Essentials Of Investments

11th Edition

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Chapter1: Investments: Background And Issues

Section: Chapter Questions

Problem 1PS

Related questions

Question

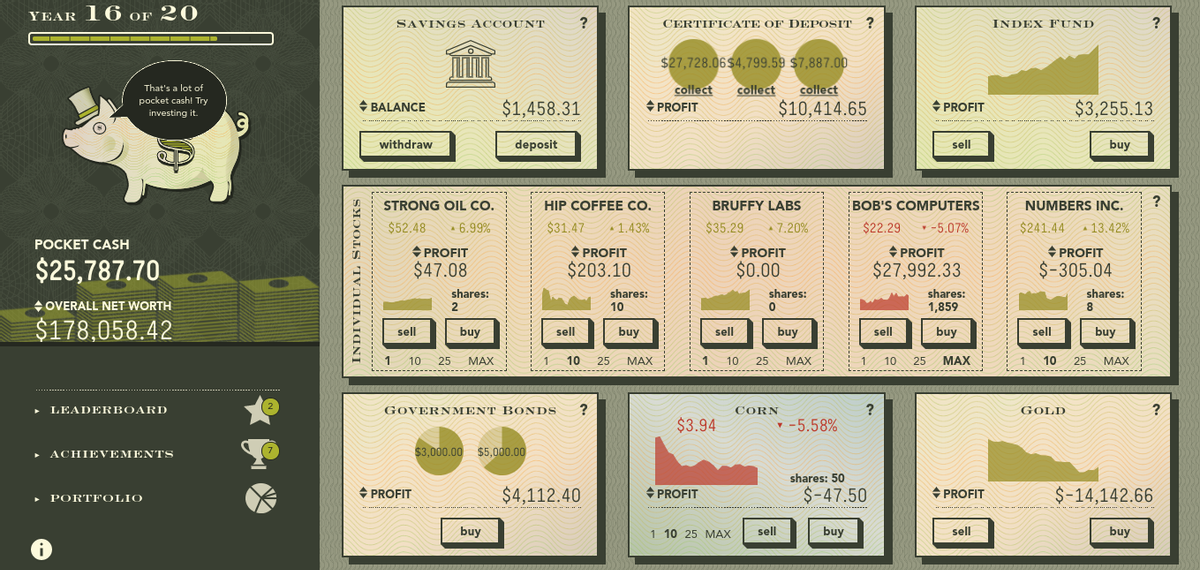

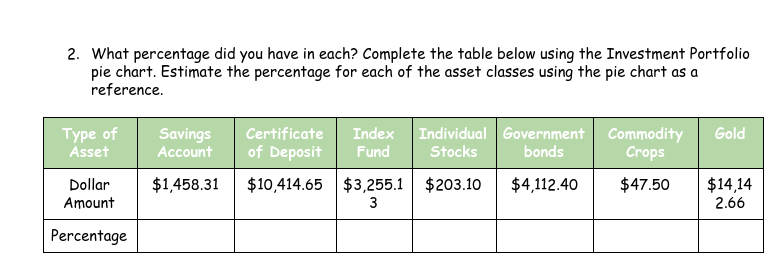

What percentage did you have in each? Complete the table below using the Investment Portfolio pie chart. Estmate the percentage for each of the asset classes using the pie chart as a reference.

Transcribed Image Text:YEAR 16 OF 20

SAVINGS ACCOUNT

CERTIFICATE OF DEPOSIT ?

INDEX F UND

$27,728.06$4,799.59 $7,887.00

collect

+ PROFIT

collect

That's a lot of

pocket cash! Try

investing it.

collect

+ BALANCE

$1,458.31

$10,414.65

+ PROFIT

$3,255.13

withdraw

deposit

sell

buy

-------------------------

HIP COFFEE co.

BOB'S COMPUTERS

• -5.07%

STRONG OIL cO.

BRUFFY LABS

NUMBERS INC.

$52.48

• 6.99%

$31.47

1.43%

$35.29

7.20%

$22.29

$241.44

a 13.42%

POCKET CASH

+ PROFIT

+ PROFIT

+ PROFIT

+ PROFIT

$25,787.70

+ PROFIT

$-305.04

$47.08

$203.10

$0.00

$27,992.33

shares:

8

shares:

shares:

2

shares:

10

shares:

OVERALL NET WORTH

1,859

$178,058.42

sell

buy

sell

buy

sell

buy

sell

buy

sell

buy

1 10

25

МАХ

10

25

MAX

MAX

----------------- -------

1 10

10 25 MAX

10

МАX

25

25

L------------------------------

----------------------------

• LEADERBOARD

GOVERNMENT BONDS

CORN

GOLD

$3.94

- -5.58%

> ACHIEVE ΜΕΝΤS

$3,000.00 $5,000.00

shares: 50

• PORTFOLIO

+ PROFIT

$4,112.40

+ PROFIT

$-47.50

+ PROFIT

$-14,142.66

buy

1 10 25 MAX

sell

buy

sell

buy

SHƆOLS 'IvndIAIUNI

Transcribed Image Text:2. What percentage did you have in each? Complete the table below using the Investment Portfolio

pie chart. Estimate the percentage for each of the asset classes using the pie chart as a

reference.

Index Individual Government Commodity

bonds

Certificate

Туре of

Asset

Gold

Savings

Account

of Deposit

Fund

Stocks

Crops

$1.458.31

$10,414.65 $3,255.1

$203.10

$4,112.40

$47.50

$14,14

2.66

Dollar

Amount

3

Percentage

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

- Your friend brags, “It was easy to try to beat the computer in the STAX game. I made $100,000 more with my strategy of actively trading those individual stocks. Why would you want to just buy an index fund? It’s so much fun to try to beat the market!” How would you respond?

Solution

Follow-up Question

Describe the various emotions you felt as you played the game. How did your emotions impact your decision-making while playing the game? Provide specific examples.

Solution

Follow-up Question

3. Looking at the table above, did you finish the game with a diversified portfolio? Explain.

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:

9780134897264

Author:

KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:

Pearson,

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i…

Finance

ISBN:

9780077861759

Author:

Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:

McGraw-Hill Education