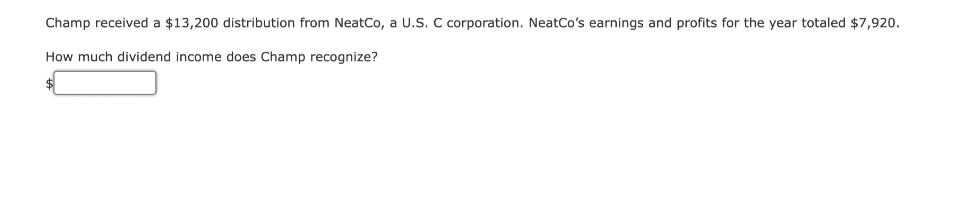

Champ received a $13,200 distribution from NeatCo, a U.S. C corporation. NeatCo's earnings and profits for the year totaled $7,920. How much dividend income does Champ recognize?

Champ received a $13,200 distribution from NeatCo, a U.S. C corporation. NeatCo's earnings and profits for the year totaled $7,920. How much dividend income does Champ recognize?

Chapter14: Choice Of Business Entity—operations And Distributions

Section: Chapter Questions

Problem 68IIP

Related questions

Question

Transcribed Image Text:Champ received a $13,200 distribution from NeatCo, a U.S. C corporation. NeatCo's earnings and profits for the year totaled $7,920.

How much dividend income does Champ recognize?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT