- Chapter X + mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/activity/q apter 15, 16, and 17 i Saved Help Save & E The following information is for Hulk Gym's first year of operations. Amounts are in millions of dollars. The enacted tax rate is 25%. Accounting income Temporary difference: Prepaid insurance Taxable income Required: Year 2024 $ 220 Future Taxable Amounts Future Amounts 2025 2026 2027 2028 Total (52) $ 13 $ 13 $13 $ 13 $ 52 $ 168 Prepare a compound journal entry to record the income tax expense for the year 2024. in millions (i.e., 10,000,000 should be entered as 10.) Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers View transaction list Journal entry worksheet Record the income taxes. < Prev 30 of 38 Next > to search 車 10:0 73°F Partly cloudy 4/14 F3 F4 F5 F6 F7 F8 F9 F10 F11 F12 PrtScr Insert Delete Calc E R * Backspace

- Chapter X + mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/activity/q apter 15, 16, and 17 i Saved Help Save & E The following information is for Hulk Gym's first year of operations. Amounts are in millions of dollars. The enacted tax rate is 25%. Accounting income Temporary difference: Prepaid insurance Taxable income Required: Year 2024 $ 220 Future Taxable Amounts Future Amounts 2025 2026 2027 2028 Total (52) $ 13 $ 13 $13 $ 13 $ 52 $ 168 Prepare a compound journal entry to record the income tax expense for the year 2024. in millions (i.e., 10,000,000 should be entered as 10.) Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers View transaction list Journal entry worksheet Record the income taxes. < Prev 30 of 38 Next > to search 車 10:0 73°F Partly cloudy 4/14 F3 F4 F5 F6 F7 F8 F9 F10 F11 F12 PrtScr Insert Delete Calc E R * Backspace

Excel Applications for Accounting Principles

4th Edition

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Gaylord N. Smith

Chapter4: Merchandising Company Financial Statements (fmerch)

Section: Chapter Questions

Problem 3R

Related questions

Question

Transcribed Image Text:- Chapter X

+

mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/activity/q

apter 15, 16, and 17 i

Saved

Help

Save & E

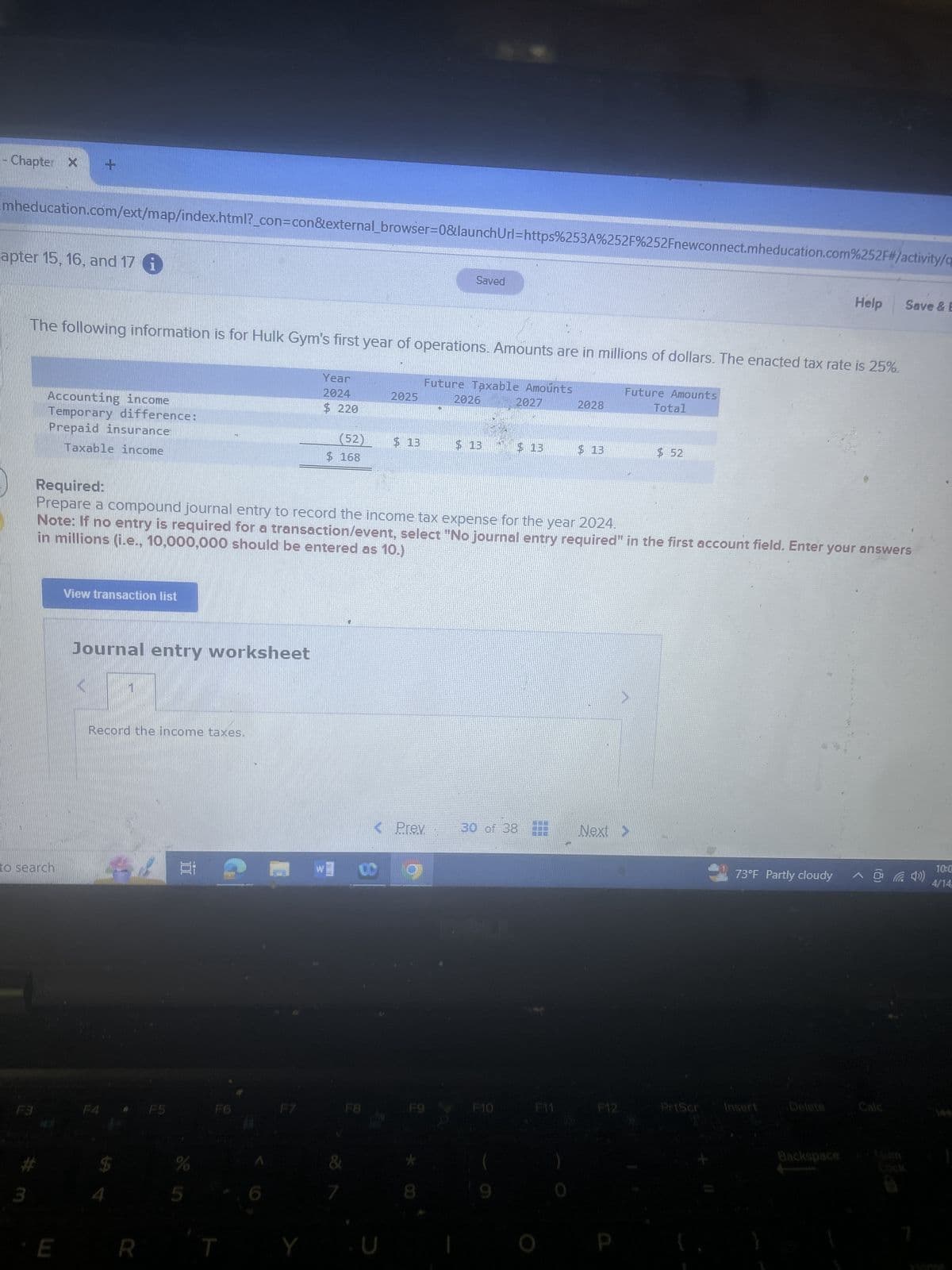

The following information is for Hulk Gym's first year of operations. Amounts are in millions of dollars. The enacted tax rate is 25%.

Accounting income

Temporary difference:

Prepaid insurance

Taxable income

Required:

Year

2024

$ 220

Future Taxable Amounts

Future Amounts

2025

2026

2027

2028

Total

(52)

$ 13

$ 13

$13

$ 13

$ 52

$ 168

Prepare a compound journal entry to record the income tax expense for the year 2024.

in millions (i.e., 10,000,000 should be entered as 10.)

Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers

View transaction list

Journal entry worksheet

Record the income taxes.

< Prev

30 of 38

Next >

to search

車

10:0

73°F Partly cloudy

4/14

F3

F4

F5

F6

F7

F8

F9

F10

F11

F12

PrtScr

Insert

Delete

Calc

E

R

*

Backspace

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Accounting Information Systems

Finance

ISBN:

9781337552127

Author:

Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan Hill

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Accounting Information Systems

Finance

ISBN:

9781337552127

Author:

Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan Hill

Publisher:

Cengage Learning