change in the Mexican peso is 1% during the next quarter, the maximum one-quarter loss is about 65 standard deviations away from the expected percentage change in the U.S. dollar, and that Gilbert estimated the standard deviation of exchange rate ovements of the Mesican peso to be 6 percent over the next 40 quarters. Based on these assumptions, Gilbert's maximum expected one quarter loss due to its ansaction exposure in Mexican pesos over the next quarter is: N-C O 10.9% O10.9%

change in the Mexican peso is 1% during the next quarter, the maximum one-quarter loss is about 65 standard deviations away from the expected percentage change in the U.S. dollar, and that Gilbert estimated the standard deviation of exchange rate ovements of the Mesican peso to be 6 percent over the next 40 quarters. Based on these assumptions, Gilbert's maximum expected one quarter loss due to its ansaction exposure in Mexican pesos over the next quarter is: N-C O 10.9% O10.9%

Chapter7: International Arbitrage And Interest Rate Parity

Section: Chapter Questions

Problem 49QA

Related questions

Question

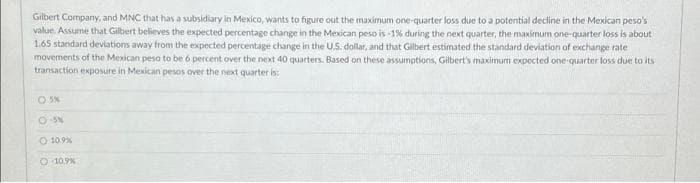

Transcribed Image Text:Gilbert Company, and MNC that has a subsidiary in Mexico, wants to figure out the maximum one-quarter loss due to a potential decline in the Mexican peso's

value. Assume that Gilbert believes the expected percentage change in the Mexican peso is -1% during the next quarter, the maximum one-quarter loss is about

1.65 standard deviations away from the expected percentage change in the US. dollar, and that Gilbert estimated the standard deviation of exchange rate

movements of the Mexican peso to be 6 percent over the next 40 quarters. Based on these assumptions, Gilbert's maximum expected one quarter loss due to its

transaction exposure in Mexican pesos over the next quarter is:

O S%

O 10.9%

O 10.9%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning