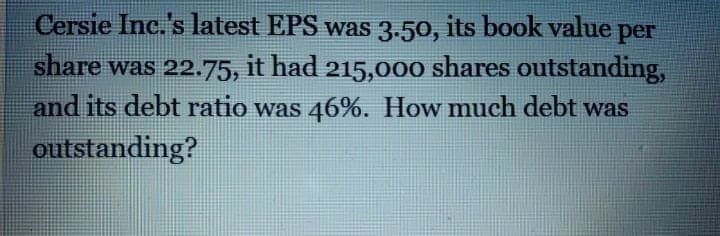

Cersie Inc.'s latest EPS was 3.50, its book value per share was 22.75, it had 215,000 shares outstanding, and its debt ratio was 46%. How much debt was outstanding?

Q: Sidewinder, Inc., has sales of $638,000, costs of $329,000, depreciation expense of $74,000,…

A: Earning per share: It is a financial ratio where how much share is contributed to the total net…

Q: Florida Co. just paid total dividends of $750,000 and reported additions to retained earnings of…

A: Dividend paid =$750,000 Addition retained earnings =$2250000 Shares =585000 PE ratio= 16 times

Q: The Harbinger Corporation reported net income of $6 million and total assets of $7 million in its…

A: Earnings per share (EPS): The amount of net income available to each shareholder per common share…

Q: A company generated revenues of $194 million during the last twelve months, with an operating margin…

A: P/E ratio can be calculated by using this equation P/E Ratio =market price par share/Earning par…

Q: ABC Company had addition to retained earnings for the current fiscal year just ended of $395,000.…

A: Part (5): Calculation of price earnings ratio: Answer: Price earnings ratio is 18.44 times

Q: and its stock price is P32. per share. What is Alessandra Company market/book Alessandra Company has…

A: Calculation of market to book ratio are as follows

Q: MJ INC. paid out $44.8 million in total common dividend and reported $289.4 million of retained…

A: “Hey, since there are multiple questions posted, we will answer first question. If you want any…

Q: In its most recent financial statements, Nessler Inc. reported $55 million of net income and $1,045…

A: Retained Earnings is the amount of earnings that is accumulated and that is attributable to the…

Q: National Co. had P24,000,000 in sales last year. The company’s net income was P500,000, its total…

A: Financial ratios: Financial ratios are performance measurement methods used by a company to Measure…

Q: Y3K, Inc., has sales of $6,319, total assets of $2,935, and a debt-equity ratio of 1.30. If its…

A: Given the following information: Sales: $6,319 Total assets: $2,935 Debt equity ratio: 1.30 Return…

Q: What is the book value per share? If the stock currently sells for $63 per share, what is the…

A: Given the following information: Additions to retained earnings: $213,000 Dividends paid: $183,000…

Q: he following information is available for the Oil Creek Corporation. Accounts Receivable $19,000…

A: The Price to Book value ratio refers to the ratio between the market price and the book value of one…

Q: Makers Corp. had additions to retained earnings for the year just ended of $285,000. The firm paid…

A: Given the following information: Addition to retained earnings: $285,000 Total equity: $4,850,000…

Q: Reagan Corp has net income of $843,800 for the year. Their share price is $13.54 and they have…

A: In the given question we require to compute the firm's price-earnings ratio.

Q: The average stockholder's equity for horn co. last year was P3,000,000. Included in this figure was…

A: The net income earned during the year will be aggregate of Earnings available for common Stock…

Q: Y3K, Inc., has sales of $4,600, total assets of $3,270, and a debt-equity ratio of 1.40. If its…

A: Dear student first we need to calculate the value of equity from above figures with the help of the…

Q: Blue Co. is funded by both debt and equity with a total debt to total asset ratio of 40%. If the…

A: Debt to total assets = 40% That means total assets = 100% Total assets = Equity + Debt 100% =…

Q: National Company's net income last year was P75,000. The company paid preferred dividends of P12,000…

A: Return on common stockholders equity means net earnings earned on the investment made by common…

Q: Net income for the period totaled OMR75,000, preferred dividends paid totaled OMR10,000, and common…

A: It is pertinent to note that preferred dividends are paid in prior to dividends to be paid to common…

Q: The Ashwood Company has a long-term debt ratio of .45 and a current ratio of 1.25. Current…

A: Long term debt ratio = long term debt/(long term debt+equity) = 0.45 Current ratio = current…

Q: For the most recent year, Camargo, Inc., had sales of $534,000, cost of goods sold of $241,680,…

A:

Q: Lamar , Inc. has sales of $8500, total assets of $2500, and a debt to equity ratio of 0.8, if its…

A: Net income refers to the income or amount which is earned by the enterprise by rendering services or…

Q: The total assets of Dierdorf Co. are $ 555,000 and its liabilities are equal to two-thirds of its…

A: As per Accounting equation,Assets =Liabilities +Shareholders equity

Q: National Co. has an ROE of 15 percent, a debt ratio of 40 percent, and a profit margin of 6 percent.…

A: The ratio analysis helps to analyse the financial statements of the business.

Q: In 2018, Caterpillar Inc. had about 730 million shares outstanding. Their book value was $30.0 per…

A: The debt to value ratio is the weight of debt in the total capital of the firm. It is also helpful…

Q: If the stock currently sells for $77 per share, what is the market-to-book ratio? Makers Corp. had…

A: Market to book ratio = Market price / Book value per share

Q: National Co. had P24,000,000 in sales last year. The company's net income was P500,000, its total…

A: The ratio analysis helps to analyse the financial statements of the business with assets and…

Q: A company had total revenues of $62 million, operating margin of 38.4%, and depreciation and…

A: EV/EBITDA is the ratio between enterprise value and earnings before interest, taxes, depreciation…

Q: Zero Corp's total common equity at the end of last year was $430,000 and its net income was $70,000.…

A: ROE or Return-on-Equity is profitability ratio that shows profit available to equity holders in…

Q: Last year Justine Corp. had sales of P315,000 and a net income of P17,382 and its year-end assets…

A: Du Pont analysis is a technique that is used to decompose the different drivers of the return of…

Q: FarCry Industries, a maker of telecommunications equipment, has 2 million shares of common stock…

A: Market value of each capital Capital Number of units Price per unit Value A B C=A*B Common…

Q: XYZ company has the following info: Company plans to issue $450,000 in dividends, long term debt is…

A: Current liabilities are the obligations for which payment is to be paid within 12 month or normal…

Q: Kawther Inc. has net income of $200,000, average equity/ordinary shares outstanding of 40,000, and…

A: Earnings per share = (Net Income - preferred dividend) /ordinary shares outstanding

Q: A company had total revenues of $64 million, operating margin of 32.4%, and depreciation and…

A: Frist we need to calculate enterprise value by using this equation Enterprise value(EV) =Total…

Q: A company had total revenues of $42 million, operating margin of 20.2%, and depreciation and…

A: EV means enterprise value and EBITDA is earnings before interest, taxes, depreciation and…

Q: In 2018, Caterpillar Inc. had about 730 million shares outstanding. Their book value was $30.0 per…

A: a) The computation of book debt to value ratio is as follows: Hence, the book debt to value ratio…

Q: Ames, Inc., has a current stock price of $58. For the past year, the company had a net income of…

A: Given the following information: Current stock price: $58 Net income: $8,400,000 Total equity:…

Q: Oregon Office Supply had 24,000,000 in sales last year. The company’s net income was 400,000, its…

A: SALE 24,000,000 NET INCOME 400,000 TOTAL ASSETS TURNOVER 6.0 ROE 15% DEBT RATIO ?

Q: ViewPoints Security's financial statements, which were constructed a few days ago, report the…

A: Financial ratios are the measures that are used to evaluate the financial performance and position…

Q: Greene, Inc.'s balance sheet indicates that the book value of stockholders' equity (book value per…

A: Market-to-book ratio is simply a comparison of book value with market value. It can be calculated…

Q: ABC Company had addition to retained earnings for the current fiscal year just ended of $395,000.…

A: Since, there are more than three parts in one question, the answer for first four parts is provided…

Q: Chikage Inc's latest net income was $1,400,000, and it had 210,000 shares outstanding. The company…

A: Net income=1400000Shares outstanding=210000Payout ratio=40%

Q: Arya Inc.'s latest net income was $1,250,000, and it had 225,000 shares outstanding. The company…

A: Net income = $ 1,250,000 Number of shares = 225,000 Payout ratio = 45%

Q: Jaster Jets has $10 billion in total assets. Its balance sheet shows $1 billion in current…

A: In this we have to calculate market capitalization and compare with book value of equity.

Q: Ames, Inc., has a current stock price of $58. For the past year, the company had net income of…

A: Stockholders are the investors who invest their funds into the company by purchasing the stocks of…

Q: Last year, ABC Inc. had sales of $375,000 and a net income of $25,000, and it had total assets of…

A: Given: Sales = $375,000 Net income = $25,000 Total assets = $350,00 Debt-to-equity (D/E) ratio =…

Step by step

Solved in 2 steps

- The Kretovich Company had a quick ratio of 1.4, a current ratio of 3.0, a days’ sales outstanding of 36.5 days (based on a 365-day year), total current assets of $810,000, and cash and marketable securities of $120,000. What were Kretovich’s annual sales?Rebert Inc. showed the following balances for last year: Reberts net income for last year was 3,182,000. Refer to the information for Rebert Inc. above. Also, assume that the market price per share for Rebert is 51.50. Required: 1. Compute the dollar amount of preferred dividends. 2. Compute the number of common shares. 3. Compute earnings per share. (Note: Round to two decimals.) 4. Compute the price-earnings ratio. (Note: Round to the nearest whole number.)Rebert Inc. showed the following balances for last year: Reberts net income for last year was 3,182,000. Refer to the information for Rebert Inc. above. Also, assume that the dividends paid to common stockholders for last year were 2,600,000 and that the market price per share of common stock is 51.50. Required: 1. Compute the dividends per share. 2. Compute the dividend yield. (Note: Round to two decimal places.) 3. Compute the dividend payout ratio. (Note: Round to two decimal places.)

- Last year, ABC Inc. had sales of $375,000 and a net income of $25,000, and it had total assets of $350,000 at the year end. The company's debt-to-equity (D/E) ratio was 75.0%. What was the company’s ROE? (Hint: Use the DuPont identity)A company had total revenues of $59 million, operating margin of 35.1%, and depreciation and amortization expense of $13 million over the trailing twelve months. The company currently has $280 million in total debt and $116 million in cash and cash equivalents. The company's shares are currently trading at $33.2 per share and there are 13 million shares outstanding. What is its EV/EBITDA ratio? Round to one decimal place.Edelman engines has $18 million in total assets. It’s balance sheet shows $2 million in current liabilities $10 million in long term debt and $6 million in common equity. It has 300000 common shares outstanding and it’s stock price is $28.20 per share. What is edelmans market / book ratio

- In 2018, Caterpillar Inc. had about 730 million shares outstanding. Their book value was $30.0 per share, and the market price was $87.00 per share. The company’s balance sheet shows that the company had $30.50 billion of long-term debt, which was currently selling near par value. a. What was Caterpillar’s book debt-to-value ratio? (Do not round intermediate calculations. Enter your answer as a decimal rounded to 2 decimal places.) b. What was its market debt-to-value ratio? (Do not round intermediate calculations. Enter your answer as a decimal rounded to 2 decimal places.) c. Which measure should you use to calculate the company’s cost of capital?Breakaway wealth had net earnings of $336,000 this past year. dividends were paid of $77,280 on the company's book equity of $2,800,000. if Safeway has 175,000 shares outstanding with a current market price of $21 per share, what is the required rate of return?Y3K, Inc., has sales of $6,319, total assets of $2,935, and a debt-equity ratio of 1.30. If its return on equity is 14 percent, what is its net income?

- Blue Co. is funded by both debt and equity with a total debt to total asset ratio of 40%. If the firm has a retained earnings breakpoint of P2,450,000, how much is the additions to the retained earnings during the year?Lilly Inc has a DSO of 20 days, and its annual sales are $3,550,000. What is its accounts receivable balance? Assume that it uses a 365-day year. Lilly's Tax has a market/book ratio equal to 1. its stock price is $13 per share and it has 4.6 million shares outstanding. The firm's total capital is $115 million and its finances with only debt and common equity. what is its debt-to-capital ratio? Lilly's Tax has an ROA of 11%, a 5% profit margin, and an ROE of 23%. What is its total assets turnover? What is its equity multiplier? Lilly's Tax has an EPS of $2.40, a book value per share of $22.84, and a market/book ratio of 27X. What is its P/E ratio?Lei Materials' balance sheet lists total assets of $1.05 billion, $127 million in current liabilities, $435 million in long-term debt, $488 million in common equity, and 54 million shares of common stock. If Lei's current stock price is $51.38, what is the firm's market-to-book ratio?