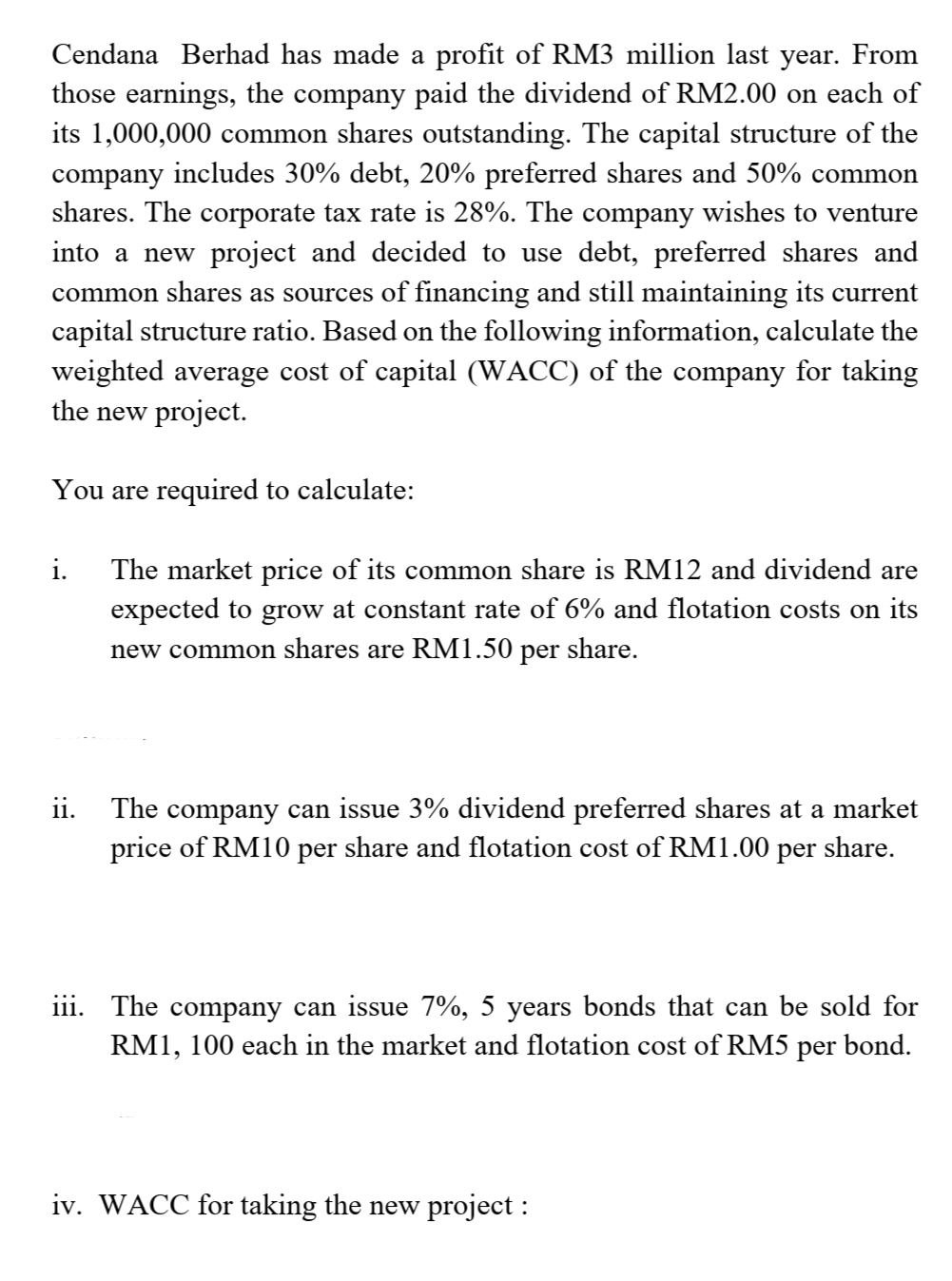

Cendana Berhad has made a profit of RM3 million last year. From those earnings, the company paid the dividend of RM2.00 on each of its 1,000,000 common shares outstanding. The capital structure of the company includes 30% debt, 20% preferred shares and 50% common shares. The corporate tax rate is 28%. The company wishes to venture into a new project and decided to use debt, preferred shares and common shares as sources of financing and still maintaining its current capital structure ratio. Based on the following information, calculate the weighted average cost of capital (WACC) of the company for taking the new project. You are required to calculate: i. The market price of its common share is RM12 and dividend are expected to grow at constant rate of 6% and flotation costs on its new common shares are RM1.50 per share. ii. The company can issue 3% dividend preferred shares at a market price of RM10 per share and flotation cost of RM1.00 per share. iii. The company can issue 7%, 5 years bonds that can be sold for RM1, 100 each in the market and flotation cost of RM5 per bond. iv. WACC for taking the new project :

Cendana Berhad has made a profit of RM3 million last year. From those earnings, the company paid the dividend of RM2.00 on each of its 1,000,000 common shares outstanding. The capital structure of the company includes 30% debt, 20% preferred shares and 50% common shares. The corporate tax rate is 28%. The company wishes to venture into a new project and decided to use debt, preferred shares and common shares as sources of financing and still maintaining its current capital structure ratio. Based on the following information, calculate the weighted average cost of capital (WACC) of the company for taking the new project. You are required to calculate: i. The market price of its common share is RM12 and dividend are expected to grow at constant rate of 6% and flotation costs on its new common shares are RM1.50 per share. ii. The company can issue 3% dividend preferred shares at a market price of RM10 per share and flotation cost of RM1.00 per share. iii. The company can issue 7%, 5 years bonds that can be sold for RM1, 100 each in the market and flotation cost of RM5 per bond. iv. WACC for taking the new project :

Chapter20: Financing With Derivatives

Section: Chapter Questions

Problem 8P

Related questions

Question

Answer all the questions

Transcribed Image Text:Cendana Berhad has made a profit of RM3 million last year. From

those earnings, the company paid the dividend of RM2.00 on each of

its 1,000,000 common shares outstanding. The capital structure of the

company includes 30% debt, 20% preferred shares and 50% common

shares. The corporate tax rate is 28%. The company wishes to venture

into a new project and decided to use debt, preferred shares and

common shares as sources of financing and still maintaining its current

capital structure ratio. Based on the following information, calculate the

weighted average cost of capital (WACC) of the company for taking

the new project.

You are required to calculate:

i.

The market price of its common share is RM12 and dividend are

expected to grow at constant rate of 6% and flotation costs on its

new common shares are RM1.50 per share.

ii. The company can issue 3% dividend preferred shares at a market

price of RM10 per share and flotation cost of RM1.00 per share.

iii. The company can issue 7%, 5 years bonds that can be sold for

RM1, 100 each in the market and flotation cost of RM5 per bond.

iv. WACC for taking the new project :

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning