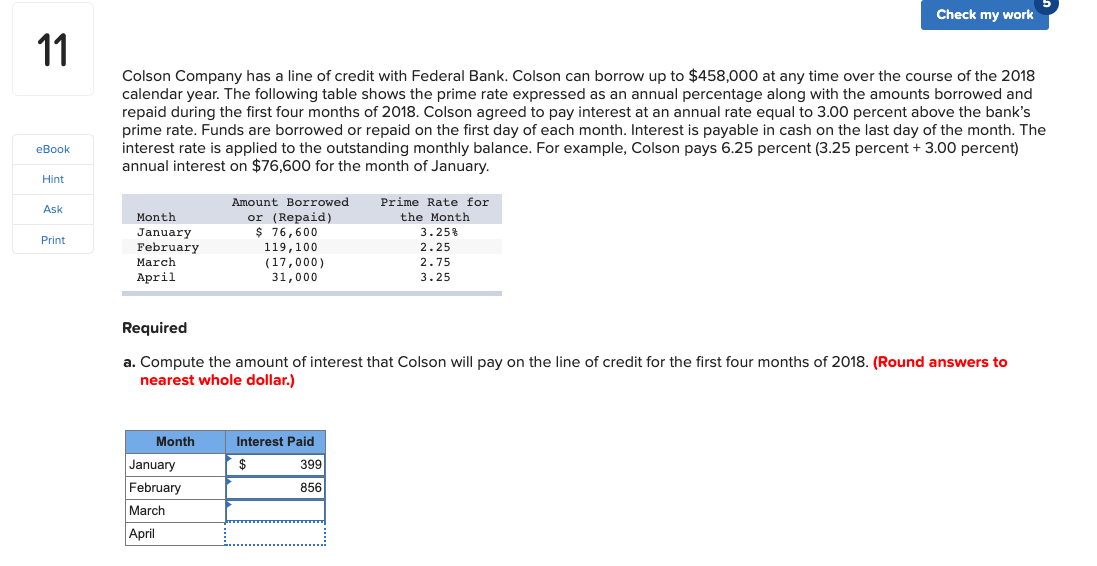

Check my work 11 Colson Company has a line of credit with Federal Bank. Colson can borrow up to $458,000 at any time over the course of the 2018 calendar year. The following table shows the prime rate expressed as an annual percentage along with the amounts borrowed and repaid during the first four months of 2018. Colson agreed to pay interest at an annual rate equal to 3.00 percent above the bank's prime rate. Funds are borrowed or repaid on the first day of each month. Interest is payable in cash on the last day of the month. The interest rate is applied to the outstanding monthly balance. For example, Colson pays 6.25 percent (3.25 percent + 3.00 percent) annual interest on $76,600 for the month of January. eBook Hint Amount Borrowed or (Repaid) $ 76,600 Prime Rate for Ask Month the Month 3.25% January February Print 119,100 (17,000) 31,000 2.25 March 2.75 April 3.25 Required a. Compute the amount of interest that Colson will pay on the line of credit for the first four months of 2018. (Round answers to nearest whole dollar.) Month Interest Paid January $ 399 February 856 March April Check my work 11 nearest whole dollar.) Month Interest Paid January 399 eBook February 856 Hint March April Ask Print b. Compute the amount of Colson's liability at the end of each of the first four months. (Do not round intermediate calculations. Round your final answers to the nearest whole dollar.) Balance End of Month Month January 76,600 February March April

Check my work 11 Colson Company has a line of credit with Federal Bank. Colson can borrow up to $458,000 at any time over the course of the 2018 calendar year. The following table shows the prime rate expressed as an annual percentage along with the amounts borrowed and repaid during the first four months of 2018. Colson agreed to pay interest at an annual rate equal to 3.00 percent above the bank's prime rate. Funds are borrowed or repaid on the first day of each month. Interest is payable in cash on the last day of the month. The interest rate is applied to the outstanding monthly balance. For example, Colson pays 6.25 percent (3.25 percent + 3.00 percent) annual interest on $76,600 for the month of January. eBook Hint Amount Borrowed or (Repaid) $ 76,600 Prime Rate for Ask Month the Month 3.25% January February Print 119,100 (17,000) 31,000 2.25 March 2.75 April 3.25 Required a. Compute the amount of interest that Colson will pay on the line of credit for the first four months of 2018. (Round answers to nearest whole dollar.) Month Interest Paid January $ 399 February 856 March April Check my work 11 nearest whole dollar.) Month Interest Paid January 399 eBook February 856 Hint March April Ask Print b. Compute the amount of Colson's liability at the end of each of the first four months. (Do not round intermediate calculations. Round your final answers to the nearest whole dollar.) Balance End of Month Month January 76,600 February March April

Chapter16: Working Capital Policy And Short-term Financing

Section: Chapter Questions

Problem 30P

Related questions

Question

100%

I have re-submitted this question. It contains everything I have recieved to complete this one problem.

Thank You

Transcribed Image Text:Check my work

11

Colson Company has a line of credit with Federal Bank. Colson can borrow up to $458,000 at any time over the course of the 2018

calendar year. The following table shows the prime rate expressed as an annual percentage along with the amounts borrowed and

repaid during the first four months of 2018. Colson agreed to pay interest at an annual rate equal to 3.00 percent above the bank's

prime rate. Funds are borrowed or repaid on the first day of each month. Interest is payable in cash on the last day of the month. The

interest rate is applied to the outstanding monthly balance. For example, Colson pays 6.25 percent (3.25 percent + 3.00 percent)

annual interest on $76,600 for the month of January.

eBook

Hint

Amount Borrowed

or (Repaid)

$ 76,600

Prime Rate for

Ask

Month

the Month

3.25%

January

February

Print

119,100

(17,000)

31,000

2.25

March

2.75

April

3.25

Required

a. Compute the amount of interest that Colson will pay on the line of credit for the first four months of 2018. (Round answers to

nearest whole dollar.)

Month

Interest Paid

January

$

399

February

856

March

April

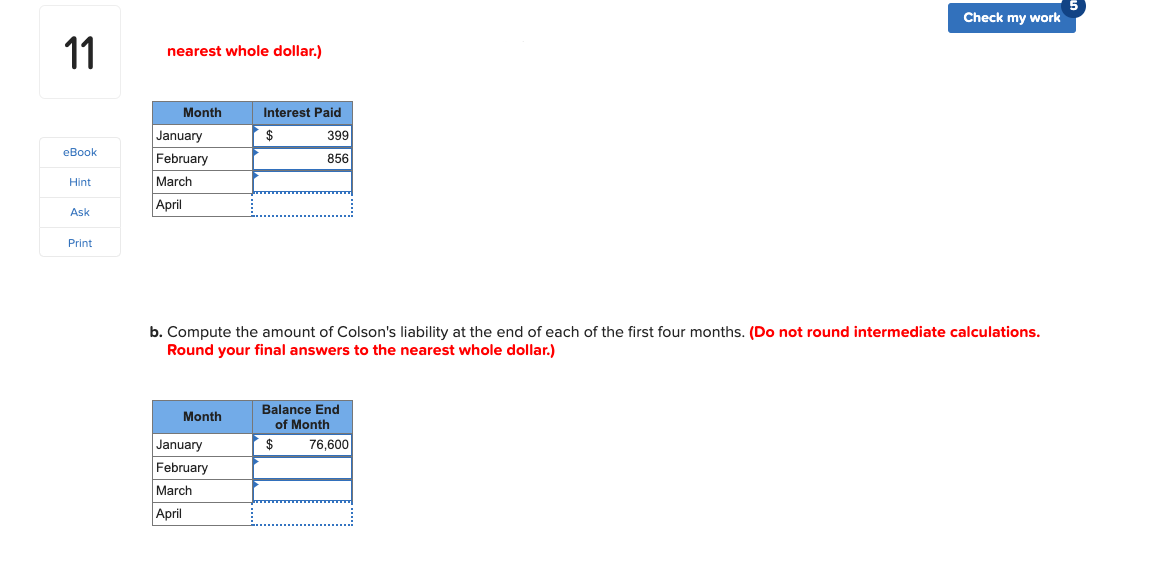

Transcribed Image Text:Check my work

11

nearest whole dollar.)

Month

Interest Paid

January

399

eBook

February

856

Hint

March

April

Ask

Print

b. Compute the amount of Colson's liability at the end of each of the first four months. (Do not round intermediate calculations.

Round your final answers to the nearest whole dollar.)

Balance End

of Month

Month

January

76,600

February

March

April

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning