chases: 1 3 8 15 27 300 units at $3.50 500 units at $4.50 100 units at $5.00 100 units at $5.50 100 units at $6.00 s: 10 400 units*

chases: 1 3 8 15 27 300 units at $3.50 500 units at $4.50 100 units at $5.00 100 units at $5.50 100 units at $6.00 s: 10 400 units*

Financial And Managerial Accounting

15th Edition

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:WARREN, Carl S.

Chapter6: Inventories

Section: Chapter Questions

Problem 5PB: Pappas Appliances uses the periodic inventory system. Details regarding the inventory of appliances...

Related questions

Question

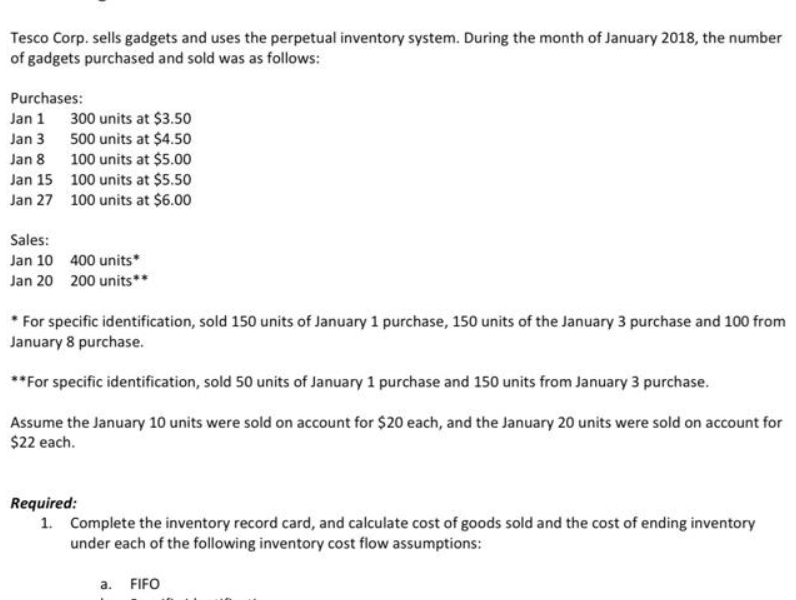

Transcribed Image Text:Tesco Corp. sells gadgets and uses the perpetual inventory system. During the month of January 2018, the number

of gadgets purchased and sold was as follows:

Purchases:

Jan 1

Jan 3

Jan 8

Jan 15

Jan 27

300 units at $3.50

500 units at $4.50

100 units at $5.00

100 units at $5.50

100 units at $6.00

Sales:

Jan 10

400 units*

Jan 20 200 units**

* For specific identification, sold 150 units of January 1 purchase, 150 units of the January 3 purchase and 100 from

January 8 purchase.

**For specific identification, sold 50 units of January 1 purchase and 150 units from January 3 purchase.

Assume the January 10 units were sold on account for $20 each, and the January 20 units were sold on account for

$22 each.

Required:

1. Complete the inventory record card, and calculate cost of goods sold and the cost of ending inventory

under each of the following inventory cost flow assumptions:

a. FIFO

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub