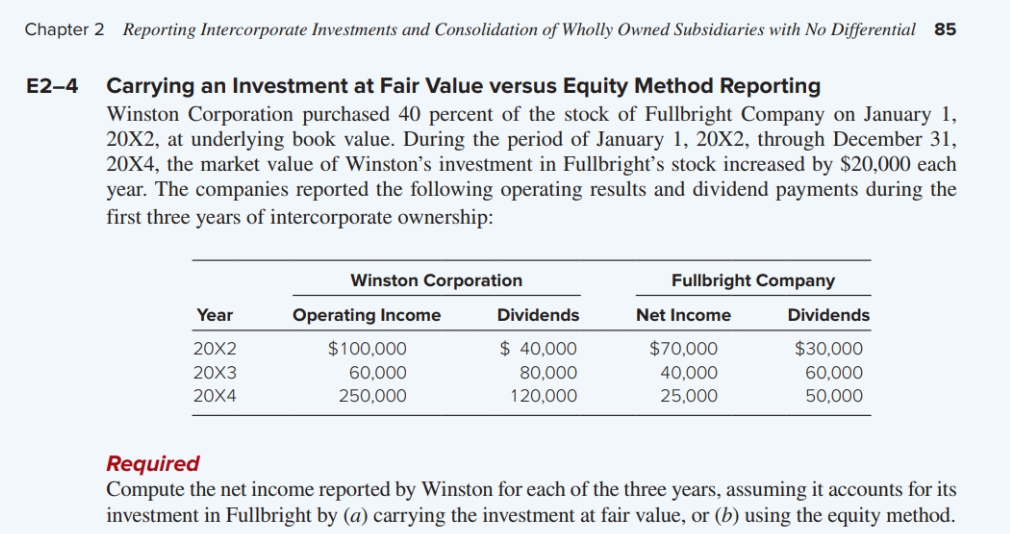

Chapter 2 Reporting Intercorporate Investments and Consolidation of Wholly Owned Subsidiaries with No Differential 85 E2-4 Carrying an Investment at Fair Value versus Equity Method Reporting Winston Corporation purchased 40 percent of the stock of Fullbright Company on January 1, 20X2, at underlying book value. During the period of January 1, 20X2, through December 31, 20X4, the market value of Winston's investment in Fullbright's stock increased by $20,000 each year. The companies reported the following operating results and dividend payments during the first three years of intercorporate ownership: Year 20X2 20X3 20X4 Winston Corporation Operating Income $100,000 60,000 250,000 Dividends $ 40,000 80,000 120,000 Fullbright Company Net Income $70,000 40,000 25,000 Dividends $30,000 60,000 50,000 Required Compute the net income reported by Winston for each of the three years, assuming it accounts for its investment in Fullbright by (a) carrying the investment at fair value, or (b) using the equity method.

Chapter 2 Reporting Intercorporate Investments and Consolidation of Wholly Owned Subsidiaries with No Differential 85 E2-4 Carrying an Investment at Fair Value versus Equity Method Reporting Winston Corporation purchased 40 percent of the stock of Fullbright Company on January 1, 20X2, at underlying book value. During the period of January 1, 20X2, through December 31, 20X4, the market value of Winston's investment in Fullbright's stock increased by $20,000 each year. The companies reported the following operating results and dividend payments during the first three years of intercorporate ownership: Year 20X2 20X3 20X4 Winston Corporation Operating Income $100,000 60,000 250,000 Dividends $ 40,000 80,000 120,000 Fullbright Company Net Income $70,000 40,000 25,000 Dividends $30,000 60,000 50,000 Required Compute the net income reported by Winston for each of the three years, assuming it accounts for its investment in Fullbright by (a) carrying the investment at fair value, or (b) using the equity method.

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

ChapterD: Investments

Section: Chapter Questions

Problem D.12EX

Related questions

Question

(a) carrying the investment at FAIR VALUE

please do not copy others answer, thank you.

Please don't provide solutions in an image format thanku

Transcribed Image Text:Chapter 2 Reporting Intercorporate Investments and Consolidation of Wholly Owned Subsidiaries with No Differential 85

E2-4 Carrying an Investment at Fair Value versus Equity Method Reporting

Winston Corporation purchased 40 percent of the stock of Fullbright Company on January 1,

20X2, at underlying book value. During the period of January 1, 20X2, through December 31,

20X4, the market value of Winston's investment in Fullbright's stock increased by $20,000 each

year. The companies reported the following operating results and dividend payments during the

first three years of intercorporate ownership:

Year

20X2

20X3

20X4

Winston Corporation

Operating Income

$100,000

60,000

250,000

Dividends

$ 40,000

80,000

120,000

Fullbright Company

Net Income

$70,000

40,000

25,000

Dividends

$30,000

60,000

50,000

Required

Compute the net income reported by Winston for each of the three years, assuming it accounts for its

investment in Fullbright by (a) carrying the investment at fair value, or (b) using the equity method.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning