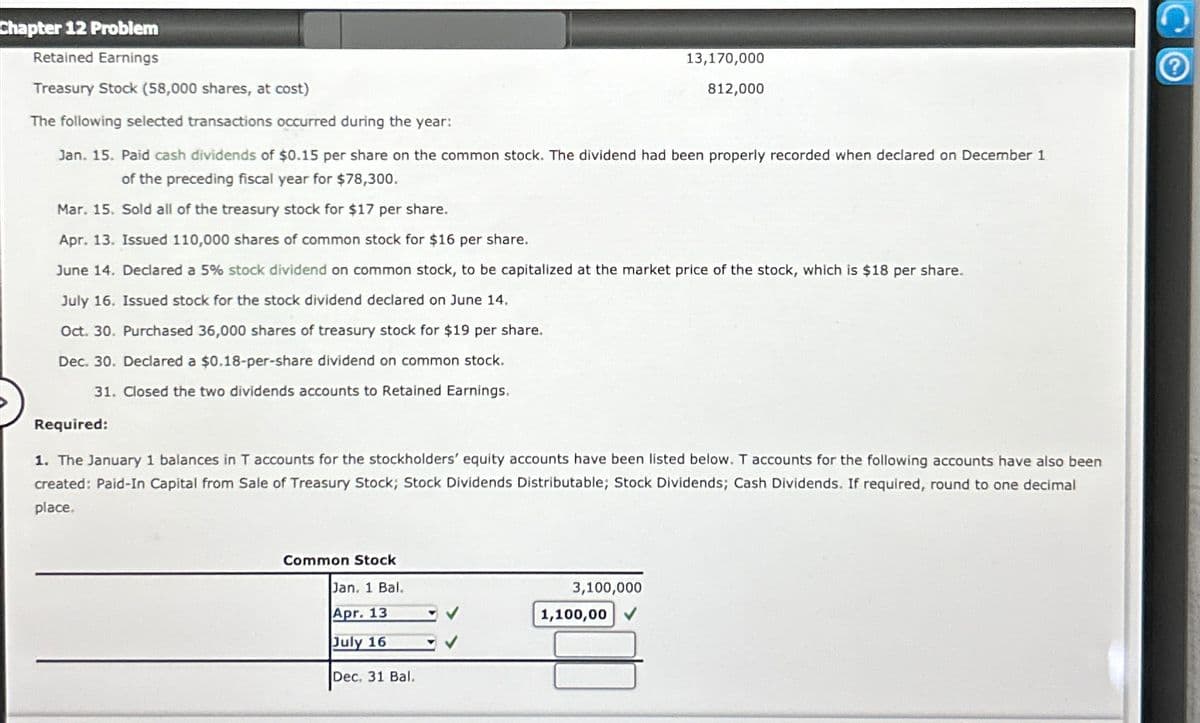

Chapter 12 Problem Retained Earnings Treasury Stock (58,000 shares, at cost) The following selected transactions occurred during the year: 13,170,000 812,000 Jan. 15. Paid cash dividends of $0.15 per share on the common stock. The dividend had been properly recorded when declared on December 1 of the preceding fiscal year for $78,300. Mar. 15. Sold all of the treasury stock for $17 per share. Apr. 13. Issued 110,000 shares of common stock for $16 per share. June 14. Declared a 5% stock dividend on common stock, to be capitalized at the market price of the stock, which is $18 per share. July 16. Issued stock for the stock dividend declared on June 14. Oct. 30. Purchased 36,000 shares of treasury stock for $19 per share. Dec. 30. Declared a $0.18-per-share dividend on common stock. 31. Closed the two dividends accounts to Retained Earnings. Required: 1. The January 1 balances in T accounts for the stockholders' equity accounts have been listed below. T accounts for the following accounts have also been created: Paid-In Capital from Sale of Treasury Stock; Stock Dividends Distributable; Stock Dividends; Cash Dividends. If required, round to one decimal place. Common Stock Jan. 1 Bal. 3,100,000 Apr. 13 1,100,00 July 16 Dec. 31 Bal.

Chapter 12 Problem Retained Earnings Treasury Stock (58,000 shares, at cost) The following selected transactions occurred during the year: 13,170,000 812,000 Jan. 15. Paid cash dividends of $0.15 per share on the common stock. The dividend had been properly recorded when declared on December 1 of the preceding fiscal year for $78,300. Mar. 15. Sold all of the treasury stock for $17 per share. Apr. 13. Issued 110,000 shares of common stock for $16 per share. June 14. Declared a 5% stock dividend on common stock, to be capitalized at the market price of the stock, which is $18 per share. July 16. Issued stock for the stock dividend declared on June 14. Oct. 30. Purchased 36,000 shares of treasury stock for $19 per share. Dec. 30. Declared a $0.18-per-share dividend on common stock. 31. Closed the two dividends accounts to Retained Earnings. Required: 1. The January 1 balances in T accounts for the stockholders' equity accounts have been listed below. T accounts for the following accounts have also been created: Paid-In Capital from Sale of Treasury Stock; Stock Dividends Distributable; Stock Dividends; Cash Dividends. If required, round to one decimal place. Common Stock Jan. 1 Bal. 3,100,000 Apr. 13 1,100,00 July 16 Dec. 31 Bal.

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter12: Corporations: Organization, Stock Transactions, And Dividends

Section: Chapter Questions

Problem 12.14EX

Question

Transcribed Image Text:Chapter 12 Problem

Retained Earnings

Treasury Stock (58,000 shares, at cost)

The following selected transactions occurred during the year:

13,170,000

812,000

Jan. 15. Paid cash dividends of $0.15 per share on the common stock. The dividend had been properly recorded when declared on December 1

of the preceding fiscal year for $78,300.

Mar. 15. Sold all of the treasury stock for $17 per share.

Apr. 13. Issued 110,000 shares of common stock for $16 per share.

June 14. Declared a 5% stock dividend on common stock, to be capitalized at the market price of the stock, which is $18 per share.

July 16. Issued stock for the stock dividend declared on June 14.

Oct. 30. Purchased 36,000 shares of treasury stock for $19 per share.

Dec. 30. Declared a $0.18-per-share dividend on common stock.

31. Closed the two dividends accounts to Retained Earnings.

Required:

1. The January 1 balances in T accounts for the stockholders' equity accounts have been listed below. T accounts for the following accounts have also been

created: Paid-In Capital from Sale of Treasury Stock; Stock Dividends Distributable; Stock Dividends; Cash Dividends. If required, round to one decimal

place.

Common Stock

Jan. 1 Bal.

3,100,000

Apr. 13

1,100,00

July 16

Dec. 31 Bal.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning